|

Weekly Update - August 10, 2011

Important Perspective on Recent Events

|

|

|

In This Issue

|

|

|

|

|

Dear , As you are surely aware, following Tuesday's debt ceiling compromise, attention quickly shifted to whether the government has what it takes to solve its budget problems. Add to this the fact that Italy is now in the forefront of debt problems in Europe and anemic economic news has been pushing investor sentiment downward, and you have a near-perfect recipe for a stock market correction. And a correction - defined as a 10% drop from recent highs - is exactly what we experienced last week as major indexes erased their gains for the year.[1] Market corrections are not unusual events. From the market lows of July 2010 to the highs of April 2011, the S&P 500 was up over 26% without experiencing a correction. To put that 26% run-up in perspective, the best 20-year time period for the stock market was 1948-1968, and the market only returned an average of 8.4% annually during that period. This illustrates that we were overdue for a correction.[2] Unexpected drops in the market can be painful, but they are part of the healing process.[3] In our assessment, the turmoil of recent weeks reflects the fact that fear is still dominating investor sentiment. What are people afraid of? While there are several factors that could be cited, we believe debt problems domestically and abroad are in the forefront.

While it is true that European countries have spent themselves into a corner, correcting this mistake will be good for long term growth, not bad. Unfortunately, there will probably be a lot of pain at the beginning of that process. Closer to home, although S&P downgraded the nation's bond rating from AAA to AA+, Moodys Investors Service took the opportunity to reaffirm the United State's AAA rating. The U.S. now has a split rating from the two largest ratings agencies. The third-largest ratings agency, FitchRatings, also agreed with Moody's AAA rating.[4] In confirming the AAA rating, Moody's recognized that the budget compromise is a first step toward achieving long-term fiscal improvement. The legislation passed on August 2nd calls for $917 billion in specific spending cuts over the next decade and established a congressional committee charged with making recommendations for achieving a further $1.5 trillion in deficit reduction over the same time period.[5] The problem for many of us is that we don't believe we will ever actually see those spending cuts. We are living in historic times folks! ECONOMIC CALENDAR:

Tuesday - Productivity and Costs, FOMC Meeting Announcement

Wednesday - EIA Petroleum Status Report, Treasury Budget

Thursday - International Trade, Jobless Claims

Friday - Retail Sales, Consumer Sentiment, Business Inventories |

|

|

|

Performance

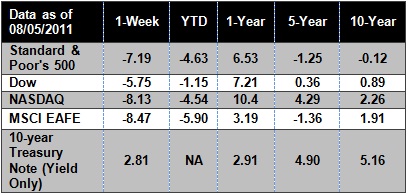

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. NA means not available. |

|

Headlines:

Treasury Secretary Timothy F. Geithner will not be stepping down, a Treasury Department official said Sunday, ending speculation that the key Obama administration advisor was preparing to resign.[6]

It was announced Friday that the Postal Service lost $3.1 billion in the April through June period and could be forced to default on payments due to the federal government when the fiscal year ends in September. Several bills designed to change the law governing the post office, an independent government agency, are pending in the House and Senate.[7]

After reaching a near-record $3.98 in May, tumbling in June, and rising throughout the month of July, gasoline prices finally settled around $3.70 a gallon in early August.[8]

The job market strengthened in July, a welcome piece of good news that sharply contrasted other recent data pointing toward an economic slowdown. Employers added 117,000 jobs last month, easily topping the 75,000 gain economists surveyed by CNNMoney had predicted. And the unemployment rate improved slightly to 9.1%.[9]

|

|

|

"We simply attempt to be fearful when others are greedy

and to be greedy only when others are fearful." - Warren Buffett

|

Grilled Peach Salad with Blue Cheese Dressing   From kraftrecipes.com From kraftrecipes.com

3 fresh peaches, pitted, quartered

2 Tbsp. oil

8 cups torn romaine lettuce

1/2 cup coarsely chopped Planters Deluxe Whole Cashews

6 slices Oscar Mayer Bacon, cooked, coarsely crumbled

1/2 cup Kraft Roka Blue Cheese Dressing

Preparation:

1) Heat grill to medium-high heat.

2) Brush peaches with oil. Grill 3 to 4 min. on each side or just until tender and heated through. Cool slightly.

3) Cut each peach piece in half. Cover platter with lettuce; top with peaches, nuts and bacon.

4) Drizzle with dressing.

|

|

|

The Hard Pan Lie

When the ball comes to rest on a patch of rock-hard ground with no grass to prop it up, select a sand or pitching wedge, and then position the ball according to the trajectory you need. Such as:

1. Forward for a high, soft shot.

2. Center for a standard pitch.

3. Back for a low, running pitch.

Next, move close enough to the ball so the club head is standing on its toe with the club shaft as vertical as possible. This helps you eliminate any angle in your wrist so that your club head won't drop lower through impact.

For the swing, use your pitching action.

|

|

|

|

Exercise Common Sense

It is important to modify your exercise routine during the summer months. To avoid heat stroke or heat exhaustion, gradually increase the intensity and duration of exercise in the heat over a period of two weeks, and make sure you take adequate rest periods between exercise sessions. You should always be sure to stay hydrated and try to exercise at cooler times of the day. Most important, be sure you know your body's limits and stop at the first sign of illness.

|

Water Conscious Gardening

Americans waste millions of gallons of water on gardens and lawns each year.

To cut back on the amount of water you use on your lawn, adjust your lawn mower to a higher setting. This allows grass to retain water better.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced! Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. The DJIA was invented by Charles Dow back in 1896. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia. The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market. Google Finance is the source for any reference to the performance of an index between two specific periods. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. You cannot invest directly in an index. Consult your financial professional before making any investment decision. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information. By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site. [1] http://money.cnn.com/2011/08/05/markets/markets_newyork/index.htm [2] http://www.nytimes.com/interactive/2011/01/02/business/20110102-metrics-graphic.html [3] http://www.loringward.com [4] http://www.moodys.com/research/Moodys-confirms-US-Aaa-Rating-assigns-negative-outlook?lang=en&cy=global&docid=PR_223568, http://www.fitchratings.com/index_fitchratings.cfm [5] http://www.moodys.com/research/Moodys-confirms-US-Aaa-Rating-assigns-negative-outlook?lang=en&cy=global&docid=PR_223568 [6] http://latimesblogs.latimes.com/money_co/2011/08/timothy-geithner-will-stay-as-treasury-secretary.html [7] http://www.dailybulletin.com/ci_18634950 [8] http://online.barrons.com/article/SB50001424052702303697804576482430333751702.html?mod=BOL_twm_mw [9] http://money.cnn.com/2011/08/05/news/economy/july_jobs_report_unemployment/index.htm?iid=HP_Highlight

|

|

|