|

3Q 2012 Quarterly Edition

October 1, 2012

|

|

|

In This Issue

|

|

|

|

|

|

The Markets:

Wall Street closed its best third quarter since 2010 after a wave of central bank actions across the globe (and expectations of future action) drove up equities in an unexpected summer rally. However, signs of weakness in the economy pushed markets down in the final week of September and may lead to further bearish sentiment. For the quarter, the S&P rose 5.76%, the Dow increased 4.32% and the Nasdaq rose 6.17%.[1] Lets take a quick look back.

July:July was a volatile month for stocks. Markets were kicked around by domestic indicators and news surrounding the debt crisis in Europe. During the final weeks of July we saw the release of corporate earnings reports for many major companies. Across the board, most companies showed weak revenue, with less than half exceeding revenue expectations. Even so, a number of companies were still able to beat earnings expectations, meaning they are getting better at doing more with less.[2]

August:August was the month of the summer sugar high rally as investors drove up stock prices on hopes that the Fed would undertake further quantitative easing. Retail sales in August beat expectations due to a strong back-to-school season, which could forecast robust holiday sales. These two shopping seasons are the most important for retailers, so a strong performance could lead to upbeat corporate earnings reports next quarter.[3]

September:Several market-moving events took place last month; markets were dominated by expectations of major Federal Reserve stimulus action and hope that the European Central Bank would unveil a new plan. Despite the Fed's historical reluctance to become involved in the election cycle, under the pressure of a disappointing August jobs report, the Fed finally launched the long-awaited additional quantitative easing. Under QE3, the Fed has made an open-ended commitment to buy mortgage-backed securities to the tune of $40 billion per month. The move is designed to lower long-term interest rates and spur more lending to businesses and consumers.[4] In a similar move, the ECB launched a bold bond-buying program designed to reassure European investors and lower interest rates on Spanish and Italian bonds.[5]

What's Next: The first week of October will provide plenty of market-moving data, with the release of third-quarter reports on GDP, manufacturing, consumer sentiment, and more. We will also see the FOMC minutes from last week's Fed meeting, which will provide more clarity into possible Fed moves this year. Earnings reports for Q3 will start trickling in during coming weeks, and although predictions indicate revenues and profits may be down across the board, we could get some surprises.

As we look ahead to the final quarter of the year, markets could decline from their summer peak or rise to new highs. The market rallies of the summer indicate that investors are poised to respond to positive news, and should the economy show further signs of recovery, we may see more bullish market behavior. With the election cycle nearing its conclusion, markets may also react to political uncertainty surrounding the fiscal cliff and other economic issues.[6]

As an investor, it is wise to assess your own risk tolerance from time to time and make sure you are allocated suitably for your personal investment objectives. If you have questions about how your own portfolio should be positioned for the rest of 2012, please don't hesitate to contact us, we'd be very happy to review it with you and answer any questions you might have.

ECONOMIC CALENDAR:

Monday: PMI Manufacturing Index, ISM Mfg. Index, Construction Spending

Tuesday: Motor Vehicle Sales

Wednesday: ADP Employment Report, ISM Non-Mfg. Index, EIA Petroleum Status Report

Thursday: Jobless Claims, Factory Orders, FOMC Minutes

Friday: Employment Situation

|

|

|

|

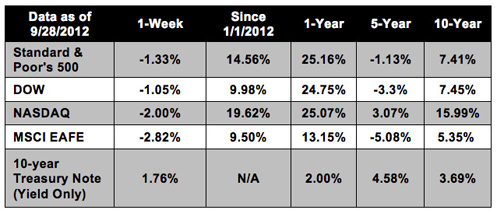

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not available. |

|

Headlines

Protests in Spain and Portugal threaten austerity measures. Thousands of demonstrators took to the streets in Madrid and Lisbon, protesting the deep tax increases, spending cuts, and high unemployment. Despite mounting tensions, politicians promise to hold the line.[7]

Durable goods orders fell in August, but business investment remains up. A significant drop in orders for commercial aircraft drove down overall durable goods orders; however, the Commerce Department reports that core capital goods orders - an indicator of business confidence - rose 1.1% after two months of declines. [8]

Consumer spending rose in August even though income barely increased. Consumers were forced to spend more at the pump as gas prices rose. This is concerning to analysts as it may rein in discretionary spending at the end of the year, affecting holiday retail sales.[9]

Housing contracts fell in August. The number of signed contracts to purchase previously occupied houses fell 2.6% in August after hitting a two-year high in July. Unemployment, lack of income growth, and a strict credit market may make it tough for housing to regain its peak this year.[10]

|

|

|

"Happiness lies in the joy of achievement and the thrill of creative effort."

- Franklin D. Roosevelt

|

|

|

Potato, Leek, and Feta Tart   This savory meatless tart is a perfect main dish when paired with a salad and green vegetables. Recipe from RealSimple.com.

Ingredients:

1 tablespoon olive oil

2 leeks (white and light green parts), cut into half-moons

2 small zucchini, cut into half-moons

kosher salt and black pepper

1/2 cup crumbled Feta (about 2 ounces)

2 tablespoons chopped fresh dill

2 Red Bliss potatoes (8 ounces), thinly sliced

1 store-bought 9-inch piecrust

Directions:

Heat oven to 375º F. Heat the oil in a large skillet over medium heat. Add the leeks, zucchini, ½ teaspoon salt, and ¼ teaspoon pepper and cook, stirring occasionally, until just tender, 4 to 5 minutes. Stir in the Feta and dill. Add the potatoes and toss to combine.

On a piece of parchment paper, roll the piecrust to a 12-inch diameter. Slide the paper onto a baking sheet. Spoon the potato mixture onto the piecrust, leaving a 2-inch border. Fold the edge of the piecrust over the edge of the potato mixture. Bake (covering with foil if the crust gets too dark) until the piecrust is golden brown and the potatoes are tender, 50 to 60 minutes.

|

|

|

Good-Lie Bunker Shot

If you have a good-lie, here are four easy steps to get you out of your unexpected trip to the beach.

1) Play the golf ball off the inside of your left foot with your feet about a foot apart.

2) Use an open stance where your feet are aimed six feet left of the flag stick, and keep an open club face pointed four feet to the right of the flag stick.

3) Be in a position where your knees are pointed in towards each other a bit, with your weight equally distributed in both feet.

4) The harder the sand, the slower the swing. The softer the sand, the faster the swing.

|

|

|

Don't Be a Yo-Yo Dieter

While many of us want to lose weight, switching your diet plan regularly means you can end up depriving your body of essential nutrients. Consuming fewer calories than you need to keep your body active can result in low energy and if you are low in energy you may feel less motivated to exercise and are more likely to snack on high sugar foods. If you must diet, consult your doctor for the best plan for you personally and stick to that plan for the recommended time period; a properly planned diet is not a quick fix and you should not expect to see immediate results. To maximize the benefits of a diet and ensure the changes you make are long-lasting, take your time and build your diet into a part of your lifestyle, rather than changing your routine overnight.

|

|

|

Protect Plants Without Pesticides

Gardeners who want to be more Eco-conscious and make the move towards organic gardening need not fear life without chemical pesticides. Connect with local gardeners to determine the most common problems in your region, and then look for organic fixes. Many pest control solutions can be concocted from household items:

Garlic and cayenne pepper can be used to deter pesky aphids, which can be very damaging to plants. Ladybugs are another solution, as they are a major aphid predator.

Used coffee grounds make a great fertilizer for plants that thrive in acidic soil, like rhododendrons or azaleas. Sprinkle coffee grounds and eggshells around the base of plants to repel ants (which can exacerbate an aphid problem), snails, and slugs.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced! Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

The Housing Market Index (HMI) is a weighted average of separate diffusion indices based on a monthly survey of NAHB members designed to take the pulse of the single-family housing market. Each resulting index is then seasonally adjusted and weighted to produce the HMI.

The Pending Home Sales Index, a leading indicator of housing activity, measures housing contract activity, and is based on signed real estate contracts for existing single-family homes, condos and co-ops. The PHSI looks at the monthly relationship between existing-home sale contracts and transaction closings over the last four years. The results are weighted to produce the index.

The Chicago Board Options Exchange Market Volatility Index (VIX) is a weighted measure of the implied S&P 500 volatility. VIX is quoted in percentage points and translates, roughly, to the expected movement in the S&P 500 index over the upcoming 30-day period, which is then annualized.

The BLS Consumer Price Indexes (CPI) produces monthly data on changes in the prices paid by urban consumers for a representative basket of goods and services. Survey responses are seasonally adjusted and weighted to produce a composite index.

The Conference Board Leading Economic Index (LEI) is a composite economic index formed by averages of several individual leading economic indicators, which are weighted to produce the complete index.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict

future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

|

|

|