|

Don't Buy Into the Hype

Weekly Update - March 26, 2012

|

|

|

In This Issue

|

|

|

|

|

|

The Markets:

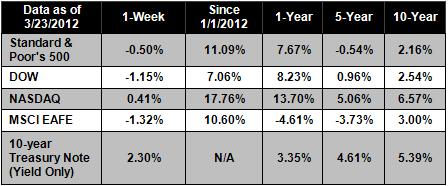

Stocks edged higher on Friday after a rough week marked by positive economic news in the U.S. but troubling economic news from Asia. For the week, the S&P and Dow notched their biggest losses of the year, 0.5% and 1.1%, respectively, while the Nasdaq edged up by 0.4%, bolstered by positive earnings in tech stocks.[1]

Despite reports of increased strength in the American jobs market, improved corporate profits, and strong consumer sentiment, some investors feel increasing worry about Asia, Europe, and the impact higher oil prices could have on consumer spending. New reports show that China's manufacturing sector is slowing due to reduced global demand; in Europe, Ireland slipped back into recession; and oil prices briefly spiked to the highest level in three weeks on Friday, following a report that Iranian oil exports dropped significantly this month.[2]

The markets have posted solid returns in 2012, with the S&P up 11.09% this year. While some data indicates that we are poised for a decline, other data indicates that the markets are likely to move higher. So is it time to pull out of equities and lock in profits? Or is it better to ride things out in hopes the markets will advance further? The short answer is that no one can say for sure. Stop and consider for a moment - if the market has peaked for the year, it would be the S&P's cheapest price/earnings ratio in the last 34 market peaks.[3] Furthermore, underlying trends suggest that the global economy is improving, potentially leading to further gains in the latter half of the year. According to a recent report by Ned Davis Research (NDR), a second-half recovery might send markets to levels not seen since 2007.[4]

While it's only natural to worry about turbulence in the market, it is important to take a deep breath and focus on overall trends and sticking to an active, long-term investment strategy. The media loves to hype stories - that's how they get ratings. Shrewd investors, on the other hand, understand that markets move up and down, and that buying into the hype can be costly. With the news about weakening economies in Asia, we should probably expect some short-term consolidation, but that doesn't mean drastic action should be taken.

Just because the major equity indexes are advancing or retreating, it doesn't necessarily mean our clients' personal investments are advancing or retreating. We don't buy the markets, and we don't try to time the markets. There are worthwhile investments to be found in almost every market environment, and these are the ones we aim to utilize.

ECONOMIC CALENDAR:

Monday: Pending Home Sales Index, Dallas Fed Mfg. Survey

Tuesday: S&P Case-Shiller HPI, Consumer Confidence

Wednesday: Durable Goods Orders, EIA Petroleum Status Report

Thursday: GDP, Jobless Claims

Friday: Personal Income and Outlays, Chicago PMI, Consumer Sentiment

|

|

|

|

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not available. |

|

Headlines:

EU task force head is optimistic on Greece. The head of the European Commission's special task force on Greece believes that Greece is well on its way to improve how it monitors its finances. However, the banking system remains in difficulty and needs to be recapitalized in order to reboot the Greek economy.[5]

Unemployment claims fell to a four-year low last week. Thursday, the Labor Department reported that weekly unemployment benefits dropped by 5,000 to a seasonally-adjusted rate of 348,000, the lowest since February 2008. The drop has coincided with the best three months of hiring since 2010, supporting the view that the job market is improving. From December through February, employers added an average of 245,000 jobs per month.[6]

Gas prices are inching toward record highs, says AAA. Regular unleaded gas averaged $3.84 nationwide, 30 cents higher than one month ago. Drivers in eight states are already paying more than $4.00 per gallon, and prices will likely edge higher this year. Cost per gallon typically peaks in May when refineries switch to summer gasoline blends, which are more vulnerable to price shocks.[7]

New home sales fell in February for the second straight month. The Commerce Department reported Friday that new home sales dropped 1.6% last month to 313,000 homes. Sales have fallen nearly 7% since December, a reminder that the housing market has a long way to go despite some recent gains.[8]

|

|

|

"The difference between what we do and what we are capable of doing would suffice to solve most of the world's problems."

- Mahatma Gandhi

|

Raspberry Delight

This beautifully simple dessert brings out the best in fresh berries.

Recipe from Real Simple.

Ingredients:1/2 cup raspberry jam

1 1/4 cups heavy cream

1 tablespoon granulated sugar

1 cup fresh raspberries

4 cookies

Directions:

In a large bowl, beat the heavy cream with the sugar until stiff peaks form.

In a small bowl, whisk the jam until smooth; fold into the whipped cream. Spoon into serving bowls and garnish with the raspberries and cookies.

|

|

|

Play by Intelligence, Not Ego

Ego involvement affects many golfing situations. We may elect to shoot over a dog-leg instead of around it. We may use a high-compression ball because hard hitters do, although we could get more distance with less compression. We may shoot for the pin when our general accuracy can only justify shooting at the green.

One of the secrets to better play is not allowing your ego to affect your choices on the course. If your opponent uses a six iron, don't hesitate to use a four wood if "your game" calls for it. In other words, play your game and not your ego.

|

|

|

Exercise to Relieve Tension and Stress

According to many psychiatric professionals, exercise is one of the best (and cheapest) stress-management techniques. While joining a gym or taking classes can offer structured ways to burn off tension, exercise doesn't have to break the bank. For example, something as simple as a 20-minute walk or jog around the block can yield up to 12 hours of improved mood and lowered stress. The important thing is to choose an activity that you enjoy and add it to your daily routine.

|

|

|

Upgrade Older Fixtures to Save Water Making minor changes to your kitchen and bathroom fixtures can drastically reduce your household's ecological footprint. Old showerheads can use three gallons per minute or more; to save water, replace it with an efficient model that uses two GPM or less. Avoid designs with multiple heads that compound water waste. In the kitchen, using an aerator, a cylindrical device that threads onto the end of a faucet, reduces the water needed to do water-intensive chores like hand washing and dish rinsing. A 2.0 GPM aerator works well in the kitchen, while a 1.0 GPM model is ideal for the bathroom sink.

|

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] http://news.yahoo.com/major-us-stock-indexes-fared-friday-210344388.html[2] http://online.wsj.com/article/SB10001424052702304724404577299070578466122.html?ru=yahoo&mod=yahoo_hs, http://www.businessweek.com/ap/2012-03/D9TMD08G0.htm

[3] https://www.invesco.com/pdf/GOLODCOM3.pdf?contentGuid=e80ab5b72ca36310VgnVCM1000000a67bf0aRCRD&img=p0

[4] http://research2.fidelity.com/fidelity/research/reports/pdf/pdf.asp?feedId=1517&docTag=GLBG20120315&versionTag=7U8IKIVBUN7CUK5I51E19FHRUJ

[5] http://news.yahoo.com/optimistic-greece-says-eu-task-force-boss-132619020.html

[6] http://www.usatoday.com/money/economy/story/2012-03-22/unemployment-benefits-march-17/53699214/1

[7] http://finance.yahoo.com/news/how-to-get--2-per-gallon-gas.html

[8] http://www.usatoday.com/money/economy/housing/story/2012-03-23/new-home-sales-february/53727960/1

|

|

|