|

|

Money 101:

Personal Money Planning's Newsletter

|

|

| Find Us On Facebook! |  | |

Join our Facebook page for interesting and helpful information about finance, business, and more.

|

|

Howdy!

I heard on the news this week that many people are taking the whole week off to celebrate Independence Day. If you are one of those lucky folks, enjoy! I hope everyone has a fantastic 4th of July!

--Gary |

|

|

Gary's Soapbox

Child Labor

OK, not really. But if you have kids or grand kids around the house, you have to find something to keep them occupied. Why not put them to work?

This may be a tough sell at first, but be prepared when the inevitable "I'm bored" comes from their lips. More than likely, they will have an idea of a fun activity, one that costs money. What better way to teach them the value of work and of a dollar than by allowing them to earn their "play" money?

Even if the teenagers can't find a job at their local burger joint or swimming pool, they can still babysit, walk dogs, mow lawns and more. The younger kids can start to earn an allowance from basic household chores. Make it fun! Give them a visual-- a bar graph with their goal that shows them how close they are to that big "payday." They may earn a day at the water park, or a new video game. Whatever it is, they purchase it and will understand the satisfaction of work well done.

Don't forget to teach them the importance of savings, too. After all, this summer they knew what they wanted (or they felt they "needed"), but what if the thing they want next summer costs more? If they always set aside something "just in case", they will always be prepared for the unexpected.

That's a good lesson at any age.

Gary Silverman, CFP®

|

|

Gary's Latest Articles

Times Record News and Biz to Biz

Value of Education Some potential changes to the Pell Grant system seem at odds with the lessons Gary's father taught him about education. Gary explored this in his Father's Day column.

Why Sell A Winner?

Reduce Overwhelm: Outsource If you are in business, especially if you own your own, you will find yourself wearing many hats. If you are not careful, all those hats will come tumbling to the ground. You can't do it all. Consider outsourcing. Your business (and your sanity) will benefit greatly.

|

Money 101: Summer School

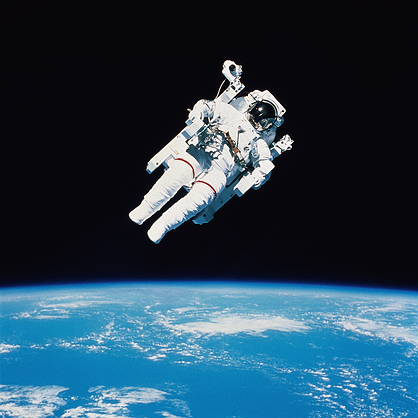

Understand Where Your Advisor is Coming From, Or, At Least, Which Planet...

Gary has written about what kind of questions to ask your potential financial advisors, but what impact gravitational forces have on their decision making process isn't one of them.

Still, when an advisor is promising "safe" returns in the 6 to 18% range, something isn't quite right. In this case, the advisor didn't share that he was inspired by the skies. He's also in trouble for using the money his clients invested for his personal use and creating a Ponzi scheme.

You can read the SEC complaint here.

|

|

|

Final Thought

All of this talk about dishonesty may make you wonder, are people honest? What is their breaking point? A bike rental company wondered the same thing. They started an experiment with a lonely bike tied up to a post. How many days do you think it was left undisturbed? Take a look...

Sincerely,

Gary Silverman

Personal Money Planning |

|

|

|

©2012 Personal Money Planning . All rights reserved by Personal Money Planning and content may not be reproduced, disseminated, or transferred in any form or by any means, except with the prior written permission of Personal Money Planning unless specifically noted. (Permission is not difficult to obtain.) The one exception is for downloading and printing information from this newsletter for general education by the original recipient.

|

DISCLOSURE

This newsletter is produced by Gary Silverman, dba Personal Money Planning, a registered investment advisor located in Wichita Falls, Texas.

Information in this newsletter is believed to provide accurate and authoritative information in regards to the subject matter covered. However, the accuracy, timeliness, or applicability of the information is not guaranteed and is provided with the understanding that we are not rendering legal, accounting, tax, or other professional advice or services.

This publication should not be construed by any consumer and/or prospective client as Personal Money Planning's solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Nor should links provided to other sites be construed as the recommendation of the services or products mentioned on those sites. If such services are required, the help of a competent professional should be sought.Remember that past performance may not be indicative of future results. Therefore, you should not assume that the future performance of any specific investment, investment strategy, or product made reference to (directly or indirectly) on this Website will be profitable or equal to indicated performance levels. Different types of investment involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for your investment portfolio.

Historical performance results for investment indexes and categories generally do not reflect the deduction of transaction or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results.

A copy of Personal Money Planning's current written disclosure statement discussing Personal Money Planning's business operations, services, and fees (known as an ADV Part II) is available from Personal Money Planning upon written request (and can be downloaded from our web site).

Personal Money Planning does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Personal Money Planning's web site or incorporated herein, and takes no responsibility therefore. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. |

|

|

|

|

|