|

As we close the books on 2011, many will associate the year with Europe's debt crisis, Congress' political gridlock, and the stock market's volatility. And to some extent, they'll be right. We did face a number of significant challenges during the course of the year. At the same time though, 2011 was a year of growth and healing for the United States.

Americans are spending again, as evidenced by a record-breaking holiday shopping season.[1] Factories are producing more. [2] Companies are generating impressive profits.[3] The housing market is showing signs of life.[4] And with the unemployment rate at its lowest level in nearly three years [5], even the job market is improving. While blind optimism can be a dangerous thing, focusing on the negative can be equally risky. So without amplifying the problems of the past or minimizing the challenges of the future, let's take a look back at some of the key events that made 2011 what it was.

Japan Quake Shakes Markets (March) The devastating earthquake and consequent tsunamis that hit Japan in March riled global markets. The Japan earthquake sent the Nikkei Index on a downward spiral, and the U.S. stock market soon followed. The auto industry lost ground as Japanese manufactures were forced to halt production due to power outages.[6]

Budget Problems Almost Result in Shutdown (April)

Well into April, the 2011 budget had still not been approved by Congress. Instead, lawmakers passed six short-term spending bills through March. The final extension was set to expire on April 8th, forcing Congress to come to a budget agreement or face a shutdown. Had a shutdown occurred, Americans would have faced grievous consequences, and nervous investors felt the pressure.[7]

Osama Bin Laden's Death Rallies Markets (May)

Following the death of Osama Bin Laden at the hands of U.S. forces in Abbottabad, the stock market opened significantly higher. President Obama called Bin Laden's death "the most significant achievement to date in our nation's effort to defeat al Qaeda." The Dow Jones industrial average rose 56 points (0.5%), the S&P 500 climbed 5 points (0.4%), and the Nasdaq Composite gained 8 points (0.3%).[8]

U.S Government Risks Defaulting on Debt (July)

After the U.S. debt ceiling was reached in May, the government was forced to find a solution or risk default on August 2. Though congress had over 11 weeks to come to an agreement, things came down to the wire once again as lawmakers argued over solutions, leaving financial markets on edge.[9]

S&P Downgrades the United State's Credit Rating (August)

In what was perhaps the most humiliating news of the year, Standard and Poor's decided to downgrade the U.S. credit rating from AAA to AA+, which marked the first U.S. credit downgrade in history. This downgrade hit stock prices hard, and the long term consequences of S&P's move are yet to be known.[10]

Occupy Movement Begins (September)

Activists began gathering in New York City's Financial district on September 17th to protest social and economic inequality, high unemployment, greed, corruption, and the influence of corporations on government. The protests in New York City have sparked similar protests around the world. News surrounding this movement has been a regular feature of recent headlines.[11]

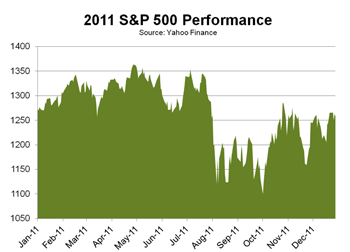

A Note About Equities

U.S. stocks slid on the final trading day of the year, with the S&P 500 surrendering its 2011 gain and settling virtually flat for the year at -0.04%. The Dow Jones industrial average ended the year up 5.5%, its second consecutive yearly rise, and the Nasdaq composite index finished down 1.8% for its first annual loss since 2008.[12] Despite disappointing equity returns in 2011, the last three months of the year were positive, which could bode well for 2012. The S&P 500 rose 11% in the fourth quarter, and the Dow climbed 12% for its largest quarterly point gain in its history. On the bright side, stocks seem to be well-priced. The S&P 500 is trading at 12 times its expected earnings per share versus a more typical 15 times. In other words, stocks appear cheaper than normal right now.[13]

In Conclusion

What is in store for 2012? The answer to that question will depend on who you ask, and where they're looking. At the end of the day, no one has a crystal ball that can be relied upon, and we should not be so arrogant as to make predictions. The indicators we are watching offer both positive and negative signs and many questions remain to be answered. How will Europe sort out its debt troubles? Will U.S. lawmakers raise the debt ceiling again in 2012? Will they extend the Bush Era tax cuts? How will China's slowing economy affect the world? The answers to these questions and more like them have the potential to affect financial markets.

All in all, 2012 is beginning on a more positive note than many investors could have predicted given the challenges of 2011. And while we hope the economy and the stock market maintains its positive momentum, history teaches us that ups and downs are part of life. Whatever we face in the year ahead, rest assured that we will maintain a watchful eye on any factors that have the potential to affect you. May a bright and prosperous 2012 be yours!

ECONOMIC CALENDAR: Monday - New Year's Day Observed Tuesday - ISM Manufacturing Index, Construction Spending, FOMC Minutes Wednesday - Motor Vehicle Sales, Factory Orders Thursday - ADP Employment Report, Jobless Claims, ISM Non-Manufacturing Index, EIA Petroleum Status Report Friday - Employment Situation |