Evaluating the Summer Rally

Weekly Update - August 27, 2012

|

|

|

In This Issue

|

|

|

|

|

|

The Markets:

After another slow trading week, markets closed slightly down, with the S&P losing 0.50%, the Dow dropping 0.88%, and the Nasdaq losing 0.22%.[1] With the S&P 500 edging close to another record high, you might be wondering how much higher markets can go in this 'sugar high' rally. We've been asking this question too, and while we typically dislike getting too much into technical analysis, we want to discuss a technical indicator that could shed some light on the answer. When determining whether equities are approaching a peak or floor, many analysts turn to the Chicago Board Options Exchange Market Volatility Index (VIX), a measure of the volatility of S&P 500 puts and calls. Historically, the VIX has been an uncanny forecaster of market tops and bottoms; whenever volatility (as measured by the VIX) is low, the S&P has reached a decisive peak, and then fallen. Last week, the VIX hit a multi-year low of 13.45 (anything under 20 is considered low), and we believe that given the lack of economic support for further gains, equities could be poised for a pullback.[2] Cutbacks in business spending, pressure on food prices, and a weak manufacturing sector mean that the domestic recovery is anything but guaranteed. Weak numbers from China and Europe indicate that our trading partners will be dealing with their own economic troubles for months or years to come. This leads us to believe that the summer rally is fundamentally driven by trader expectations around further global quantitative easing. Recent jawboning by Fed officials, European leaders, and EU central bankers is largely to blame for the recent rally. So if there is a pullback, what could it mean? How much equities retreat and when they do so will depend on a number of factors, such as the murky global economic outlook, September Federal Reserve meeting, and upcoming elections. In terms of headwinds, we can expect the continued contraction of the European markets to present further challenges, as will a potential hard landing in China. On the flip side, investors could see a boost after the next FOMC meeting, as it looks increasingly likely that the Fed will undertake further quantitative easing. Much will also depend on what action legislators take to address the fiscal cliff. Although it is reasonable to expect an end to our summer market romance, we believe there will be many opportunities for growth further down the road. To wrap it all up, please remember that short-term gyrations in the market are expected and have little relevance to long-term investment performance. When markets pull back, it can sometimes feel like riding an elevator to the basement, but market losses are rarely evenly dispersed across all sectors. In every market environment there are investment opportunities to be had, and we specialize in finding those hidden gems and putting them to work in our clients' portfolios. ECONOMIC CALENDAR: Monday: Dallas Fed Mfg. Survey Tuesday: S&P Case-Shiller HPI, Consumer Confidence Wednesday: GDP, Pending Home Sales Index, EIA Petroleum Status Report, Beige Book Thursday: Jobless Claims, Personal Income and Outlays Friday: Chicago PMI, Consumer Sentiment, Factory Orders

|

|

|

|

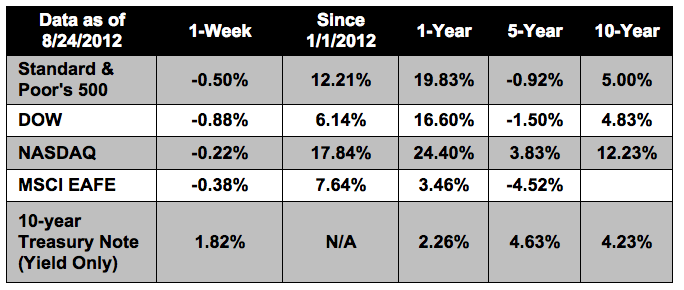

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized.

Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results.

Indices are unmanaged and cannot be invested into directly. N/A means not available.

|

|

Headlines

Durable goods order rise in July. Overall, durable goods rose a seasonally-adjusted 4.2%, beating expectations of a 2.5% increase. However, excluding the volatile transportation category, long-lasting goods actually fell 0.4%, indicating that the manufacturing sector is still suffering. Core capital goods, products like computers, industrial machinery and steel, a key measure of business investment, fell 3.4%, a steep drop that indicates businesses are scaling back investment in the slow economy.[3] Unemployment claims rise by 4,000. The number of first-time unemployment beneficiaries rose last week to a seasonally-adjusted 372,000, showing that the jobs recovery remains modest and uneven. While hiring continues to improve, it grew more slowly in August than July.[4] New homes sales grew 3.6% in July. The gain in sales matches the two-year high the housing market reached in May, indicating that housing is recovering steadily. Although housing sales have leaped 25% in the last year, we are still well below the levels that economists consider healthy. One trend slowing housing sales is a relative lack of available new homes; inventory levels dropped in July to the lowest on record.[5] Spain in unofficial talks with Eurozone about bailout. Although they have not yet made an official bailout request, Spanish officials are negotiating with Eurozone leaders to have government debt purchased by the existing rescue fund and are asking the ECB to intervene in secondary markets to lower bond yields. [6]

|

|

|

|

"Nothing is predestined: The obstacles of your past can

become the gateways that lead to new beginnings."

- Ralph Blum

|

|

|

This luxurious dessert is deceptively simple, making it perfect for a easy meal with friends. Recipe from RealSimple.com

Ingredients:

6 large egg yolks

1 tablespoon finely grated lemon zest plus 1/2 cup lemon juice

1/2 teaspoon kosher salt

1 1/2 cups sugar

2 cups heavy cream

1/4 cup sliced almonds

Directions:

1) Set a fine-mesh sieve over a medium bowl. In a heatproof medium bowl, whisk together the egg yolks, lemon zest and juice, salt, and 1 cup of the sugar. Set the bowl over (not in) a saucepan of simmering water and cook, stirring constantly, until the lemon mixture becomes opaque and has thickened slightly, 12 to 15 minutes.

2) Pour the lemon mixture through the sieve into the bowl. Place a piece of plastic wrap directly on the surface of the lemon mixture and refrigerate until completely cool, at least 2 hours.

3) Using an electric mixer, whip the cream and the remaining ½ cup of sugar on medium until soft peaks form, 2 to 3 minutes. In 3 additions, gently fold the whipped cream into the lemon mixture. Pour into an 8-by-4-inch loaf pan or another 6-cup pan, cover, and freeze until firm, at least 4 hours.

4) Meanwhile, heat oven to 375° F. Spread the almonds on a rimmed baking sheet and toast, tossing once, until golden brown, 4 to 6 minutes.

5) Serve the semifreddo sprinkled with the almonds.

|

|

|

|

Think long, slow, and smooth for your short game. Precision is important around the green, so there isn't much margin for error. It's vital that you maintain a steady, smooth rhythm and tempo for every short shot you hit. Forcing yourself to make a short swing because you have to move the ball a short distance throws off your timing.

Instead, try counting through each short shot you hit: "One, two, three." Count "one" as you start the club away from the ball, "two" when you reach the top of the swing, and "three" as you swing through. From 40-yard pitch shots to delicate chips off the apron, maintain this same count. If you do, you'll find it much easier to make consistent contact.

|

|

|

|

Many successful business people turn as much attention to their personal lives as they do their businesses. Lifestyle management involves the slow addition of health-improving activities and the removal of negative influences in your life. Rather than embarking on crash diets and large-scale changes of life, consider the slow, gradual approach to building healthy habits like exercise, diet, and personal downtime.

|

|

|

|

We all know that you don't attend a social gathering empty-handed. Instead of bringing cut flowers to your next dinner date or party, bring a potted plant. Cut flowers are often grown internationally and flown to florists around the world, creating a significant carbon burden. They may also be grown in areas which have been cleared of natural flora and fauna, contributing to the loss of critical biodiversity. By opting for a locally-grown potted plant, you avoid participating in a damaging cycle and will contribute to the clean air and pleasure a living plant provides.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

The Housing Market Index (HMI) is a weighted average of separate diffusion indices based on a monthly survey of NAHB members designed to take the pulse of the single-family housing market. Each resulting index is then seasonally adjusted and weighted to produce the HMI.

The Pending Home Sales Index, a leading indicator of housing activity, measures housing contract activity, and is based on signed real estate contracts for existing single-family homes, condos and co-ops. The PHSI looks at the monthly relationship between existing-home sale contracts and transaction closings over the last four years. The results are weighted to produce the index.

The Chicago Board Options Exchange Market Volatility Index (VIX) is a weighted measure of the implied S&P 500 volatility. VIX is quoted in percentage points and translates, roughly, to the expected movement in the S&P 500 index over the upcoming 30-day period, which is then annualized.

The BLS Consumer Price Indexes (CPI) produces monthly data on changes in the prices paid by urban consumers for a representative basket of goods and services. Survey responses are seasonally adjusted and weighted to produce a composite index.

The Conference Board Leading Economic Index (LEI) is a composite economic index formed by averages of several individual leading economic indicators, which are weighted to produce the complete index.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] http://briefing.com/investor/markets/weekly-wrap/weekly-wrap-for-august-20-2012.htm

[2] http://www.thestreet.com/story/11670491/2/kass-get-ready-for-the-fall.html

[3] http://www.usatoday.com/money/economy/story/2012-08-24/durable-goods-orders-july/57268288/1

[4] http://www.usatoday.com/money/economy/employment/story/2012-08-23/initial-claims-unemployment-benefits/57231664/1

[5] http://www.usatoday.com/money/economy/housing/story/2012-08-23/housing-reports-august-28/57234792/1

[6] http://www.cnbc.com/id/48765115

|

|

|