|

The Prettiest Girl at the Dance

Weekly Update - April 30, 2012

|

|

|

In This Issue

|

|

|

|

|

|

The Markets:

The trading week started off slowly as investors absorbed further troubling news about the state of the global economy: Disappointing manufacturing reports from China, France, and Germany, plus news that the Netherlands might be heading for its own fiscal crisis.[1] Things turned around later in the week though, as domestic equities closed higher on positive news surrounding U.S. corporate earnings. The Dow managed to recoup all its April losses, closing up 1.53% for the week, while the S&P rose 1.80%, and the Nasdaq gained 2.29%. For the moment, corporate earnings are providing a positive counterpoint to lackluster economic news.

The state of our nation's economy was also in the spotlight last week. Gross Domestic Product (GDP) grew by 2.2% in the first quarter, down from 3.0% in the fourth quarter of 2011. The biggest factors in the slowdown were slower inventory-building by private companies and less defense spending by the federal government. Thankfully, consumer spending - the largest contributor to GDP - is still strengthening, which should lead to ongoing improvement in our overall economic picture.[2] In keeping with its upbeat tone, the Fed added 20 basis points to its 2012 GDP forecast, increasing predicted growth to between 2.4%-2.9% this year. The Fed also agreed to keep interest rates between 0.00%-0.25%, and expects inflation to remain below 2.0% for the next two years. During the follow-up press conference, Chairman Ben Bernanke stated that the Fed was still prepared to take an active role in the recovery.[3]

Unemployment claims continue to remain near a three-month high, indicating that employers have stepped-up layoffs and are reluctant to increase hiring. However, economists believe that the mild winter distorted first-quarter hiring, making it appear unusually strong. Overall, the economy has continued to add jobs and unemployment is falling well ahead of estimates.[4]

Regardless of what happens with short-term market movements and news from abroad, we are grateful to see that the U.S. economy is recovering from the financial crisis better than any other economy in the world right now. This is likely a major reason why we have seen domestic equities performing so well lately - when compared with the rest of the world, U.S. companies are the prettiest girl at the dance. While there are sure to be bumps in the road ahead, corporate balance sheets are strong, the job market is slowly improving, consumers are still spending, and our economy is chugging along.

ECONOMIC CALENDAR:

Monday:Personal Income and Outlays, Chicago PMI, Dallas Fed Mfg. Survey

Tuesday:Motor Vehicle Sales, ISM Mfg. Index, Construction Spending

Wednesday:ADP Employment Report, Factory Orders, EIA Petroleum Status Report

Thursday:Jobless Claims, Productivity and Costs, ISM Non-Mfg. Index

Friday:Employment Situation

|

|

|

|

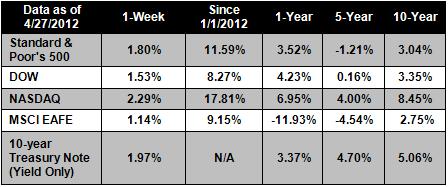

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not available. |

|

Headlines:

U.S. Gas prices are lower now than they were a year ago. After falling for most of the month of April on slowing global demand, gas prices are lower in most of the U.S. than they were last year. This should give consumer confidence a boost as we move into the peak summer driving season.[5]

Spain's economic crisis worsens as unemployment rises. A recent report shows that Spain's overall unemployment rate hit 24.2% while the unemployment rate for youths under 25 reached a staggering 52%. Underscoring the bad news, the S&P downgraded Spain's debt rating to BBB+.[6]

Home sales jumped by 4.1% in March to reach the highest level since April 2010, indicating that the battered housing market is recovering. In a separate report, mortgage buyer Freddie Mac says that the average rate on 30-year loans averaged 3.88%, very close to the historic low reached in the 1950s, keeping home financing affordable.[7]

Heavy debt may be depressing consumer spending. The housing bust may have burdened households with high debt levels, preventing them from spending more. Record student-loan debt and poor job prospects may be prompting younger workers to put off marriage and live at home longer, reducing household formation and furniture purchases.[8]

|

|

|

"The difference between a successful person and others is not a lack of strength,

not a lack of knowledge, but rather a lack in will."

- Vince Lombardi

|

|

|

Spiced Chicken Kebabs   These colorful kebabs mix chicken with flavorful vegetables. Recipe from Real Simple. These colorful kebabs mix chicken with flavorful vegetables. Recipe from Real Simple.Ingredients:

8 boneless, skinless chicken thighs (1 1/2 pounds), cut into 1-inch pieces

1 tablespoon paprika

1 tablespoon cumin

1 bell pepper, cut into 1-inch pieces

1 zucchini, cut into 1-inch pieces

2 tablespoons olive oil

kosher salt and black pepper

1 10-ounce box couscous (1 1/2 cups)

fresh mint, torn, for serving

Directions:

1) Soak 8 wooden skewers in water for at least 10 minutes. Heat broiler.

2) Season the chicken with the paprika and cumin. Thread onto the skewers with the bell pepper and zucchini. Drizzle the chicken and vegetables with the oil and season with ½ teaspoon salt and ¼ teaspoon black pepper. On a rimmed baking sheet, broil the kebabs, turning once, until the chicken is cooked through, 15 to 18 minutes.

3) Meanwhile, place the couscous in a large bowl and pour 1½ cups hot tap water over the top. Cover and let stand for 5 minutes; fluff with a fork. Sprinkle with the mint and serve with the kebabs.

|

|

|

Push & Tap, not Swing, when Putting

|

|

|

Take a Break from Cooked Food

|

|

|

Save Energy with Hot Water Heater Modifications Hot water heaters can account for a surprising amount of a house's energy use. Situating your water heater as close as possible to the points of greatest use (the bathroom, kitchen, or laundry room, typically) will save both water and energy by reducing the time it takes for hot water to travel to the outlet and limiting the distance through cold pipes it has to travel. For a less expensive fix, wrapping a water heater with insulation can keep as many as 1,000 pounds of greenhouse gas out of the atmosphere.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe,

Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

The Housing Market Index (HMI) is a weighted average of separate diffusion indices based on a monthly survey of NAHB members designed to take the pulse of the single-family housing market. Each resulting index is then seasonally adjusted and weighted to produce the HMI.

The BLS Consumer Price Indexes (CPI) produces monthly data on changes in the prices paid by urban consumers for a representative basket of goods and services. Survey responses are seasonally adjusted and weighted to produce a composite index.

The Conference Board Leading Economic Index (LEI) is a composite economic index formed by averages of several individual leading economic indicators, which are weighted to produce the complete index.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] http://biz.yahoo.com/mu/update.html

[2] http://www.usatoday.com/money/economy/story/2012-04-27/first-quarter-gross-domestic-product/54574828/1[3] http://biz.yahoo.com/mu/update.html

[4] http://www.usatoday.com/money/economy/story/2012-04-26/unemployment-claims/54547952/1

[5] http://www.dailyfinance.com/2012/04/24/gasoline-prices-cheaper-than-year-ago/

[6] http://www.usatoday.com/money/world/story/2012-04-27/spain-financial-crisis-unemployment/54577324/1

[7] http://www.usatoday.com/money/economy/housing/story/2012-04-26/pending-sales-mortgage-rates/54550188/1

[8] http://www.usatoday.com/money/perfi/credit/story/2012-04-26/household-debt/54568170/1

|

|

|