|

Fed Action, Earnings, and Politics

Weekly Update- September 24, 2012

|

|

|

In This Issue

|

|

|

|

|

|

The Markets:

During the past three months, the stock market has turned in one of its strongest performances in U.S. history. Since early June, the Dow Jones Industrial Average has gained 12%. If this rate of increase continued, it would offer close to a 50% annualized gain.[1] But of course, such expectations are entirely unrealistic. While we are grateful for market gains when we can notch them, we must acknowledge that healthy markets move up and down.

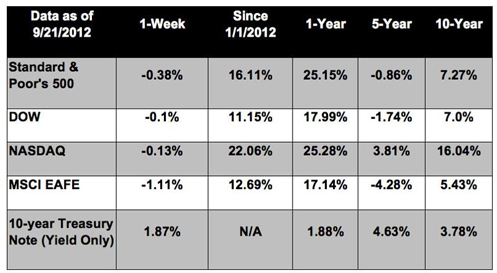

In keeping with this behavior, markets closed slightly down last week as investors weighed promises by the Fed and other central banks against signs of economic hurdles and political challenges ahead. The S&P closed 0.38% lower, the Dow lost 0.1%, and the Nasdaq trimmed 0.13%.[2]

Federal Reserve officials made the rounds last week, giving speeches and expressing support for the Chairman's efforts to stimulate the economy. Some comments lead analysts to believe that the Fed will act on its strong mandate and take further action if necessary; however, most believe it will leave policies unchanged until the end of the year. While investors cheered the recent aggressive Fed actions, some believe the move indicates the U.S. recovery is still uncertain at best.[3]

As we near the end of the third quarter, we will begin to see the first corporate earnings reports. Profit warnings from companies in the S&P 500 are outpacing positive pre-announcements by the largest margin in 11 years, indicating that businesses are still feeling the economic crunch.[4] Because companies have been cutting earnings estimates for months already, there is a possibility that weak earnings could trigger a decline in stock prices. Even so, equities could heat up in the first week of October due to market-moving events like the release of unemployment data, the presidential debate, and the Eurozone finance meeting.

As the elections near, politicians are ramping up the rhetoric, but still failing to deal with the fiscal cliff, a huge issue in the minds of analysts and investors. Although we wish that legislators would get their priorities straight and do their jobs, it is unlikely that any major resolution will be reached until after the elections. Should you have any questions about how the fiscal cliff or any other issue could affect your personal financial picture, please contact us. We are always happy to provide guidance. ECONOMIC CALENDAR: Monday: Dallas Fed Mfg. Survey Tuesday: S&P Case-Shiller HPI, Consumer Confidence Wednesday: New Home Sales, EIA Petroleum Status Report Thursday: Durable Goods Orders, GDP, Jobless Claims, Pending Home Sales Index Friday: Personal Income and Outlays, Chicago PMI, Consumer Sentiment

|

|

|

|

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not available. |

|

Headlines

Homebuilders see strong third quarter. In a further sign that the housing sector may have turned the corner, U.S. homebuilder KB Homes, reported strong third quarter earnings. The company reports that it is experiencing rising orders for new homes as inventory drops and housing prices rise.[5]

Jobless claims rise in 26 states. Unemployment rates rose in 26 states in August, according to a Labor Department report, although most states still showed lower rates than a year ago. 42 states and the District of Columbia had lower rates last month than in August 2011.[6]

Oil prices near $93 per barrel.Oil prices rose higher Friday as traders weighed slowing economic growth and reduced demand for oil against potential supply disruptions in the Middle East. Higher energy prices as we head into the winter months could hit consumer spending hard.[7]

Concern grows about China's hard landing. A raft of negative economic reports is raising concerns that China's economy will not recover. A one-two punch of softening domestic and foreign demand is threatening the giant's economic stability. A recent report shows that manufacturing grew only slightly in September and that foreign direct investment fell in August for the third month in a row.[8]

|

|

|

|

"Leadership is a potent combination of strategy and character.

But if you must be without one, be without the strategy."

- Norman Schwarzkopf

|

Baked Apples   This deceptively simple recipe means a delicious dessert is never more than minutes away. Recipe from RealSimple.com.

Ingredients:

8 baking apples (such as Cortland, Empire, Gala, Braeburn, or Pippin)

1/2 cup chopped candied or plain nuts

1/3 cup light or dark brown sugar

4 tablespoons unsalted butter, cut into small pieces

1) Heat oven to 400° F. Remove and discard the cores from the apples. Place the apples in a 9- by-13- inch baking dish.

2) In a small bowl, combine the nuts, sugar, and butter. Divide the mixture among the apples. (You can cover and refrigerate for up to 24 hours.) Bake until tender, about 25 minutes. Serve warm with a scoop of vanilla ice cream.

|

|

|

Your Last "Swing Thought"

"I knew it! I knew I was gonna do that!" It's a confession heard on every golf course, every day. Amateurs are often quick to admit that they knew what mistake they were going to make in advance. Prophets they are not; negative thinkers perhaps. And the worst time to have a negative thought is the instant before swinging.

At address, when negative thoughts creep into your mind, step back and regroup. Break the chain of negative thinking by recalling good shots you've hit in similar situations. Don't swing until you can confidently visualize a perfect shot.

|

Grab Fresh Fruit Wherever you're going - to work, on a walk, or on a drive to the supermarket - pick up a few fresh fruits and eat them on the way. Fruits are a great way to introduce vitamins to your diet while curbing the cravings that lead to impulse food stops.

|

Be Eco-Conscious about Garbage

One of the best ways to reduce the environmental footprint of your household is to be conscious of what you're throwing away. Educate yourself about what is recyclable, consumable, and able to be composted. Be aware of the packaging that comes with food and products and the waste it will produce. Be very careful to appropriately dispose of toxic waste like batteries and used electronics.

Start a compost heap for food waste like vegetables, eggs, and coffee grounds. Be aware that meat, dairy, and processed foods cannot be composted. Eventually, you'll be able to use your compost as a nutrient-rich fertilizer for your garden.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced! Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

The Housing Market Index (HMI) is a weighted average of separate diffusion indices based on a monthly survey of NAHB members designed to take the pulse of the single-family housing market. Each resulting index is then seasonally adjusted and weighted to produce the HMI.

The Pending Home Sales Index, a leading indicator of housing activity, measures housing contract activity, and is based on signed real estate contracts for existing single-family homes, condos and co-ops. The PHSI looks at the monthly relationship between existing-home sale contracts and transaction closings over the last four years. The results are weighted to produce the index.

The Chicago Board Options Exchange Market Volatility Index (VIX) is a weighted measure of the implied S&P 500 volatility. VIX is quoted in percentage points and translates, roughly, to the expected movement in the S&P 500 index over the upcoming 30-day period, which is then annualized.

The BLS Consumer Price Indexes (CPI) produces monthly data on changes in the prices paid by urban consumers for a representative basket of goods and services. Survey responses are seasonally adjusted and weighted to produce a composite index.

The Conference Board Leading Economic Index (LEI) is a composite economic index formed by averages of several individual leading economic indicators, which are weighted to produce the complete index.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

|

|

|