|

|

|

Dear Friends, Although

this spot is largely reserved for market commentary, I wish to

digress for just a moment to highlight some incredible accomplishments at

Legacy Properties Sotheby's International Realty. For the first time in our history, we have hit two significant mile

stones with respect to Unit Volume Listed and Dollar Volume List with more than

300 current listings totaling more than a quarter of a billion dollars.

This is no small feat in Maine Real Estate. In addition to the great work of our veteran agents, we have had an extraordinary

recruiting season as well, adding terrific new agents in each of our offices and

expanding our market territories further into the Lakes and Mountains. We

are so thankful to our trusted clients in making our goals a reality. Time to move the goal posts again!!

So much for "Relative Calm" and a return to "Normalcy" in

the global financial markets!? Greece,

with its' 11 + million strong population, has become the focal point for

intraday changes in interest rates, currencies, stocks and commodities. We are

looking at a whole new snapshot of economic indicators compared to last

month. The 10-year US Treasury yield

fell below 3.10% last week in a flight to quality by global investors looking

for a safe investment. This dramatic

reduction in interest rates has once again fueled lower mortgage rates. Crude

Oil fell below $70 per barrel while most major currencies weakened relative to

the US Dollar. The Euro closed the session yesterday at a 4-year low.

The Maine home sales statistics for April were released last week along with regional and national real estate reports. All of the data consistently demonstrated

that we appear to be in the early stages of a significant recovery in single family

residential markets in terms of unit volume sold. The Maine Association of Realtors reported

that home sales volumes increased by 63% from the same period last year while

median prices improved by 3.4%.

While we are encouraged by the monumental volume

improvement in unit sales, we are also keenly aware that the expiration of the

"First Time Home Buyer Credit" has accelerated the purchasing decision for a

significant amount of the activity. In

fact, nearly 80% of the residential sales in April were sold below $250,000,

which tends to be the price range for first time home buyers.

On a national level, the home buyer credits also played a

very important role in driving sales.

According to Bloomberg News, single family existing home sales increased

by 5.6 % to 5.65 million homes in the US.

This is the highest level since November 2009 when it was thought the

Tax Credits were due to expire. Housing

Starts in April reached the highest level since October 2008 in a sign that

builder confidence has improved.

The

Maine Luxury Real Estate Market also evidenced a rebound with 10 sales over $1

million since the beginning of April. Once

again, Legacy Properties Sotheby's International Realty had a leading market

share in representing both buyers and sellers during this

time. Of the 10 homes sold for more than

$1 million, Legacy Properties Sotheby's International Realty was involved in 4

sales. We are proud that eight

of our agents participated in these market leading sales. It is further confirmation of our market leading

strategy with respect to Maine lifestyle properties.

In

conclusion, we believe that we will stay on the course identified in the last

several newsletters. We are looking for

a moderation in volume in lower priced homes as the US Government home buyer credit has expired. We believe that the market will continue to

enjoy small increases in the median sales price in most markets in Maine. We caution that the "Fasten Seat Belt" sign is still flashing

as we work our way through some turbulent global economic times.

As we enjoy one of the most beautiful spring

seasons in Maine history, it seems obvious that the Maine real estate markets

will continue to show signs of strength and steady improvement in all market

segments. Wishing you a healthy summer season!

|

|

| |

|

|

|

|

|

|

|

|

Located near charming Pemaquid Point in South Bristol,

this classic Maine cottage combines elegant simplicity with coastal splendor.

Perched overlooking St. John's Bay, you'll enjoy breathtaking views and

bountiful wildlife including seals, porpoises, bald eagles and whales right

from your porch and balcony. Click here

for a full description and more information.

|

|

Stunning oceanfront home in Kennebunkport, Maine.

Offering six bedrooms 4.5 baths and commanding ocean views from nearly every

room. Featured in Travel & Leisure

Magazine and Maine HOME + DESIGN

Magazine. Make this home your vacation destination. Click here

for availability and more information.

|

|

Situated on a private home site overlooking the Sheepscot

River, this completely renovated three bedroom retreat provides easy access to

Boothbay Harbor and the Pemaquid Peninsula. Click here for a full description and more information.

|

Join Legacy Properties Sotheby's International Realty at the 2nd MH+D Midcoast Show. After a great event last year we are thrilled to be participating again this year! Hope to see you there!

|

|

|

George C.

Ballantyne, a 30-year real estate industry veteran, served the Sotheby's

International Realty® brand as Senior Vice President, Distinguished Markets. He has acted as liaison between the

Sotheby's Auction House and the Sotheby's

International Realty brand, overseeing referrals and synergies between the

two. He has been responsible for

providing client level services to affiliates in nine states where

licensed. In all other markets, he

has serve as a resource on pricing, negotiating and marketing strategies.

In this role he was responsible for implementing a

Distinguished Properties Learning platform for high net worth Sotheby's International Realty clients

worldwide.

He joined the Sotheby's

International Realty brand in 1978 as senior vice president to establish an

affiliate network in the Mid-Atlantic and Tri-state regions, New England, the

Midwest and Eastern Canada. In this

role, he participated in the first on-premises sale of contents by Sotheby's

Fine Arts and real estate by the Sotheby's

International Realty brand.

Between 1978 and 2004, he participated in the

listing and negotiation of more than 2,000 luxury residential properties.

His notable sales include: The "Anchorage" in Seal

Harbor, Maine, property of former Governor Rockefeller; "Skylands" in Seal

Harbor, Maine, purchased by Martha Stewart; "The Olson House" in Cushing, Maine,

made famous by Andrew Wyeth in "Christina's

World"; the Berkshire Property of Nat King Cole; the Litchfield County

residence of Erich Segal, author of "Love

Story"; and the Edgartown property of Peter Sharp, former owner of the

Carlisle Hotel in New York.

From 1975 to 1978, he worked for Citibank's Financial

Management division in New York, responsible for serving high net worth

clients' banking needs. During his

tenure there, he introduced a concept of fine arts as collateral for demand

loans. This concept became the

foundation of Sotheby's Financial Services.

Ballantyne began

his career in 1971 with working with the director of the Detroit Institute

of Arts, responsible for cataloguing the Tannehill Collection of French

impressionist paintings and drawings.

He earned his bachelor's

degree from The College Wooster, Ohio, and his master's degree in architectural

history from Columbia University, N.Y. Ballantyne also earned a master's in business

administration from Boston University, Mass.

|

|

"More

Than Money"

Money

is ahead of whatever is in second place. Or is it? Too often we assume money is

the pivotal issue. We can resolve all differences with more money.

Each

of us has a risk tolerance. There are buyers and sellers who will pay or

receive five or six figures more or less for certainty. An offer with no

financing or inspection contingencies may have more value than a competing

offer.

It's often difficult to distinguish between

the emotional and financial decision. The children have grown and the property

is receiving little use. Financially, it makes sense to sell. Emotionally, it

may be difficult to let go.

This

is a particularly difficult decision for seasonal properties that have been in

the family for multiple generations. The business decision may have been made

to sell but there's pressure from multiple generations to retain the property.

The compromise is an above market-listing price. This ensures the property will

remain available for multiple years. It's both available and not available. The

family's ambivalence, laid out for all to see.

The

first question asked by all buyers: "How long has the property been available?"

While the family is going through the painful process of letting go, buyers are

calculating days on market. As time on market increases, selling prices

typically decrease.

A

better question for buyers is not how long but the frequency and the amount of

price revisions. A property on the market for two years with three successive

revisions in the last six months tells a different story than a property with

no revisions.

If

you're a seller, a buyer's initial offer can provide insight. When would the

buyer like to close? What are the contingencies? If financing is a contingency,

what is the percentage of the proposed selling price? The seller might be able

to find out, if this is the first property on which the buyer is bidding. If

not, what happened to the last sale/negotiation?

By

having as much information as possible, a seller can tailor their counter to

most closely meet both buyer and seller objectives. A counter only addressing

price may be less successful than one that seeks to uncover the underlying

motivation behind the buyer's offer.

Whether

or not you are the buyer or seller, you will want to tie your offer to

objective criteria favorable to you. If you are a seller, with few comparables, you

might advance cost or replacement cost as objective criteria. If you're a

buyer, attempting to justify your offer, you will want to assemble "comparables"

to support your position.

Both

approaches are self-serving with each individual advancing the "standard" to be

used. Advancing a standard, however, will be more successful than submitting an

offer or counteroffer not based on objective criteria. Wanting to sell for more

or pay less, are not objective criteria.

There's

always more than money. Buyer and seller

should explore their mutual interests. There may be multiple opportunities for

dovetailing these interests. In a successful negotiation both parties "win".

|

|

|

|

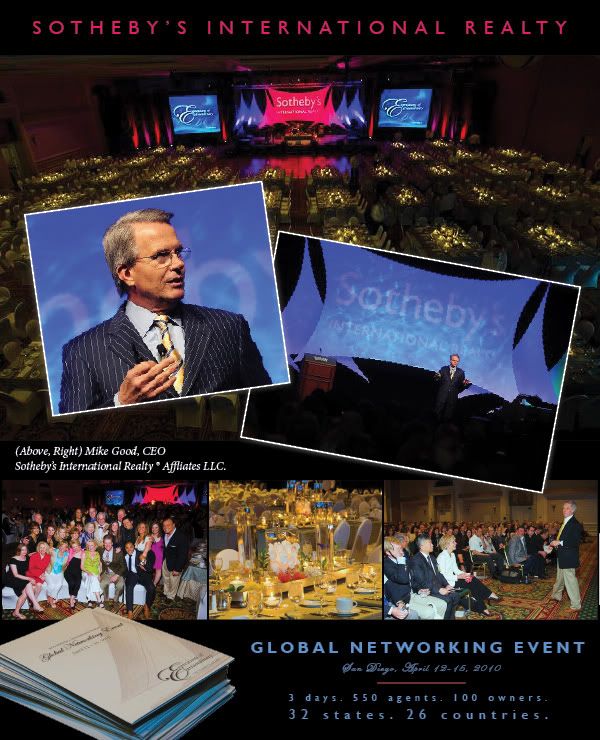

Chris Lynch,

President, Legacy Properties Sotheby's International Realty, recently

participated in Sotheby's 2010 International Realty Global Networking event in

San Diego, Calif. During the three-day

event,

Sotheby's sales associates, managers and owners exchange ideas, leads, contacts

and property marketing ideas. Among the keynote speakers were three time Olympic

medalist Julia Mancuso and

Benjamin

Zander, conductor of the Boston Philharmonic Orchestra.

|

|

|

Conditions

that make it a buyers market for primary homes-motivated sellers, ample

inventory and attractive prices-are enticing interested investors to diversify

their portfolios. For those with capital and a strategy, it just may be the

right time to pounce.

In

2009, investment home sales in the United States accounted for 17% of all

residential real estate transactions (940,000 homes), according to the National

Association of Realtors. While sales figures were still off significantly from

2008, investment activity continues to be on the upswing in 2010.

Sales

picked up in January after a slow fourth quarter, which was no surprise to

Stuart Saft, a partner at Dewey & LeBoeuf and chair of the global law

firm's real estate practice. "We have seen a remarkable uptick since the

beginning of the year. We represent a great many developers, and we're seeing a

sudden dramatic increase in interest in their properties, both in multifamily

buildings and in individual condominium units."

The

interest is widespread. Some of Saft's clients are looking to buy distressed

properties and hold them for appreciation. Others are interested in luxury

units in places like Beijing, Paris, London, New York and the Middle East. "A

year ago, there was not even a glimmer of hope. There was no money around,"

Saft says. Now, he adds, the dollars are available and there's a feeling out

there that this is the time to start nibbling because prices will only go up.

"It's still early in the cycle, but these are the green shoots we were hoping

to see."

In

the short term, mortgage lending for second homes, extremely tight in 2009, is

expected to ease somewhat. The long-term demand for second homes is favorable.

Buyers are typically in their mid-40s, with more than 44 million people falling

into the primary buying demographic of 40 to 49 years old.

Experienced

homeowners know the familiar real estate mantra-location, location, location.

Investors, Saft says, would do better to follow a next-level mantra-location,

timing and use. Location is, of course, always critical. As for timing, Saft

says, "For the next 24 months, there's no doubt this is the opportune time to

get in. The market is still recovering." After that, it's a matter of usage.

Specifically, determine what areas are likely to experience changing

demographics such as population growth, then project which markets will be in

demand based on new housing and development.

That's

the big picture. Once a property becomes a candidate for investment purposes,

it comes down to the details. Beyond the sale price, taxes and insurance, what

are the full and future carrying costs? Saft recommends doing legwork to

mitigate any surprises. "If you're buying in a small community, check in with

the town clerk to see if there are any plans for a tax reassessment, tax

increase or if there are any new developments planned for the town." With so

many municipalities struggling with finances, find out how they plan to

maintain services. Will some services be curtailed or disbanded? If you're

buying a condo or co-op, talk with management, request and review board meeting

minutes, and have an accountant look at the financial statement, Saft counsels.

For

overseas properties, investors need to ask a lot more questions to understand

costs, ownership rights, and procedures for conducting real estate

transactions. Some governments encourage foreign investment and accord

non-residents the same property rights as residents. Others levy additional

taxes or limit the size of property that can be purchased. Mortgages are rare

in some countries or even nonexistent. It's important to have a local team on

the ground-typically, a real estate agent and attorney-that understands the

legal issues and nuances involved in international purchases.

Argentina

has been a draw for international investors, particularly those from Europe and

North America, according to Adriana Massa of Argentina Properties Sotheby's

International Realty in Buenos Aires. The trendy neighborhoods of Recoleta and

Puerto Madero in Buenos Aires-hotspots of premium developments-are considered

very attractive because of lifestyle and, in some cases, prices. Outside the

capital, places like Mendoza, Argentina's wine country, and the lake district

of Patagonia are "very much appreciated by foreigners and excellent places to

make investments," says Massa. Going in, however, it helps to know that both

buyers and sellers pay agent fees, and that mortgages "are very few" and "not

used for high-end transactions."

All-cash

purchases are, in fact, fairly common. In the U.S., half of all investors made

cash purchases last year. Eliminating interest charges on loans nets a better

return on investment. Patience bodes well, too. Real estate wealth is typically

created through appreciation, which takes time. Craig Venezia, a self-described

conservative investor and author of Buying a Second Home: Income, Getaway or

Retirement, says, "Anyone looking for a quick jump in appreciation is a little

misguided." Venezia takes a buy-and-hold strategy and recommends a

10-plus-years' view. "We're in a dip but historically, over the last 25 years,

housing prices have gone up about 5% a year. If you buy now, assume an

appreciation of about 3-5% over the next 5 or so years," he says.

Investors

are more likely to purchase homes in metropolitan areas, but there is no single

ideal investment. The important thing, Venezia says, is to "take over a

property, start renting it as soon as possible, and don't get bogged down with

a fixer-upper." Multifamily units generate cash flow from several renters, so

if one unit is vacant income is still flowing in. Vacation homes are attractive

because an owner can use the property for personal use for up to 14 days (per

IRS guidelines) without losing business deductions.

Vacation

areas that offer easy access, a long season and plenty of recreational options

make for some of the soundest investments. Add waterfront or water views and

you boost the likelihood of strong gains. "When comparing similar homes, those

located in close proximity to water have historically yielded a higher return

for investment," says Linda Briggs of Anne Erwin Sotheby's International Realty

in York, Maine. She cautions investors, however, to put personal preferences

aside, no matter how alluring the property. "A buyer of an investment property

must set aside his or her own desires, opinions and needs, take a step back,

and look at what is collectively in demand."

Property

at top presented by Argentina Properties Sotheby's International Realty,

property ID #4000014685. Tel:

+54.11.5648.9880.

|

|

|

As most people whiz by on Route One, the people who call

Westport home are happily treasuring their island haven which is bordered

by the Sheepscot, and Back Rivers, both of which are salt water.

Westport is connected by a bridge spanning the slim gap of the

Cowsegan Narrows to the town of Wiscasset. It is bounded across

tidal waters by the towns of Wiscasset, Edgecomb, Southport and

Georgetown. Originally called Jeremisquam Island, or simply Squam Island it was

part of Edgecomb before incorporating into an independent town in 1828. This 10

mile long island is crisscrossed by fields and brooks and offers a strong sense

of community which is bolstered by the community association which maintains a

year round calendar of events. When questioned, many residents were

reluctant to share the wonders of their precious gem feared that their secret

will be spilled. However, those who did share spoke of their contentment at finding

a peaceful retreat. One couple described how purchasing a home on

Westport was "accidental". They were staying at the Squire Tarbox Inn

and so enjoyed the locale that they decided not to leave the

island--and happily bought on the west side. |

|

|

This island community is approximately 50 miles northeast of

Portland and yet is an oasis from the hustle of route one and from the business

of other coastal communities based strongly on tourism. Westport still supports

a strong fishing industry with the focus on lobstering and crabbing. The

population of just under 800 is a mix of retirees from away and locals, and

that is exactly what keeps the strong sense of community pride alive. Driving

along the main road you see a mix of architecture and views out across to the

rivers. As you head down the eastern side you are looking directly across to

Boothbay, and Boothbay Harbor-- both a quick trip by boat, and if you go a bit

south, and west you arrive at Georgetown. This makes Westport an ideal base for

sailing, and boating--protected, quiet and yet close to all the activity the

larger harbors have to offer. Cruise along the rivers, and out through Townsend

Gut into Boothbay Harbor, Southport, and beyond, or head out to

open ocean--all within easy reach.

If you take the time and explore this charming island spot,

traveling along it's back roads you will be delighted with it's simple beauty.

If you are lucky perhaps some residents will share their favorite spot to

picnic, or to pick up some fresh lobster for dinner. If you choose to eat

dinner out or spend the night the Squire Tarbox Inn is a magical place. |

|

Inviting home on 2.67

acres with 227' of deep waterfront and dock on a protected cove and with easterly

views across to Townsend Gut. Eight fireplaces, a living room flooded with light

and a cooks kitchen. Combo of new construction and period detail from the

historic Ross/Hall house. $1,350,000

MLS# 955024

KIM LATOUR | 207.729.2820 | KLatour@LegacySIR.com

|

|

|