|

Strong Earnings Drive Stocks

Weekly Update - April 23, 2012

|

|

|

In This Issue

|

|

|

|

|

|

The Markets:

Strong corporate earnings caused stocks to rally last week for the first time this month. The S&P closed up 0.6% for the week, while the Dow closed 1.4% higher, and the Nasdaq trimmed 0.36%. With no domestic economic reports released on Friday, traders turned their attention back to lingering concerns over Europe and China, and markets lost some momentum in afternoon trading. Even so, last week's positive earnings reports are alleviating concerns about the economy and making investors feel more confident about the rallies we've seen this year. With 23% of S&P 500 companies having reported results so far, more than four out of five have beaten expectations by an average of 8.8%. Profit growth in this quarter has also been up 6.2%, according to Thomson Reuters Proprietary Research.[1]

While some analysts are concerned that stocks are poised to repeat their 2010 and 2011 performance - when a mid-year retreat followed an April peak - there are many differences between the economy of the past two years and today. The 2010 and 2011 pullbacks largely occurred because of recession fears and shocks created by the Japanese Tsunami, but the U.S. economy is on more solid footing than at any other time in the recovery. Current indicators point to slow and steady economic growth, and we have already moved away from index highs. If we continue to see positive earnings among the nearly 180 S&P 500 components reporting next week, we may see markets sustain their upward trajectory.[2]

Investors will also be closely watching Tuesday's meeting of the Federal Reserve FOMC. With an optimistic economic outlook and improving jobs situation, it is unlikely that the Fed will conduct another round of bond purchases. Even so, we will be monitoring the Fed's statement on Wednesday, and will be certain to fill you in on any outstanding developments. We hope you have a great week!

ECONOMIC CALENDAR:

Tuesday: S&P Case-Shiller HPI, New Home Sales, Consumer Confidence

Wednesday: Durable Goods Orders, EIA Petroleum Status Report, 5-Yr Note Auction, FOMC Meeting Announcement, FOMC Forecasts, Chairman Press Conference

Thursday: Jobless Claims, Pending Home Sales Index

Friday: GDP, Employment Cost Index, Consumer Sentiment

|

|

|

|

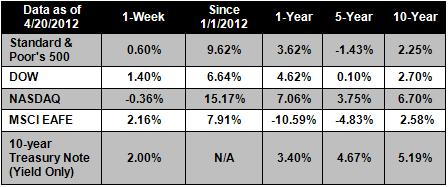

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not available. |

|

Headlines:

Spain's bond auction sees strong demand from investors. Spain's central bank sold all the 2.54bn euros of bonds it was offering, with demand higher than expected. These eased global worries about Europe's lingering debt problems and shows that investors are eager to snap up bargain-basement debt.[3]

Fewer U.S. states reported job gains in March, indicating a slowing of job growth nationwide. According to Labor Department figures, 29 states reported job gains last month while 20 states lost jobs. In more positive news, the unemployment rate fell in most states.[4]

Sales of previously-owned houses dropped in March, despite low mortgage rates. According to National Association of Realtors figures, home sales fell last month by 2.6%. Seasonal factors might be behind the disappointing figures: the first months of 2012 were the strongest in five years, indicating that a mild winter may have encouraged buyers to close earlier, stealing sales from March.[5]

High energy prices may be slowing rural economic growth. According to the Rural Mainstreet survey, higher energy and fuel costs are slowing growth in 10 Midwest and Plains areas dependent on agriculture. Slowing global demand for key crops may also be having an effect on growth.[6]

|

|

|

"Friendship with oneself is all important, because without it one cannot

be friends with anyone else in the world."

- Eleanor Roosevelt

|

|

|

Lemon Cream Pie   Tangy lemon cream tops a spicy gingersnap crust. Tangy lemon cream tops a spicy gingersnap crust.

Recipe from Real Simple.

9 ounces gingersnaps (about 35)

6 tablespoons unsalted butter, melted

2 tablespoons granulated sugar

1 teaspoon kosher salt

2 large eggs

1 14-ounce can sweetened condensed milk

1 tablespoon finely grated lemon zest, plus more for serving, plus 1/2 cup lemon juice

1 cup heavy cream

2 tablespoons confectioners' sugar

Directions:

1. Heat oven to 350° F. In a food processor, process the gingersnaps until fine crumbs form. Add the butter, granulated sugar, and ½ teaspoon of the salt and pulse until moistened. Press the mixture firmly into the bottom and up the sides of a 9-inch pie plate, using a straight-sided dry measuring cup to help. Place on a rimmed baking sheet and bake until the edges are dry and set, 16 to 18 minutes. (Note: The bottom will still appear moist and soft but will become firmer as it cools; this is a crunchy cookie crust, not a soft, graham cracker-style one.) Let cool.

2. In a medium bowl, whisk together the eggs, condensed milk, lemon zest and juice, and the remaining ½ teaspoon of salt. Pour the mixture into the crust and bake until set in the center, 18 to 20 minutes. Let cool and then refrigerate until firm, at least 2 hours.

3. Using an electric mixer, whip the cream and confectioners' sugar on medium until soft peaks form, 2 to 3 minutes. Spread on the pie, sprinkle with the additional zest, and serve immediately.

|

|

|

|

Taking a deep breath before you swing will help put oxygen in your system and keep your head clear. It gives your cells energy to allow your muscles to perform their best. Put simply, deep breathing helps you hit better shots. Why do you think most basketball players precede their free throws by taking a few good, deep breaths? Many bad swings are made during moments when we are short of breath. Why do you think they call it choking? So take a deep, relaxed breath before you swing.

|

|

|

Yoga can be a safe and effective way to add some physical activity to your routine - particularly if you haven't exercised in the past. A recent study suggests that yoga can help you stay slim. Participants between the ages of 45 and 57 who practiced yoga weighed an average of 10 pounds less than their non-yoga contemporaries, even when diet and lifestyle were accounted for. To get started with a yoga program, check your local gyms and yoga studios for introductory offers and beginner packages to get you off on the right pose.

|

|

|

Make Your Home Purchase a Green One Buying a home is the most expensive purchase most Americans will make in their lives and is also one of the best ways to limit your family's environmental impact. When shopping for a house, look for a smaller home that requires you to pare down and simplify, rather than encouraging sprawl. Smaller homes require less energy to heat and maintain, and prevent you from buying more stuff to fill the space. Your home's location also directly influences how much energy your family burns to get around - try to find a home close to work, school, and shopping to minimize fossil fuel use.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced! Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

The Housing Market Index (HMI) is a weighted average of separate diffusion indices based on a monthly survey of NAHB members designed to take the pulse of the single-family housing market. Each resulting index is then seasonally adjusted and weighted to produce the HMI.

The BLS Consumer Price Indexes (CPI) produces monthly data on changes in the prices paid by urban consumers for a representative basket of goods and services. Survey responses are seasonally adjusted and weighted to produce a composite index.

The Conference Board Leading Economic Index (LEI) is a composite economic index formed by averages of several individual leading economic indicators, which are weighted to produce the complete index.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] http://news.yahoo.com/earnings-fed-prove-skeptics-wrong-215428772--finance.html [2] http://www.reuters.com/article/2012/04/20/us-usa-stocks-weekahead-idUSBRE83J1JO20120420

[3] http://www.bbc.co.uk/news/business-17769769

[4] http://www.usatoday.com/money/economy/story/2012-04-20/state-unemployment-rankings/54432478/1

[5] http://www.usatoday.com/money/economy/housing/story/2012-04-19/home-sales-march/54409400/1

[6] http://www.usatoday.com/money/economy/story/2012-04-20/rural-growth-slows-energy-price-spike/54433130/1

|

|

|