|

|

Overview

On April 14, 2010, the U.S. Department of the Treasury and the Department of Housing and Urban Development (HUD) released an update on the Administration's nationwide campaign to help borrowers in the trial phase of their modified mortgages convert to permanent modifications under the Home Affordable Modification Program (HAMP).

As of the end of the month, more

than 1.4 million homeowners received offers for trial modifications, and

more than 1.1 million borrowers were receiving a median savings of $500

each month.

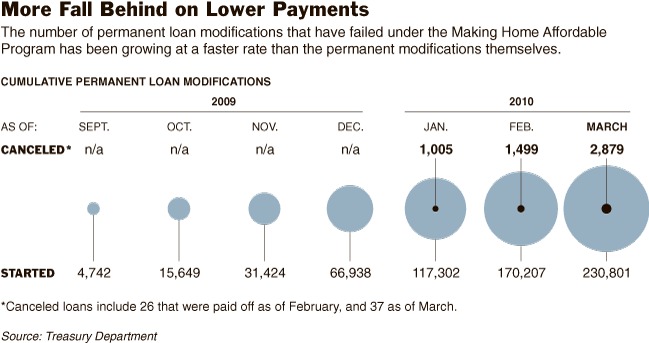

Permanent modifications have been granted to more than

230,000 homeowners, and an additional 108,000 permanent modifications

have been approved by servicers and are pending only borrower

acceptance.

HAMP was designed to offer through 2012 up to 3-4 million homeowners reduced monthly mortgage payments that are affordable and sustainable over the long-term. |

Trend Graphic: New York Times - April 14, 2010

|

Comment

Unfortunately, the number of homeowners who defaulted on their mortgages -- even after securing cheaper terms through the government's modification program -- nearly doubled in March, continuing a trend that could undermine the entire program.

- Sixty percent of modifications undertaken by banks in late 2008 were in default a year later, according to the latest Mortgage Metrics Report compiled by the Office of Thrift Supervision and the comptroller of the currency.

|

Highlights

Making Home Affordable Program

Servicer Performance Report - March 2010

Over 230,000 Homeowners Granted Permanent Modifications- More than 230,000 total permanent modifications have been granted to homeowners, who are guaranteed lower payments for five years.

- In addition, more than 108,000permanent modifications have been approved by servicers and are pending borrower acceptance.

Over 1.1 Million Trial Modifications for Homeowners

- More than 1.1 million trial modifications have begun under the program.

- 57,000 new trial modifications were added in March, down from 72,000 in February, reflecting servicers increasingly requiring upfront documentation from homeowners to comply with pending HAMP policy requirements.

- Borrowers realize immediate relief with the first trial payment.

- More than 1.4 million homeowners have received offers for trial modifications.

- Of the 1 million borrowers in active modifications (trial and permanent), more than 227,000 borrowers are in permanent modifications.

- The lower monthly mortgage payments for homeowners in HAMP represent a cumulative reduction of over $3 billion.

Servicers Making Progress on Trial Modification Decisions - Over 60,000 trial modifications converted to permanent modifications in March, an increase of almost 15% from the nearly 53,000 in February.

|

|

Want To Stop Mortgage Defaults?

Task Force designed to reduce high compare ratios

caused by excessive defaults and claims.

Task Force Description

- Staffed with subject matter experts and skilled auditors

- Specially designed checklists and automated file screening systems

- State-of-the-art quality control, compliance, forensics, and modern research facility

- Scalable up to virtually any size default and claims experience

- Upload/download large file formats for prompt reviews

- Located in a secured and safe audit location

Our Remedy

- Comprehensive review of existing defaults and claims for loss mitigation and loan modification eligibility

- HUD-FHA and regulatory compliance guidance for the mortgagee

- FHA and conventional Early Payment Defaults resolution strategies and loss mitigation methodologies

- Mortgagee notification of borrower's loss mitigation eligibility

- Borrower notification of loss mitigation eligibility

- Expert, nationwide legal counsel to handle loss mitigation and loan modification strategies

- Monitoring of loss mitigation applications in process

- Follow-up with servicers to assure proper and timely resolution and notification to HUD-FHA

- Loss mitigation resolution of new defaults and claims

The Compare Ratio provides a value that

reveals the largest discrepancies between the mortgagee's default and

claim percentage and the default and claim percentage to which it is

being compared.

An indicator of excessive defaults and claims is the FHA Compare Ratio statistic. When a Compare Ratio is above 150, HUD begins a due diligence process.

Mortgagees with a Compare Ratio of greater than 200 are subject to disciplinary review, termination of underwriting authority, and possible loss of FHA mortgagee approval. |

Visit our Library for Issuance

Making Home Affordable Program

Servicer Performance Report Through March 2010

April 14, 2010

|

|

|

|

Lenders Compliance Group is a full-service, mortgage risk management firm, providing professional guidance to financial institutions in all areas of mortgage compliance.

Specializations

Mortgage Compliance

Compliance Administration

Compare Ratio Task Force®

Forensic Mortgage Audit®

Business Development

Mortgage Fraud Audit®

Quality Control

FHA Examinations

State and Federal Examinations

Fannie/Freddie/Ginnie Applications

Mortgage Due Diligence

Legal Reviews & Remedies

Loss Mitigation Compliance

HMDA & CRA Reviews

Disaster Recovery Plan®

IT & IS Compliance

Statutory Licensing

This communication is sent to our valued clients and colleagues, who regularly receive our Advisory Bulletins, Mortgage Compliance Updates, Compliance Alerts, Licensing Alerts, and News and Views.

These publications are free to subscribers. Information contained herein is not intended to be and is not a source of legal advice.

© 2010 Lenders Compliance Group, Inc. All Rights Reserved. |

|

|