Take a look at these headlines to get an idea of what went on over the weekend..

I could post more but you get the idea. So what you may say? That's over there, who cares? Well the US markets for one.

As we continually refine our investment strategies we need to evaluate risks. What has changed and how does that affect our strategies? Based on what is going on can we anticipate other future changes and how could those changes affect our strategy? That is what I want to focus on here.

I believe what you are seeing happen in Europe could be a preview of what is to come in this country. In Europe you have several countries that have made promises to their citizens that they are no longer able to deliver on. Greece is the prime example.

Greece spent more money than it collected in tax revenue and so it borrowed the rest. Sound familiar? That worked until one day the people (other countries) that were loaning Greece the money started doing some calculating and became concerned that they wouldn't get paid back. At that point they started demanding a higher interest rates from Greece to compensate them for the additional risk of the loans. Then they started putting other conditions on the loans. Conditions like you have to stop spending more than you collect in tax revenue. These are the bailouts we have been hearing so much about.

That process is being replayed throughout Europe right now. As these countries are no longer able to fulfill their promises to their people, their citizens are understandably getting angry. They feel they've been cheated. Their pensions have been repeatedly cut. Other benefits have either been cut or taken away. They feel victimized. They're tired of austerity, they're angry and looking for someone to blame. You're even starting to see the rise of extremist groups such as the Neo Nazis in Greece rioting in the streets and threatening ever escalating violence. Again, sound familiar?

You have one side telling them that "hey you can't spend more that you take in. You have to cut back. You have to make do with less. You're going to have to endure some financial pain to get your house back in order." Now you have other politicians come along and say "Hey it's not your fault. It's not fair. You shouldn't have to suffer, we're going to make those damn rich people pay. They can afford to do with less more than you can so in the interest of "fairness" we're going to make they pay." Again, sound familiar?

Now for the masses who have had their benefits repeatedly cut, which message is going to resonate?

The headlines above answer that question, don't they?

The other interesting dynamic here is the anger that is starting to be directed against Germany. Of all of the European countries, Germany has been the most fiscally responsible. So when the other countries have needed to be bailed out it has been Germany to the rescue because they're about the only ones with money over there. Now you would think the other countries would be grateful but no, the other countries are starting to get angry and resentful towards Germany. "How dare Germany put conditions on their loans that make our people suffer."

So where am I going with this?

Well first of all, when the most recent bailout of Greece was announced a few months back I said at the time that it would not work. It was doomed to fail. It looks as if I was correct on that count. So how have these changes affected our strategy? Not at all because it is what we prepared for. The second point that I am making is that we have a very similar situation here and we could be getting a peak into our future.

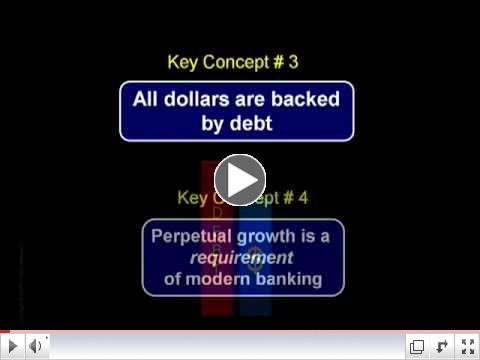

What I mean is that we too spend way more than we collect in tax revenue. So much so that of every dollar the US government spends, approximately 40% of it is borrowed money. How long can that go on before other countries start becoming concerned that they won't get paid back. I believe that process has already started as evidenced by the fact that China has dramatically scaled back on the amount of debt that they but from us and last year the Fed stepped up and bought over 60% of all of the new dept that the US Treasury Department issued! How did they do that? Buy printing money out of thin air. If you are not sure how this works then watch this 7 minute video by Dr. Chris Martenson.

|

| Crash Course: Chapter 8 - The Fed & Money Creation by Chris Martenson |

There are tremendous opportunities created in times of crisis!

As we've said over and over, there are tremendous opportunities created in times of crisis for those who are prepared. Would you like to know what opportunities we think this new crisis offers? Then give us a call or send us an email and we'd love to share our ideas with you!