|

Weekly Market Update

SPECIAL EDITION - 2010 IN REVIEW |

|

|

The Markets:

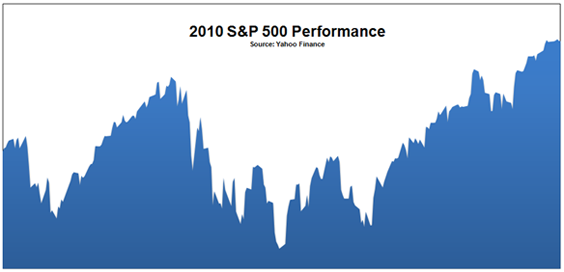

2010 was truly a year for the history books! The Standard & Poor's 500 began January at 1115, and then crisscrossed that line 165 times to eventually end the ride with its finest December performance in 19 years. The Dow's second-straight annual increase was equally dramatic, with almost half of its climb (5.2%) occurring in December.[1]

|

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. Indexes cannot be invested into. Chart is for illustration purposes only.

|

More than a few factors influenced the roller coaster ride of last year. Here are a few of the highlights:[2]

January - Stocks start out looking good at 15-month highs.

February - European debt concerns take center stage as investors fear Greece will default and trigger a landslide that continues into Portugal, Italy, Ireland and Spain. Anxiety about these areas tug at the markets all year.

April - In a series of left hooks, the SEC files charges against Goldman-Sachs related to improper sale of securities tied to subprime mortgages, the BP oil spill fiasco begins, and Greece requests a $53 billion bailout.

May - Wall Street experiences the infamous "Flash Crash" that sends the Dow plunging almost 1,000 points in just a matter of minutes.

July - Stocks sink to 2010 lows as June's jobs report disappoints. President Obama signs the Frank-Dodd Wall Street Reform and Consumer Protection Act into law, enacting the most far-reaching financial reform since the 1930s.

November - Republicans win back the House in mid-term elections - a shift in power that is generally seen as a win for Wall Street. The Fed unveils a $600 billion bond-buying stimulus program called quantitative easing, and the Dow and Nasdaq touch 2-year highs.

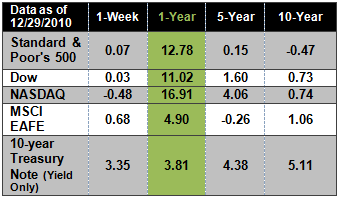

December - President Obama signs the $858 billion tax cut deal into law. Stocks end the year on a high note with the S&P up 12%, the Dow up 10%, and the Nasdaq up 17%.

As we ride a wave of optimism into 2011, there are still a number of challenges to face. The Fed's QE2 policy has many experts increasingly worried about inflation. Home prices are falling again, leading to questions about a double-dip in the housing market recovery. And the economy continues to suffer from one of the longest job droughts in our nation's history, with the monthly unemployment rate lingering above 9% for 19 straight months.[3]

Investors will also be paying attention to politics and global economics as the year begins. Congress will return this week with Republicans in control of the House, and while investors are hoping the new political landscape will deliver business-friendly policies, there's also the chance of political gridlock. In addition, Euro zone debt and China's attempts to rein in inflation without derailing progress pose potential hurdles to overcome.[4]

All things considered, the future looks bright for 2011. Bullish sentiment toward the stock market is spreading and investors are beginning to put more money into it than they are pulling out.[5] There has been a recent decrease in unemployment claims which are currently at their lowest level since July 2008.[6] And corporate earnings are strong, with a 32% growth rate estimated for S&P 500 companies in 2010's fourth quarter.[7]

The new year is beginning on a more positive note than many investors could have predicted given the challenges of 2010. And while we hope the economy and the stock market maintains its positive momentum, history teaches us that ups and downs are a part of life. Whatever we face in the year ahead, rest assured that we will maintain a watchful eye on any factors that have the potential to affect you. May a bright and prosperous 2011 be yours!

ECONOMIC CALENDAR:

Tuesday - Motor Vehicle Sales, Redbook, Factory Orders

Wednesday - ISM Non-Mfg Index, EIA Petroleum Status

Thursday - Jobless Claims, Fed Balance Sheet, Money Supply

Friday - Employment Situation, Consumer Credit

|

|

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized.

Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results.

Indices are unmanaged and cannot be invested into directly. NA means not available.

|

|

"And in the end, it's not the years in your life that count. It's the life in your years."

- Abraham Lincoln |

|

|

Apple Fritters   From: Better Homes and Gardens From: Better Homes and Gardens

Time: 30 minutes

Ingredients:

2 tart, medium cooking apples, such as Jonathan or Granny Smith

2/3 cup all-purpose flour

1 tablespoon powdered sugar

1/2 teaspoon finely shredded lemon peel

1/4 teaspoon baking powder

1 egg

1/2 cup milk

1 teaspoon cooking oil

Shortening or cooking oil

Powdered sugar (optional)

Cinnamon sticks (optional)

Directions:

1. Core apples and cut each apple crosswise into 6 slices. Set slices aside.

2. In a large bowl combine flour, the 1 tablespoon powdered sugar, the lemon peel, and baking powder. In a medium bowl use a wire whisk or rotary beater to beat egg, milk, and the 1 teaspoon cooking oil until combined. Add egg mixture all at once to flour mixture; beat until smooth. Using a fork, dip apple rings into batter; drain off excess batter.

3. Fry 2 or 3 fritters at a time in deep hot fat (365 degrees F.) for 1 minute on each side or until golden, turning once with a slotted spoon. Drain on paper towels. Repeat with remaining fritters. Sprinkle warm fritters with sifted powdered sugar, if desired. Cool on wire racks. To serve, thread fritters onto cinnamon sticks, if desired. Makes 12 fritters.

|

|

|

|

POINT OF IMPACT

Although there are many types of impact tape and gadgets you can put on the club face to show you where the ball hits, they have two things in common:

1. They are difficult to put on - especially when you are playing a round of golf.

2. They are expensive.

Here's an easy, inexpensive way to know exactly where the ball is striking the face of your club:

Buy a small container of Johnson & Johnson baby powder. (The small plastic ones that moms carry in their purses are perfect because they fit anyplace in your golf bag.) When you are at the range or playing a round of golf and want to see the impact point, just pull out the powder and lightly dust the ball. After you hit, the point of impact will be marked on the face of the club.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced! Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

|