|

Special Update: Markets in Flux

Weekly Update - June 11, 2012

|

|

|

In This Issue

|

|

|

|

|

|

The Markets:

After the sustained selloff in previous trading sessions, the markets rallied Friday to claim a strong gain for the week. The S&P and Dow both booked a 0.8% gain, while the Nasdaq rose 1.0%.[1] With the choppy market performance and gloomy economic sentiment we've seen in the past weeks, we wanted to spend some time discussing recent trends and what they might mean for the future.

In short, many of the problems that plagued the markets in 2010 and 2011 - a serious European debt crisis and recession, a slowing Chinese economy, slow domestic growth, and the looming expiration of Bush-era tax cuts - are still with us in 2012. The uncertainty around these issues has dealt investor sentiment a major blow and spurred an exodus from equities into bonds and other "safe haven" investments, pushing Treasury yields to record lows similar to levels seen in the 2008 crisis. There's a real current of fear underlying these moves that the global economy is slipping back into recession.

Whether this fear is realized depends largely on how the credit crisis in Europe develops. Things may be looking up (at least temporarily) as Eurozone leaders have pledged to lend Spain up to 100 billion euros (approx. $125 billion) to recapitalize its banks, pending an audit this month. By pumping more liquidity into the economy, policymakers have bought themselves a bit more time to find a solution.[2] We hope that markets will react positively to the news this week.

Domestically, many people are worrying about whether 2012 will be a repeat of the last two years, where an initially promising start fizzled out in the spring. Economic data has been patchy at best, and employment growth seems to have lost steam over the past few months, with not nearly enough jobs created to sustain continued growth. At this point, we can't be sure if this is just a temporary slowdown or a sign of continued economic contraction. Based on a number of factors, we currently suspect that this is a temporary, cyclical slowdown and that job growth will pick up in the latter half of the year. Supporting this belief, the Fed's most recent Beige Book report stated that U.S. economic growth picked up over the last two months, and hiring showed signs of a "modest increase," indicating that the situation is not as grim as many originally feared.[3]

With respect to equity markets, we know that historically, the market suffers one 10% (or greater) market correction each year. The S&P briefly touched an intraday correction of 10%, so does that mean we can expect solid growth going forward? It's impossible to know for sure, but it's rare to see the kind of persistent selling pressure that we've seen for the last month, where, for example, the Dow experienced 17 losses in 22 trading sessions. This lingering weakness has resulted in very pessimistic investor sentiment that may set markets up for a positive rebound. Additionally, we're also under the effect of typical Presidential Election year trends, which historically have called for a peak in April and a decline in June, a script the markets have followed closely this year. If the cyclical trend continues, we can expect a new burst of energy in the second half of the year.

ECONOMIC CALENDAR:

Tuesday: Import and Export Prices, Treasury Budget

Wednesday: Producer Price Index, Retail Sales, Business Inventories, EIA Petroleum Status Report

Thursday: Consumer Price Index, Jobless Claims

Friday: Empire State Mfg. Survey, Treasury International Capital, Industrial Production, Consumer Sentiment

|

|

|

|

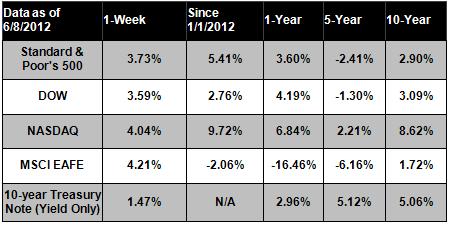

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not available. |

|

Headlines:

Wholesale businesses restocked faster in April, indicating strong sales could push economic growth higher in the second quarter. The Commerce Department report says wholesale stock grew by 0.6% in April, nearly double the March growth. Wholesale sales grew by 1.1% in April, almost triple March sales growth. [4]

Chinese exports jumped 15.3% in May from May 2011, compared to April's 4.9% growth. Imports also increased 12.1% compared with March's insipid 0.3%. Although the positive numbers may ease fears that China's economy is slowing, the Chinese government will likely take further measures to boost their economy.[5]

Fed survey found that U.S. economy grew moderately in most regions of the country this spring. The report shows growth in each of its 12 bank districts from April 3 through May 25, indicating that despite a poor jobs showing, the economy is still chugging along. [6]

Unemployment claims dropped by 12,000, according to the latest Labor Department report. Although a one week decline does not indicate a trend, a recent Labor Department report indicates that worker productivity is low, meaning employers will have to hire again if business picks up.[7]

|

|

|

|

"The only thing we have to fear is fear itself."

- Franklin D. Roosevelt

|

|

|

Blueberry Tart   Store-bought puff pastry cuts the work while lemon-infused cream cheese ups the wow factor. Recipe from RealSimple.com. Store-bought puff pastry cuts the work while lemon-infused cream cheese ups the wow factor. Recipe from RealSimple.com.

Flour for the work surface

1 8-ounce sheet frozen puff pastry, thawed

1 large egg, beaten

1 tablespoon granulated sugar

4 ounces cream cheese, softened

1/4 cup heavy cream

1/2 teaspoon grated lemon zest

3 tablespoons confectioners' sugar

2 cups blueberries

Directions:

1) Heat oven to 375° F. On a lightly floured surface, unfold the sheet of pastry and roll it into a 10-by-12-inch rectangle. Transfer to a parchment-lined baking sheet.

2) Using the tip of a knife, score a 1-inch border around the pastry without cutting all the way through. Brush the border with the egg and sprinkle with the granulated sugar.

3) Bake until golden and puffed, 18 to 22 minutes.

4) Using the tip of a knife, rescore the border of the cooked pastry without cutting all the way through. Gently press down on the center of the pastry sheet to flatten it. Let cool to room temperature, 15 to 20 minutes.

5) Meanwhile, with an electric mixer, beat the cream cheese until smooth. Add the cream, lemon zest, and 2 tablespoons of the confectioner's sugar, and beat until smooth.

6) Spread the cream cheese mixture evenly within the borders of the pastry.

7) Arrange the blueberries in a single layer over the filling and sprinkle with the remaining tablespoon of confectioners' sugar.

|

|

|

Less Spin Equals More DistanceThe next time you clean your clubs, skip the driver. Let those grooves get a little bit clogged up. The fewer grooves there are the less spin is induced on the ball, thus causing it to fly farther. Sometimes the simplest things can make a difference.

|

Don't Skip BreakfastStudies have shown that people who skip breakfast burn fewer calories during the day than those who eat a healthy breakfast. Skipping meals can be especially harmful for dieters who may assume that they are reducing their calorie intake when the opposite is actually true. After a good night's rest, your body is already in a fasting state and missing breakfast can lower your metabolism. Giving your body a healthy start to the day will boost your metabolism and improve how your body burns calories.

|

Lower the Impact of Home ElectronicsThe average American home contains two televisions, a VCR, DVD player, three phones, and an entertainment center. These home electronics can use more energy than you think. To reduce consumption, unplug unneeded electronics and when making new purchases, look for Energy Star models that help reduce carbon emissions.

|

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

The Housing Market Index (HMI) is a weighted average of separate diffusion indices based on a monthly survey of NAHB members designed to take the pulse of the single-family housing market. Each resulting index is then seasonally adjusted and weighted to produce the HMI.

The BLS Consumer Price Indexes (CPI) produces monthly data on changes in the prices paid by urban consumers for a representative basket of goods and services. Survey responses are seasonally adjusted and weighted to produce a composite index.

The Conference Board Leading Economic Index (LEI) is a composite economic index formed by averages of several individual leading economic indicators, which are weighted to produce the complete index.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] http://biz.yahoo.com/mu/update.html

[2] http://finance.yahoo.com/news/eurozone-agrees-lend-spain-100-002740709.html

[3] http://finance.yahoo.com/news/fed-beige-book-points-moderate-180850401.html

[4] http://www.usatoday.com/money/economy/story/2012-06-08/wholesale-inventories-april/55462346/1

[5] http://news.yahoo.com/chinas-exports-jump-15-3-percent-may-041812280--finance.html

[6] http://www.usatoday.com/money/economy/story/2012-06-06/beige-book-june-6/55423974/1

[7] http://www.usatoday.com/money/economy/story/2012-06-07/unemployment-claims/55439162/1

|

|

|