|

No BS Weekly Update - October 3, 2011

Quarterly Review - 3Q 2011

|

|

|

In This Issue

|

|

|

|

|

|

Dear ,

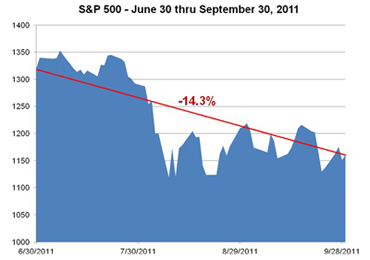

From the debt ceiling debate, to S&P's downgrade of the United State's prized bond rating, to ongoing challenges in the Eurozone, and wild swings in the stock market, the third-quarter has taken investors for quite a ride!

Source: Yahoo! Finance. The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. Past performance does not guarantee future results. You cannot invest directly in an index.

July - After a volatile first half that eventually ended U.S. stocks in positive territory, the debt ceiling debate quickly took center stage. As policymakers debated ways to cut spending and raise the nation's borrowing limit, stock markets faltered.

August - Following an eleventh hour debt ceiling compromise, Italy rose to the forefront of debt problems in Europe and anemic economic news pushed investor sentiment downward. As fear dominated the markets, major indexes erased their gains for the year during the first week of the month. Hitting especially close to home, S&P downgraded the nation's bond rating from AAA to AA+ on August 5th.[1]

September - After a brisk market rally early in the month, European debt woes dominated investor sentiment once again. By the middle of the month, tables turned dramatically as many asset classes experienced their worst weeks in years. Even gold faced its largest monthly fall since October 2008.[2] In conjunction with persistent concerns about European debt and a weakening U.S. economy, the Fed's Open Market Committee (FOMC) launched "Operation Twist" on September 21st, leading to further selloffs.

In reading the quick summary above, it's easy to see why investors are somewhat dazed and confused. The last three months have been rough. The stream of bad news coupled with occasional flickers of optimism led to one of the most volatile periods ever for stocks. The Dow moved more than 200 points on 18 separate times during the quarter, swinging by more than 400 points on four consecutive days in August alone.[i] Wow, talk about a roller coaster. Folks, have you been on this ride before? Now What? Last week we published "Bear or Bull - What Are the Clues?" where we attempt to answer that question. In that report we take a look at the issues from four perspectives and we offer several clues that we think can lead you to the answer to that question. Here is a brief excerpt:

From a Fundamental Perspective

From a fundamental perspective how is it looking? Just as recently as this spring the Fed was saying that there was no way that there would be a QE3 (think another bailout) because we had a growing economy. How quickly things change (that is if you believed them in the first place). Again going with our mantra of profitable companies, jobs, and consumer spending, let's take a look at the numbers. From a fundamental perspective how is it looking? Just as recently as this spring the Fed was saying that there was no way that there would be a QE3 (think another bailout) because we had a growing economy. How quickly things change (that is if you believed them in the first place). Again going with our mantra of profitable companies, jobs, and consumer spending, let's take a look at the numbers.

Companies - Profitability and Growth

Companies have certainly been profitable lately. I have two questions regarding that profitability. How did they do it and is it sustainable?

Did they do it through explosive growth in sales and revenue? Or did they do it through aggressive cost cutting? Did they do it through hiring more people or firing more people? I think we all know the answer to that don't we? Aggressive cost cutting, one cost of which was letting people go.

The next question is can they sustain this increase in profitability through continued cost cutting or is there a point at which your costs can't go any lower? Most of us know the answer don't we? There is a certain point at which you can't cut costs any further. At that point the game is over.

In addition we have been seeing news stories from the last 6 months to a year that these profitable companies are sitting on piles of cash. What conclusions can we draw from that? The lack of investment isn't necessarily from lack of money. Many of these companies have the ability to expand but are choosing not to. Why?

There are multiple reasons: uncertainty about the economy, uncertainty about the tax environment, uncertainty about regulatory burden; but I think the overriding cause again comes down to Rational Expectations. At this point in time, the owners of those companies believe there is too much risk or not enough reward to put their hard earned capital to work.

Now as an investor what type of Rational Expectations can we draw from this? If these profitable businesses are unwilling to put their excess profits to work expanding their businesses, what do they know that we don't? If they aren't confident enough in those profits continuing to invest for the future growth of their companies, why should we be?

Maybe that's another clue.

If you would like to read the rest of "Bear or Bull - What Are the Clues?", you can download your free copy by clicking this link:

(Please click here for your free copy of Bear or Bull - What Are the Clues?)

If you have any questions or would like any guidance, please don't hesitate to reach out to us. We have spent the last several years preparing for such a time as this and would like to help you preserve your wealth!

ECONOMIC CALENDAR:

Monday - ISM Mfg Index, Construction Spending

Tuesday - Motor Vehicle Sales, Factory Orders

Wednesday -ADP Employment Report, ISM Non-Mfg Index, EIA Petroleum Status Report

Thursday - BOE Announcement, ECB Announcement, Jobless Claims

Friday - Employment Situation

|

|

|

|

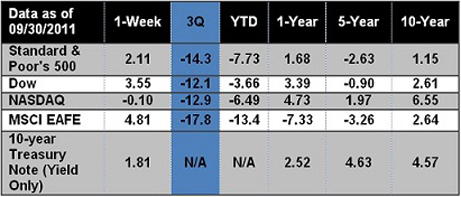

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not available. |

|

Headlines

According to a Bloomberg Gallup Poll, 63 % of global investors approve of President Barack Obama's plan to tax people with annual incomes of $1 million or more. The so-called Buffett rule is a nod to investor Warren Buffett and his New York Times op-ed piece calling on the wealthy to pay their fair share.[6]

Consumers made less money and spent less money in August, according to a report released Friday. The Commerce Department said personal income declined by 0.1% in August. Consumer spending rose just 0.2%, and was flat when adjusted for inflation.[7]

An examination of credit-rating agencies by the Securities and Exchange Commission staff found repeated instances of the companies failing to follow their own procedures or adequately manage conflicts of interest, according to an S.E.C. staff report issued Friday. The examinations were mandated in the Dodd-Frank regulatory law passed last year after numerous investigations into the causes of the financial crisis. Several of those inquiries found that the rating agencies issued inaccurate reports, failed to report or manage conflicts of interest, and put generating revenue ahead of rigorous financial analysis.[8]

Eurozone inflation has surged unexpectedly to a three-year high of 3%, adding to the dilemma facing the European Central Bank as an escalating debt crisis pushes the region towards recession.[9]

|

|

|

"What matters is not the idea a man holds, but the depth at which he holds it."

- Ezra Pound

|

Greener (and Cheaper) Fuel BillsDuring the cooler months of the year, lower your thermostat to 55 degrees F if you'll be gone for two days or more. Whenever you can lower your thermostat, you'll also save a little on the operation of the refrigerator and freezer, which won't need to work so hard to maintain their cool.

|

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

Securities offered through Foothill Securities, Inc. Member FINRA/SIPC.

Reames Financial is not an affiliate of Foothill Securities, Inc.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Reames Financial and not necessarily those of Foothill Securities, Inc., and should not be construed as investment advice. Neither Phil Reames, Reames Financial, nor Foothill Securities, Inc. gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] http://www.standardandpoors.com/ratings/articles/en/us/?assetID=1245316529563

[2] http://www.marketwatch.com/story/gold-rises-to-regain-safe-haven-shine-2011-09-30?link=MW_latest_news

[3] http://online.wsj.com/article/SB10001424052970204226204576603202392429600.html?mod=WSJ_Markets_LeadStory

[4] http://online.wsj.com/article/SB10001424052970204226204576603202392429600.html?mod=WSJ_Markets_LeadStory

[5] http://www.russell.com/US/documents/investment_manager_outlook_Q311.pdf

[6] http://www.bloomberg.com/news/2011-09-30/obama-s-buffett-rule-backed-by-63-investors.html

[7] http://www.forbes.com/2011/09/30/consumer-income-spending-weak-in-august-marketnewsvideo.html

[8] http://www.nytimes.com/2011/10/01/business/sec-finds-problems-at-credit-rating-agencies.html

[9] http://www.ft.com/intl/cms/s/0/2a5a15fa-eb48-11e0-9a41-00144feab49a.html#axzz1ZStm9eP4

|

Phil Reames

Reames Financial 1856 Skyler Dr. Kalamazoo, MI 49008 269-349-3966

|

|

|