|

No BS Special Report - September 28, 2011

Bear or Bull

What Are the Clues? |

|

|

In This Issue

|

|

|

|

|

|

Dear ,

Is It True?

That is the key question isn't it? How do we tell the difference between a pull back before further gains in a Bull Market vs. the reversal of a trend back into a Bear Market? If it is merely a pause before higher highs, then hang in there it'll get better makes sense doesn't it?

But what if it is a resumption of a Bear Market? What if this is just the beginning? According to the New York Times article above, if you are in the S&P 500, you have already lost 16% just since April. If you knew for a fact that this is it and that it is going back up then no big deal right? But what if this is just the beginning?

Here at Reames Financial we have put together this new Special Report:

Click here to read this free report!

Why is this question so important? Because your answer to this question should help determine your investment outlook and asset allocation going forward. In this report we will talk about what we think the important factors are to look at when doing this type of analysis as well as what we think the outlooks are for those factors.

So if you would like to get a different perspective on where we are and more importantly where we think we are going, please download and read Bear or Bull - What Are the Clues? Even if you have something else in place, this must-read guide includes research you can use right now!

Click here to read this free report!

If after reading the report you have any questions, please give us a call. If you can think of any others that would benefit from reading this report, please feel free to forward this email to them!

ECONOMIC CALENDAR:

Monday - New Home Sales

Tuesday - S&P Case-Shiller HPI, Consumer Confidence

Wednesday -Durable Goods Orders, EIA Petroleum Status Report

Thursday - GDP, Jobless Claims, Pending Home Sales

Friday - Personal Income and Outlays, Chicago PMI, Consumer Sentiment

|

|

|

|

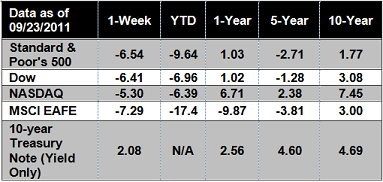

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not available. |

|

Headlines

Last week, the government released the latest census report showing the poverty rate rose to a 17-year high. A whopping 46.2 million people (or 15.1% of the U.S. population) live in poverty, and 49.9 million live without health insurance.[6]

BP is preparing its rigs and workers to resume full drilling operations in the Gulf of Mexico, seeking to end a 17-month production slump following the worst U.S. oil spill.[7]

The International Monetary Fund annual meetings wrapped up in Washington on Sunday with no immediate consensus on the solution. Participants said they were waiting for the ratification of the action plan agreed on July 21 by the Eurozone, particularly by the German Bundestag this week, before starting serious negotiations on increasing the rescue fund's firepower or asking for a bigger write-down in private sector holdings of Greek debt.[8]

For the first time in months, retail gasoline prices have fallen below $3 a gallon in places, including parts of Michigan, Missouri, and Texas. And the relief is likely to spread thanks to a sharp decline in crude-oil prices. The national average for regular unleaded gasoline is $3.51 per gallon, down from a high of $3.98 in early May. Last week's plunge in oil prices could push the average to $3.25 per gallon by November, analysts say.[9]

|

|

|

|

"Don't judge each day by the harvest you reap but by the seeds that you plant."

- Robert Louis Stevenson

|

Gouda-Pecan Bites

From: Better Homes and Garden From: Better Homes and Garden

Gouda is a semi-firm Dutch cheese with a mild flavor. It's the cornerstone of this easy appetizer or snack. Serve with crackers or vegetables.

Ingredients: 1 cup finely shredded Gouda cheese (4 oz.) 1/4 cup dairy sour cream 1/4 cup very finely chopped pecans Assorted crackers and/or cut sweet peppers

Directions: 1) Bring shredded cheese to room temperature in a medium mixing bowl (allow 30 minutes). Add sour cream and pecans. Beat with an electric mixer until combined and mixture is creamy. Cover and chill for up to 1 hour. If mixture is too firm, let stand for a few minutes to soften before piping. 2) To serve, spoon cheese mixture into a pastry bag to which a very large star tip (1/2-inch) has been fitted. Pipe mixture onto assorted small crackers and/or vegetable slices. Makes 1-1/2 cups.

|

|

|

Steam Your Broccoli

Italian researchers recently discovered that steaming broccoli increases its concentration of glucosinolates (compounds found to fight cancer) by 30 percent. Boiling actually lowers the levels.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

Securities offered through Foothill Securities, Inc. Member FINRA/SIPC.

Reames Financial is not an affiliate of Foothill Securities, Inc.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Reames Financial and not necessarily those of Foothill Securities, Inc., and should not be construed as investment advice. Neither Phil Reames, Reames Financial, nor Foothill Securities, Inc. gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] http://www.google.com/finance

[2] http://www.foxbusiness.com/investing/2011/09/23/dismal-week-stocks-metals-crushed-in-worst-plunge-in-years/

[3] http://www.nytimes.com/2011/09/22/business/22text.html

[4] http://www.nytimes.com/2011/09/22/business/22text.html

[5] http://www.foxbusiness.com/investing/2011/09/23/dismal-week-stocks-metals-crushed-in-worst-plunge-in-years/

[6] http://money.cnn.com/2011/09/21/news/economy/middle_class_income/index.htm?iid=HP_Highlight

[7] http://www.bloomberg.com/news/2011-09-23/bp-plans-full-return-to-gulf-drilling-this-year.html

[8] http://www.ft.com/intl/cms/s/0/5a3b7a9e-e796-11e0-9da3-00144feab49a.html#axzz1YzcSBAmu

[9] http://abclocal.go.com/ktrk/story?section=news/national_world&id=8367162

|

Phil Reames

Reames Financial 1856 Skyler Dr. Kalamazoo, MI 49008 269-349-3966

|

|

|