Table of Contents |

From David's Desk |

| | David Schectman |

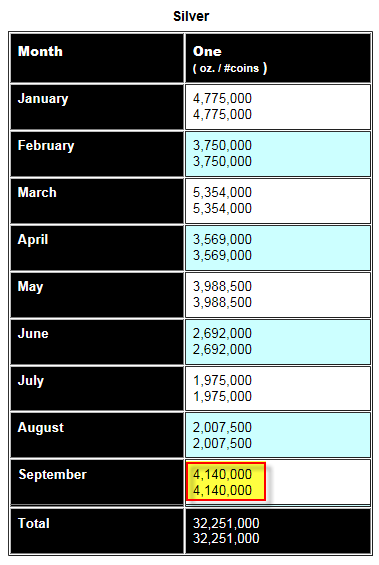

Here is a great article from SRSRocco Report: The U.S. Mint Sells Over 750,000 Silver Eagles In One Day Filed in Precious Metals by SRSrocco on September 30, 2014 The market reacted to the big drop in the paper price of silver by a huge increase in Silver Eagle purchases. September was turning out to be a much stronger month compared to July and August even before the last update of the month. On Monday, the U.S. Mint reported 3,375,000 sales for the month. Then this evening, I checked to see if they had updated their figures.. which they did in A BIG WAY. In one day, the U.S. Mint sold 766,000 Silver Eagles, more than all the Gold Eagles sold to date. Actually, is was more than double the 379,000 oz of Gold Eagles sold this year. If we look at the chart below, sales of Silver Eagles in September, were double that of July and August:  | | SRSRocco Report |

Silver Eagle sales were quite strong in the beginning of the year and started to slow down in June. However, the manipulated lower price of silver motivated investors to ramp up the purchases making September one of the three strongest months of the year.  | | SRSRocco Report |

Only January and March were stronger than the 4,140,000 Silver Eagle sales in September. The total for the first three-quarters of the year is 32,251,000. If Silver Eagle sales are exceptional strong in September, it would it also be true for Canadian Maples, Chinese Pandas, Philharmonics and Perth Mint Silver sales. While its frustrating to see the price of silver at these lows, I still believe there isn't a better deal out there than exchanging fiat Dollars for ounces of silver. Continue reading on SRSRocco Report. Sincerely, David Schectman

|

The Holter Report |

| Bill Holter

|

Mr. Magoo Could See All Along!

October 2, 2014

Nothing like trying to clean up your legacy before you die, your lie blows up publicly ...or both. Alan Greenspan decided to talk about "gold" in an Op-Ed piece this past week in an effort to clean up his legacy. The article was published by Foreign Affairs. Please read this opinion piece very carefully, or even twice before continuing.

OK, so now you've read "The Maestro's" opinion on "Why Beijing is buying gold?" Do you buy his arguments? Even a little? I don't buy any of it from start to finish (except for his admission gold and silver ARE monies), in my opinion Mr. Magoo who "couldn't ever see a bubble before it popped" has just as bad hindsight as current sight even with the ability to see factual history. Actually, this is wrong as Mr. Greenspan "did" get it and I am now sure he always "has" gotten it ...he just cannot ever really admit to this without being hung from a lamp post somewhere.

Greenspan contends that China could purchase a relatively small portion of their $4 trillion of reserves in gold without "much risk." He says the interest lost and storage costs would be relatively small. Ya think? If the reserves pay almost nothing in interest and the gold can be stored in a State owned facility ...and they are exchanging fake money for real money ...is there ANY risk at all? Another area of humor is his contention the Chinese will "announce their plans" to purchase gold with a small portion of their reserves. Really? Do you really believe the Chinese will "announce" their future plans to the world and allow a bunch of speculators to front run them? ...And after they are done "buying," the price of gold will "fall back down?" I will address all of this shortly as I want to put his thoughts out first, before I fix his spectacles for him.

He then contends (quite correctly) gold and little cousin silver "are" money. Actually he says "currency" and they are "universally acceptable at ALL times." Digressing just a bit, if (since) this is true, Ben Bernanke either perjured himself before Congress or is just plain ignorant as he told Ron Paul "gold is not money, it is held out of tradition." Greenspan also correctly points out that gold nor can silver ever default. They are no one's liability and do not rely on any sovereign's ability to tax or perform for their values. In case you were wondering, Mr. Greenspan DOES "get it," he always has...

... I think it is important to understand Mr. Greenspan's thought process (es) along the way. He wrote a very well thought out and "very Austrian" article back in 1966 which explained gold thoroughly and why it is the "ultimate money." "Ultimate money" is my term because of the word "ultimate," meaning "last." In any panic, market meltdown or banking panic, gold (and silver) will be the last currency standing. As other currencies become "unacceptable," gold and silver will still be accepted to settle any debts or trade. Greenspan fully understood this in 1966, he fully understood it while Chairman of the Fed and churning out trillions of $ in fake money and he knows it now. He will know it until his last dying breath and is only now trying to "re paint" his legacy. A legacy which included spading the ground, planting the seed and watering regularly ...to the destruction of Western capitalism. There is no one on the planet more responsible for where we are now than Mr. Greenspan, no matter how much he writes, speaks or tries to re paint history ...this is a fact and is the legacy he will take to his grave with him!

Do you really believe the Chinese would ever tip their hand and say we "are going to" buy gold? Wouldn't it behoove them to buy the gold first and then point out to the world "look what we did?" First, at today's pricing they could amass as much gold as the U.S. claims to have with less than 10% of their reserves. Would this qualify as a "small enough percentage" in Mr. Magoo's mind? Actually, China has already announced they plan to accumulate 8,500 tons which tells me they already have! They announced the ownership of 1,054 tons back in April of 2009, we also know they have imported almost 4,000 tons over the last two years. This brings them to 5,000 tons without accounting for 2009, '10, '11 nor '12. It also does not account for an average of 350+ tons internally produced each year since 2009 which amounts to another nearly 2,000 tons. Including internal production we can already see nearly 7,000 tons, could they have possibly accumulated another 1,000 tons or so between 2009 and 2012? By my math, this comes to about 8,000 tons and "presto" they have as much as we "say" we do. Amazing!

At current pricing, China has enough in dollar reserves and Treasury holdings alone to purchase 70% of ALL the gold ever produced by man (yes I know, if they tried it they would blow the price to the moon and back). Alan Greenspan knows this and is fully aware of it which is why he used the term "relatively small percentage" in his writing. This is also why he finished his piece by talking about the "politics" of China and their "inability" (his words) to vault past the U.S. technologically. He says China stifles innovation by suppressing "freedom of speech and action"... change subject and maybe no one will notice.

I would simply ask the near sighted maestro a few questions. Did he really believe the Chinese would not eventually "use" their accumulated dollars to "buy stuff?" In fact, I believe they tried to purchase Unocal while he was Fed Chairman in 2002? And were told an emphatic no for national security reasons. Did he really believe they would not purchase gold with their dollars? More gold than the U.S. claimed to have? Heck, back then our gold was only worth $100 billion or so, did he think this too big of a hurdle? Suppression of gold and silver prices were full blown during his tenure, did he really believe it would or could work after watching the U.S. lose 60% of their holdings via the London Gold Pool and then the price of gold to explode?

Here is what I think. I believe the Chinese already have 8,000 tons of gold more or less (not including the Elders gold). They know for a fact that much of what they own came from the U.S. (and let's not forget German gold held at the Fed). China's accumulation could have only come from one place. It had to come from "where" it was previously held since China has purchased more than was available by current production. I believe China floated the 8,500 ton number in preparation for making a global bid for gold. It would not surprise me to see China say something like "we will buy any and all gold at $4,000 per ounce until further notice." This would surely accumulate gold and eventually the selling would dry up. I believe they would then raise their bid and attract more gold. Maybe their total would amount to 15,000 tons or even the 20,000 tons the U.S. had before the 1960's, where would this put China in the financial world? It would put them well ahead of the U.S. and number two Germany combined ...if they really have the gold they claim to have. Maybe China would say something like "we'll show you ours if you show us yours" to prove the Western gold is gone? This would leave who, France and Italy as number 2 and 3 in the world? Please don't tell me the IMF because they won't be showing anybody anything. I don't really believe the Chinese want to "prove" the West has no gold left but I do believe they want their silver (which was leased over 10 years ago) back. They may only use the "phantom" gold situation of the West as "leverage" ...or they may simply blow up the game if they end up being stiffed on their silver.

In any case, Alan Greenspan had to know where this would end up. He had to know the world would finally want to "spend" some or all of the dollars he and his warped cohorts created. He had to know some of these dollars would end up chasing gold which is and was a finite amount within Western vaults. He had to know that each bubble he created would burst and then the next "necessary" bubble to reflate the system would grow and then again ultimately pop.

By what he wrote all the way back in 1966, it is clear to me that Alan "Mr. Magoo" Greenspan was and is a really smart guy who knew exactly what would ultimately happen (but I don't think he thought it would happen in his lifetime). It does not matter what "colored glasses" he is trying to prescribe to the masses by what he say's or so eloquently pens. He clearly knew the value of gold as proven by his 1966 paper and speech. He was in office when Nixon defaulted on the international dollar and then was Chairman of the Fed when dollar and debt creation began to go parabolic. He was there from the beginning, he was there during and he is still here now in the end acting as if he "never knew." He did and he does, the only thing he can now hope for is some event to come along big enough, obvious enough and public enough which wipes out the system ...to point at. "Surely no banking or financial system could have survived that?" he will say. I'll bet however, Mr. Magoo doesn't even need glasses to see how beautiful his own personal stack of gold is!

|

Andy Hoffman's Daily Thoughts |

| Andy Hoffman

|

Painting the Tape

October 1, 2014

When I was a buy-side analyst at a NYC hedge fund from 1996-98, our portfolio consisted primarily of small-cap, over-the-counter stocks. Many had large bid-asked spreads, tempting the fund's managers to "paint the tape" by purchasing small lots with "market on close" orders at the end of each quarter. That way the portfolio was "marked up" in time for our quarterly fee assessments - which, naturally, were based on fund's size. This practice, though not "illegal," was - and still is - common practice; yet another reason why I eventually left Wall Street, kicking and screaming. Such "tape painting" is not only unethical but manipulative and borderline felonious.

Tape painting, of course, is not just limited to sniveling "hedge bombs," but corporations, municipalities and sovereign nations as well. For corporations, Lehman Brothers was the poster child of "window dressing" its balance sheet at quarter's end, engaging in overnight repurchase agreements that temporarily boosted its balance sheet before being unwound the following day. Sadly, this practice is not only alive and well, as "TBTF" banks are, in reality, far more insolvent than in 2008. And thus, the below graph of Federal Reserve initiated repurchase agreements over the past five quarters shouldn't surprise anyone. To wit, when Lehman Brothers engaged in such deception, it did so via overnight "repos" with other banks; while today, the Fed itself is initiating!

| | Zero Hedge |

Similarly, the government "paints the tape" in numerous ways, such as its quarter and year-end finances. Yesterday marked the end of its (September) fiscal year, and you can bet a slew of pork-barrel spending was jammed into the past few weeks, driving the national debt sharply higher. Not to mention, attacking gold and silver prices to maximize losses on PM-holding portfolio managers' holdings; thus, discouraging them from holding them when they "start fresh" today. To that end, it should surprise no one that last year's gold lows - in the $1,180-$1,190/oz. range - occurred on...drum roll please...June 28th and December 30th, respectively. Or that yesterday, amidst a swarm of PM-bullish news, the Cartel ended Wall Street's third quarter and the nation's fourth quarter with a massive gold and silver smash - naturally, at the "key attack time" of 10:00 AM EST. Silver was taken as low as $16.85/oz., and rest assured, if this were year-end, mining write-downs would have been unfathomable; as at such prices, I'd guess more than half the world's mines would be deeply in the red.

And finally, there's paint taping of other sorts, like the politically-motivated manipulation of economic data ahead of elections. Not that the "island of lies" doesn't pervade all data publication these days, but especially periods ahead of key elections - like the upcoming mid-terms. Which, to be honest, was the initial catalyst for this article, before yesterday's "fortuitous" coalescence of the aforementioned factors broadened its scope.

Recall two years ago, when the "unemployment rate" mysteriously plunged in the last NFP report before Obama's re-election. At the time, the numbers appeared so rigged even mainstream commentators like former GE CEO Jack Welch - ironically, the king of corporate accounting shenanigans - accused the Obama Administration of fudging the numbers. And voila; a few months later, a census bureau whistleblower emerged, admitting he was told to produce a positive jobs number - which, as it turned out, placed the "unemployment rate" exactly 0.1% lower than when Obama took office.

This morning's decidedly boring ADP employment report certainly doesn't provide encouragement that Friday's NFP report will be much better than last month's disaster. Nor, for that matter, will yesterday's "trifecta" of miserable data, of consumer confidence, the Chicago PMI, and the Case-Shiller real estate index; or today's "superfecta" of horror, starting with mortgage purchase applications, followed by the PMI and ISM manufacturing indices and concluding with a catastrophic "unexpected" plunge in construction spending.

In fact, as I write, stocks are getting crushed, gold has recouped all of yesterday's losses, silver is up sharply, and the benchmark 10-year Treasury yield has plummeted to 2.42% enroute to the 2.30% low achieved when the Fed "painted the tape" by goosing rates into the September 17th FOMC meeting, when absolutely "Nothing!" hawkish was uttered. In other words, the Fed put on a full-court press to prevent universal realization of the "most damning proof yet of QE failure" - but decidedly failed, when rates were promptly capped at the key 2.6% level we wrote of five months ago before promptly plummeting anew. In other words, they have already failed, which will become painfully evident after the elections, when U.S. economic data will, most likely, really plunge. And this time around, if the BLS attempts to BS the world with a fabricated September employment "surge," methinks the market won't "agree" with the same fervor as two years ago - particularly if the BLS is foolish enough to report another "unemployment rate" plunge accompanied by new Labor Participation rate lows.

As for the rest of today's "horrible headlines," what could be more symbolic than the first verified Ebola case in the States? Or how about this? Fannie Mae, which despite being nationalized, somehow has a new publicly traded stock is down 40% today and 80% from its March 2014 high, enroute to ZERO yet again. Talk about the adage, "some people never learn." And speaking of stocks, recall our recent discussion of how nearly half of NASDAQ were in bear markets, despite the PPT-supported index's largest stocks hitting record highs. Well that was nearly a month ago, just before the "Alibaba top" that clearly has the PPT on the run. Momentum stocks are getting attacked, the small-cap Russell index is in freefall, and pressure on even the big caps is intensifying - particularly homebuilding stocks, which are badly breaking down despite the so-called housing "recovery." And oh yeah, high-yield bonds which just completed their worst quarter in three years.

Let's face it, the global economy is weakening so rapidly and interest rates and currencies plunging so dramatically, that even history's most maniacal scheme of money printing and market manipulation is straining under the pressure. Today's news that Germany's manufacturing PMI fell below 50 only fuels speculation of a return to the "Great Recession"; not to mention, rumors that the ECB will be buying up huge swaths of toxic PIIGS bonds following today's scheduled QE launch. Heck, the IMF is vocally calling for massive deficit-funded European "infrastructure spending"; which if enacted, would likely serve as the coup de grace of unsustainable, unproductive debt accumulation before the Euro's inevitable implosion. Which, by the way, may be accelerated if Catalonia votes to secede from Spain on November 9th or Switzerland to re-engage the gold standard November 30th.

As for precious metals, I'm not sure how much more we can speak of the urgency to own ounces before the cratering global financial system inevitably implodes. Prices have been so dramatically smashed, it'll be a wonder if the mining industry survives much longer in its present form. Production has no doubt peaked - enroute to what I believe will be a 20%+ plunge in the coming years; while capital spending has virtually disappeared, capital availability vaporized, and the Majors on the verge of consolidations that will stall mine development for years to come. Unquestionably, the Cartel has already committed "suicide"; and frankly, it's difficult to believe any of the world's "big money" doesn't know it.

Conversely, PM demand is now surging and will only accelerate as the Chinese and Indian holiday seasons approach. U.S. Mint Silver Eagle Sales doubled from August to September, Shanghai silver inventories are down to essentially nothing, and COMEX silver open interest has never been higher relative to prices - and inventories. Looking at the downright comical plunge in silver prices - even compared to the base metal prices that depict true industrial demand, the gap between silver's value and "price" has never been wider.

And thus, we can only "pound the table" so loudly, to "paint your own financial tape" with the only assets proven to protect one's net worth throughout history. And for those wise enough to

act, we humbly ask you to call Miles Franklin at 800-822-8080 and " give us a chance" to earn your business.

PROTECT YOURSELF, and do it NOW!

Call Miles Franklin at 800-822-8080, and talk to one of our brokers. Through industry-leading customer service and competitive pricing, we aim to EARN your business.

|

Interview with Caravan to Midnight Show |

October 1, 2014 Andy Hoffman talks to John Wells at the Caravan to Midnight Show (1:45:00) to discuss the U.S. dollar, gold and silver, debt in the U.S., the Dow,currencies collapsing around the world and manipulation of the markets. To listen to the interview, please click below.

|

Market Recap |

|

Wednesday October 1, 2014

|

About Miles Franklin |

|

Miles Franklin was founded in January, 1990 by David MILES Schectman. David's son, Andy Schectman, our CEO, joined Miles Franklin in 1991. Miles Franklin's primary focus from 1990 through 1998 was the Swiss Annuity and we were one of the two top firms in the industry. In November, 2000, we decided to de-emphasize our focus on off-shore investing and moved primarily into gold and silver, which we felt were about to enter into a long-term bull market cycle. Our timing and our new direction proved to be the right thing to do.

We are rated A+ by the BBB with zero complaints on our record. We are recommended by many prominent newsletter writers including Doug Casey, David Morgan, Future Money Trends and the SGT Report.

|

The views and opinions expressed in this e-mail are solely those of the original authors and other contributors. These views and opinions do not necessarily represent those of Miles Franklin Ltd., the Miles Franklin Ltd. staff, and/or any/all contributors to this site.

Readers are advised that the material contained herein is solely for informational purposes. The author and publisher of this letter are not qualified financial advisors and are not acting as such in this publication. The Miles Franklin Report is not a registered financial advisory and Miles Franklin, Ltd., a Minnesota corporation, is not a registered financial advisor. Readers should not view this publication as offering personalized legal, tax, accounting, or investment-related advice. All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The information and data contained herein were obtained from sources believed to be reliable, but no representation, warranty or guarantee is made that it is complete, accurate, valid or suitable. Further, the author, publisher and Miles Franklin, Ltd. disclaims all warranties, express, implied or statutory, including, but not limited to, implied warranties of merchantability, fitness for a particular purpose, accuracy and non-infringement, and warranties implied from a course of performance or course of dealing. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author, publisher, Miles Franklin, Ltd, and their respective officers, directors, owners, employees and agents are not responsible for errors or omissions or any damages arising from the display or use of such information. The author, publisher, Miles Franklin, Ltd, and their respective officers, directors, owners, employees and agents may or may not have a position in the commodities, securities and/or options relating thereto, and may make purchases and/or sales of these commodities and securities relating thereto from time to time in the open market or otherwise. Authors of articles or special reports contained herein may have been compensated for their services in preparing such articles. Miles Franklin, Ltd. and/or its officers, directors, owners, employees and agents do not receive compensation for information presented on mining shares or any other commodity, security or product described herein. Nothing contained herein constitutes a representation, nor a solicitation for the purchase or sale of commodities or securities and therefore no information, nor opinions expressed, shall be construed as a solicitation to buy or sell any commodities or securities mentioned herein. Investors are advised to obtain the advice of a qualified financial, legal and investment advisor before entering any financial transaction.

IN NO EVENT SHALL AUTHOR, PUBLISHER, MILES FRANKLIN, LTD, AND THEIR RESPECTIVE DIRECTORS, OFFICERS, EMPLOYEES AND AGENTS BE LIABLE FOR ANY DIRECT, INDIRECT, PUNITIVE, INCIDENTAL, SPECIAL, CONSEQUENTIAL, EXEMPLARY OR OTHER DAMAGES ARISING OUT OF OR IN ANY WAY CONNECTED WITH ANY INFORMATION CONTAINED HEREIN OR IN ANY LINK PROVIDED HEREIN, PRODUCTS AND SERVICES ADVERTISED IN OR OBTAINED HEREIN, OR OTHERWISE ARISING OUT OF THE USE OF SUCH INFORMATION, WHETHER BASED ON CONTRACT, TORT, NEGLIGENCE, STRICT LIABILITY OR OTHERWISE.

|

|