Welcome to the September Market Update, providing current information on the Maplewood/South Orange real estate markets, as well as the surrounding towns. I'm back in the saddle, looking forward to a great fall season! As always, I'd love to hear from you with any feedback and suggestions. So, thanks for reading, and I look forward to satisfying any real estate needs you might have.

|

|

September 2014 Market Update

|

Locally

September is off to a typically slow start with the number of active listings down from the spring. As people ease back into work/ school mode, we'll see this number increase towards the latter part of the month. Since the spring, Maplewood has seen an increase in sale prices resulting in August numbers at 3% above list prices. Since April, Montclair homes have been consistently selling 3-4% above asking. South Orange saw an increase of about 1%. Millburn/Short Hills has been stable, with homes sales 98-99% of their list price. If this past week is any indication of the upcoming fall market, several of the new listings that showed well and were priced under market value went quickly, with multiple offers. See recent sales in your area.

Nationally

| | This Month In Real Estate September 2014 |

|

Insider Tips for Buying and Selling Interested in buying a"Fixer Upper" but don't have the cash? Investor "flips" were big this year due to the rise in inventory and the hot sales market. With cash on hand, many investors took advantage and scooped up distressed homes to renovate and re-sell. If you're interested in getting in the game but don't have the cash, a 203K loan may be a great way to acquire investment properties. Here are the steps involved in obtaining this type of loan:

- Get pre-qualified

- Work with a realtor to find the property with maximum immediate return on investment

- Apply for the mortgage

- Discuss repairs and costs with a contractor

- Complete required bank forms with a bank consultant (which gets added to the loan amount)

- Bank schedules an appraisal (which factors into the renovation)

- Loan is underwritten

- Close on the property in "As-Is" condition

- Rehab account created

- Funds are dispersed as construction progresses

- Rehab is complete

- List it with your realtor and sell it at a profit!

|

|

Interest Rates

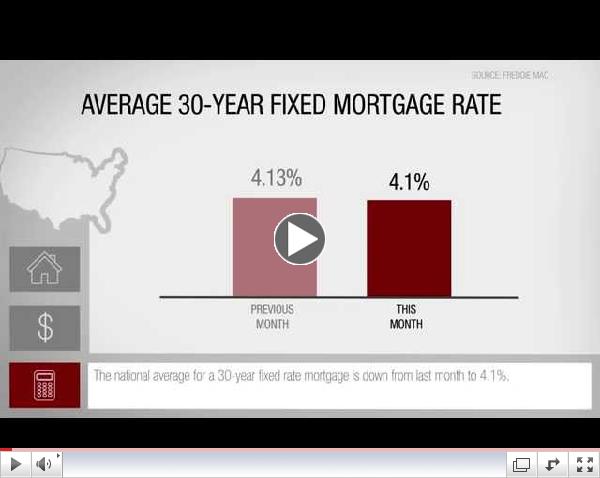

After dipping early this year, mortgage rates remain low.

|

| Type | Rate | | 30-year fixed | 4.13% | | 15-year fixed | 3.23% | | 5/1 ARM | 2.97% | | Historical Average | 8.9% |

|