|

Our Members

Public Sector Members

California Department of Transportation (Cal Trans)

I-95 Corridor Coalition

Minnesota Department of Transportation

Nevada Department of Transportation

New York City Department of Transportation

North Carolina Department of Transportation

Oregon Department of Transportation

Washington State Department of Transportation

Private Sector Members

AECOM

Atkins

Baker

Cambridge Systematics

CDM Smith

CH2M Hill

Computer Aid

D'Artagnan Consulting

IBM

International Bridge, Tunnel, and Turnpike Association (IBTTA)

Kapsch TrafficCom IVHS

Parsons Brinckerhoff

Reason Foundation

3M

Transcore

Verdeva

Xerox

|

|

| This is the latest issue of MBUFA's e-Newsletter. Please use the "In this Issue" links (left) to jump directly to articles and departments of interest. We welcome any comments and suggestions as well as contributions --news, features or links to recent research -- for upcoming issues. -- The Editor. |

|

| | Jack Basso, Chairman of MBUFA |

DC Update

from Chairman Jack Basso

In 2009, the National Surface Transportation Infrastructure Financing Commission completed their work and the findings in their report could not have been clearer:

"The Commission cast a wide net, reviewed many funding alternatives, and concluded that indeed the most viable approach

to efficiently fund federal investment in surface transportation in the medium to long run will be a user charge system based

more directly on miles driven (and potentially on factors such as time of day, type of road, and vehicle weight and fuel economy)

rather than indirectly on fuel consumed."

The Commission was created by Congress in SAFETEA-LU to prepare the way for legislative action in MAP-21 to fuel the pilot programs necessary to work through the implementation and operation issues related to a mileage based fee system. We've been fortunate to have a former Commission member, Adrian Moore, as a member of MBUFA and his experience and insight have been invaluable to us over the past two years.

Unfortunately, as we all know, Congress was unable to take the next step in solving the transportation infrastructure financing challenge and failed to include support for further study and pilot testing of mileage based fee systems in MAP-21. That's the disappointing news of the year.

At the same time, however, states have continued to move forward even without the federal funds they truly need to scale up the pilots they are testing. MBUFA vice chairman, Jim Whitty, has continued his extraordinary efforts with the Oregon DOT and they are rolling out a new pilot to further test the system and build public acceptance. Washington State just voted to add a $100/year charge on electric car owners to insure that they contribute their fair share for road use. Other states like Nevada and Minnesota are testing other approaches. The member states of the I-95 Corridor Coalition are looking closely at how a multi-state mileage-fee system might work. And in Congress, Rep. Earl Blumenauer has introduced legislation which would direct the Secretary of the Treasury to fund a pilot program to study alternative financing systems, like mileage based fees for transportation infrastructure funding.

The awareness that the current transportation infrastructure finance system is inadequate to meet the nation's needs has increased tremendously. Already we have heard from the new Transportation and Infrastructure Committee chairman, Bill Shuster that he is willing to look at options like mileage based fees as a possible solution. With our new MBUFA committees in place, we are poised to build awareness and advance mileage based fees as a viable option to the excise tax on gasoline.

We have a big year ahead and I look forward to working with all of you in my new capacity with increased focus and renewed commitment.

|

|

Executive Director's Report

by Barbara Rohde

The Mileage Based User Fee Alliance officially turned two years old in late 2012. We thank you for your continued support and encouragement.

Since the organization has now grown to over 25 members with more planning to join in early 2013, we believe it is a time to more formally structure MBUFA. We have so appreciated the advice and support of the membership and we have asked for their help in this endeavor as well.

To assist in providing this feedback, we have formed four committees:

1). Communications--Dr. Adrian Moore, Reason Foundation, Chair

2). Strategic Planning--Lou Neudorff, CH2M Hill and Jeff Doyle, Washington DOT, Co-Chairs

3). Research--Lee Munnich, University of Minnesota, Chair

4). Membership--Jim Whitty, Oregon DOT, Chair

If you have missed any of the communication about these committees and would like to participate in one or more, please let me know and we will be delighted to include you in upcoming meetings.

We will be scheduling a time to meet during the Transportation Research Board's (TRB) annual meeting in Washington, DC in mid-January, but we are still trying to coordinate schedules. We will send a Membership Alert shortly with the date, time, and location. IF YOU HAVE PREFERRED TIMES, PLEASE LET ME KNOW BY JANUARY 4th.

As we mentioned during the Quarterly Meeting in December, we are very pleased that Jack Basso will be continuing as Chair and will have a formal office at FaegreBD Consulting beginning February 1, 2013

Thanks again for your assistance and we look forward to seeing many of you during TRB.

|

|

New RAND Guide on Mileage Fees Released.

By Liisa Ecola, Senior Project Associate, The RAND Corporation

The RAND Corporation is releasing a new guide, Mileage-Based User Fees for Transportation Funding: A Primer for State and Local Decisionmakers. The primary audiences are states, metropolitan regions, and cities that are considering pilot programs. The illustrated guide provides senior decision-makers with a high-level synopsis of mileage fee issues: policy motivations, technical options, key challenges, and emerging strategies to address those challenges.

RAND's two previous reports on mileage fees looked at

the potential to implement mileage fees in the short-term (within five years), and considered how a possible large-scale trial program might be designed. Both reports implicitly assumed that the federal government

would play a major role, especially with regard to funding. But in the two years since the second report was released, much of the momentum for implementing mileage fees has moved to the state level. RAND's new guide, aimed at state and local legislators and transportation decision-makers, draws from previous work and provides up-to-date information about legislation, planning, and trials in states and cities around the country.

The guide focuses on emerging strategies for overcoming two challenges associated with mileage fees: administrative cost and weak public support. It discusses 15 emerging strategies for addressing these challenges, including ideas about technologies, phase-in approaches, and stakeholder involvement.

Download PDF of the guide.

Hard copies can be ordered via the web site, or by contacting the authors directly: Paul Sorensen or Liisa Ecola.

Short video introducing the guide, narrated by Paul Sorensen.

|

|

Transportation Finance and Mileage-Based User Fee Symposium to be held April 14-16 in Philadelphia.

This Summit will explore the full range of issues affecting surface transportation policy, finance and funding. Sessions will address the latest studies in mileage-based user fees and the diverse range of financing tools. Topics include

- MAP-21 implementation: TIFIA

- Transitioning from a fuel tax to VMT

- Fuel efficiency standards and the impact on transportation funding

- Legal, Financial and International P3 update

- Bonding and revenue generation for managed lane projects

- What's new in Traffic and Revenue studies

- Legislative needs/updates

- Next Generation Payment Applications (e.g. GPS, RFID, Mobile Apps, etc.)

- Public opinion studies

The IBTTA is co-hosting the meeting with MBUFA, AASHTO, I-95 Corridor Coalition, the Reason Foundation and TRB. Additional meeting information. |

The MBUF Onboard System - Do We Need It?

Dick Schnacke - VP, TransCore

Lots of people have proposed approaches to a VMT-type system. Many of them have been studied intensely

and a few have made it into tests or pilots. Undoubtedly, more of these will be happening over the next few years. Although the approaches have varied, by necessity most

of them have used a dedicated onboard system. But

other things are happening that might change our universe a little.

One of these, the USDOT-sponsored Connected Vehicle (CV) Program, is moving steadily forward, almost as a

direct parallel to the MBUF developments and pilots. It, too, is in the later stages of development and the initial stages of evaluation. In fact, due to CV programmatic changes and delays, the CV and MBUF initiatives are now on trajectories that may have them deploy at approximately the same time. And those of us who are working in both areas see some interesting connections that others may have missed. Chief among these are characteristics of the onboard system necessary to enable them.

First, here's a quick sketch of the Connected Vehicle program at USDOT. It's a safety enhancement for all vehicles that is intended to save lives by eliminating crashes rather than simply protecting people better when they do crash. This is the program that was called VII (Vehicle-Infrastructure Integration) for years, then became IntelliDrive for another period of time and is now called Connected Vehicle. Many people have been working toward this for at least 15 years and it's the number one development program at USDOT with lots of support. Considerable testing has been done and lots more is planned.

There is a commitment for NHTSA to make a 'deployment readiness' decision in late 2013. This would start the cycle of activities leading up to a federal mandate for deployment in all new vehicles, with current plans targeting 2019-2020 for that deployment to begin. Between the readiness decision and the actual start of deployment, there will be lots more testing and the development of many 'apps' (safety and otherwise) that can run on the CV platform.

So let's discuss synergy. What onboard system attributes do we need for a viable MBUF system - and how do they compare to what's coming on the Connected Vehicle (CV) platform?

1) MBUF needs: A way to tell where you are (or where you have been)

The CV platform implements GPS. It's not optional - it is the way to know instantaneous position. CV-equipped vehicles use this to inform nearby vehicles of their presence, even when they're in your blind spot or otherwise obscured by the terrain or local traffic.

2) MBUF needs: A way to get information off the vehicle

The CV platform implements 5.9GHz Dedicated Short-Range Communications (DSRC). This is a derivative of WiFi that is customized for the transportation safety environment. It's very fast, connects almost instantly and operates in a dedicated spectrum to eliminate interference. And although the name says 'short', it works reliably at a range of 1000 feet.

3) MBUF needs: Super data security

The DSRC radios designed for the CV platform are ultra-secure. USDOT will mandate this. You cannot tolerate hacking or other security breaches in a vehicular safety system.

4) MBUF needs: A highly capable processor

The CV platform is designed to support numerous simultaneous applications. The processor driving the CV onboard system is powerful, with lots of excess capacity.

5) MBUF needs: Plenty of memory

The CV platform will incorporate lots of memory and is quite modular. Any reasonable MBUF implementation should be easily accommodated.

So what does this mean for MBUF? Start by remembering some things we hear all the time - the things people DON'T want in an MBUF onboard system:

1) It should not cost a lot

It will cost zero if running on the CV platform. No hardware, just software.

2) It should not track people

We've spent a lot of energy fighting the GPS battle. We should stop fighting. GPS will be on CV-equipped vehicles - we don't have to justify it or defend it. We can simply use it.

3) It should not jeopardize privacy & anonymity

The CV program has faced the same user requirements and has been designed to protect people's private information.

4) It should not be possible to crack the vehicle communications

MBUF requirements are easily covered by the CV safety system requirements, which are even more severe.

The bottom line is:

The Connected Vehicle and the need for an MBUF type of road cost recovery are likely to land at approximately the same time. The CV platform, which is happening with or without MBUF, can carry the load (and the cost) of the needed onboard device. MBUF should be nothing more than an 'app' on the CV platform. We should be focusing our energy on the back-end issues, i.e., how to translate what the onboard system provides into a legitimate collection of funds. |

|

The True Costs of Fuel Taxes and of 21st Century Toll Collection Technologies *

by Bob Poole and Adrian Moore of Reason Foundation

| |

Bob Poole |

One of the strongest arguments raised against MBUF is that fuel taxation is a highly efficient means of raising highway revenue, while toll collection (and hence MBUF collection) is highly inefficient (i.e. very costly). In May 2007 the American Trucking Association's American Transportation Research Institute came out with a major report on highway funding alternatives. Its assessment of tolling

Research Board (NCHRP Report 689)

This conventional wisdom is being challenged by a

new study from the Reason Foundation, released the last week of November. Based on original research on the cost of collecting both types of revenue, it finds that the real cost of collecting revenue via fuel taxes is actually about 5% of the revenue. And it also finds that 21st-century all-electronic tolling (AET) can cost

| | Adrian Moore |

as little as 5% of the revenue collected.

The principal author of the study is Daryl S. Fleming, PhD, PE. Dr. Fleming has been helping implement electronic toll collection for 35 years as a researcher and consultant. He and one of his three co-authors helped develop the world's first AET system, implemented 15 years ago on the then-new Highway 407 electronic toll road in Toronto.

Dr. Fleming and colleagues critically analyzed three recent reports that assessed the cost of collecting highway revenues via tolling, including the ATRI report and NCHRP 689. All three studies were primarily backward-looking, thereby capturing costs that are rapidly disappearing as toll facilities shift from cash to electronic tolling. The ATRI study also misleadingly lumped ferries and toll facilities together, and also counted one-time capital investments as part of annual costs, rather than amortizing them over their useful life.

Fleming and his co-authors also identified and studied in some detail three U.S. toll operators that have pioneered cashless all-electronic tolling (AET): Colorado DOT's I-25 managed lanes, the Fort Bend County Toll Road Authority in Texas, and the Tampa-Hillsborough Expressway Authority. Despite all three being small agencies, they were able to achieve the low costs of collection that might be expected of much larger agencies that can spread fixed costs over a larger volume of transactions. Extrapolating their findings to larger toll roads, they estimate that AET can achieve a cost of toll collection as low as 5% of the revenue collected, using streamlined business models.

Fleming and colleagues also used information from a recent National Cooperative Highway Research Program report (and other sources) to re-estimate the cost of collecting highway revenue via per-gallon fuel taxes. Thanks in part to recent information on fuel-tax evasion and exemptions, as well as tax costs hidden within the fuel-delivery supply chain, they estimate that the true cost of fuel-tax collection is close to 5% of the revenue collected-i.e., in the same ballpark as best-practice AET.

These findings have major implications for the future of highway finance and funding. They directly counter arguments that shifting from increasingly inadequate per-gallon fuel taxes to a per-mile charging system would be ruinously expensive. Consequently, these findings give advocates of mileage-based user fees a stronger case for proceeding with further research on alternative ways of making such a transition.

In this context the authors make a bold proposal. They suggest that this country begin the transition now, focusing on the limited-access highway system (i.e., urban expressways and major highways such as the Interstates). Doing this would not require any expensive new technology (such as a Big Brother GPS box in every vehicle). All it would take is today's low-cost transponders in vehicles and the installation of AET equipment at on-ramps and off-ramps. Each vehicle's miles driven would thereby be recorded and charged appropriately, based on vehicle type.

In other words, yet another way to begin to move to MBUF. You can read a summary of the Reason study Dispelling the Myths: Toll and Fuel Tax Collection Costs in the 21st Century: Dispelling the Myths: Toll and Fuel Tax Collection Costs in the 21st Century or view the complete study PDF at complete study PDF.

*A version of this column appeared in Public Works Finance.

|

State Update: Oregon

By Jim Whitty, Manager Office of Innovative Partnerships and Alternative Funding, Oregon Department of Transportation

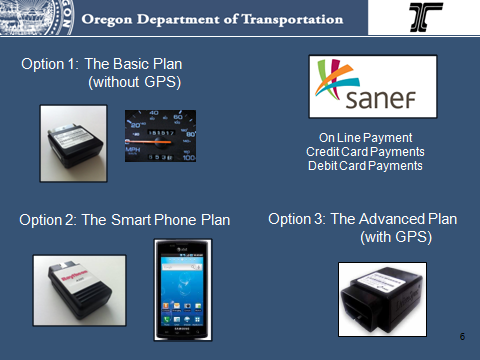

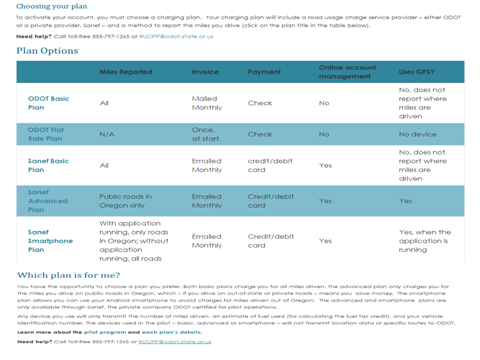

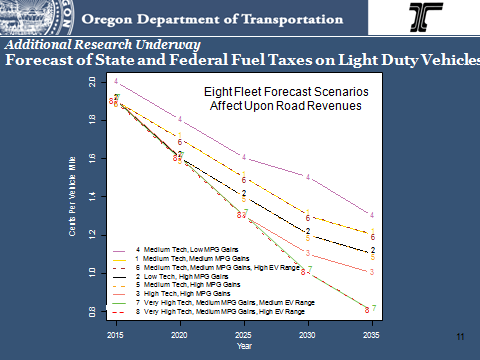

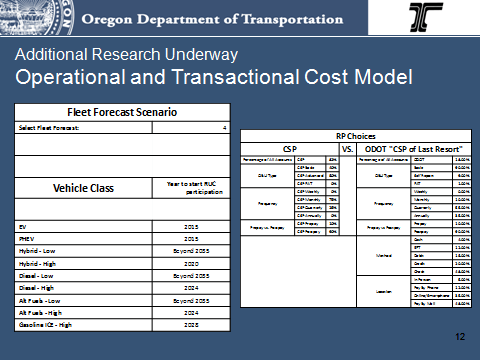

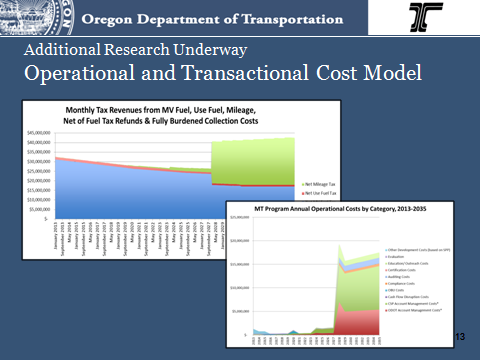

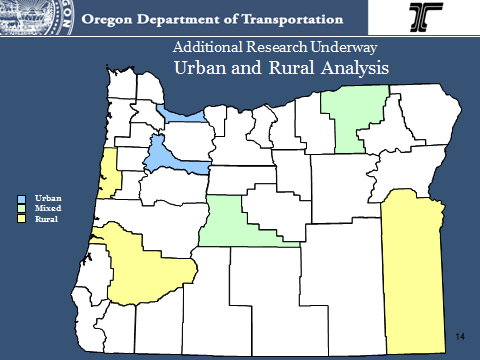

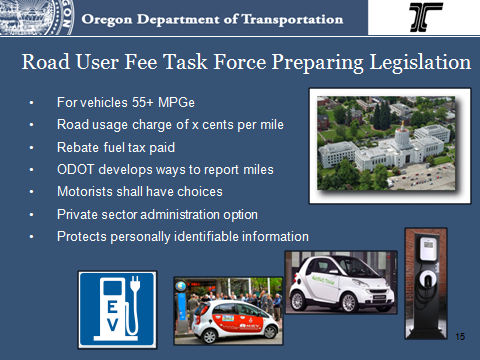

Oregon's Road User Fee Task Force is introducing legislation in the 2013 state legislative assembly to apply a road usage charge to new vehicles rated at 55 MPGe and above in 2015. In preparation for this legislative push, Oregon DOT has developed and run a new pilot program to demonstrate a new approach to mileage reporting and charge collection to participants of policy import.

The three month pilot presents a cloud based mileage data reporting system, private sector data tax processing and accounting and an open system that provides choices to motorists. Participants include state legislators from the House and Senate transportation and revenue committees, state transportation commissioners and executive level ODOT management among others.

The following slides describe the case for a new road usage charging system and describes how it works

|

|

Research Library

Congressional Budget Office

How Fair is Road Pricing? Evaluating Equity in Transportation Pricing and Finance

Bipartisan Policy Center

Click Here

|

|

Article Headline

Include articles on topics of interest to your readers, relevant news and events. If you find an interesting article on the Web, you can easily ask the author's permission to summarize the article and link to it from your newsletter. Inserting a link in your article lets you track which topics attract the most interest.

|

|

|

|

|