|

Eyes on the U.S. Economy

Weekly Update - January 30, 2012

|

|

|

In This Issue

|

|

|

|

|

|

The Markets:

With only a couple trading days left in January, stocks are positioned to lock in four straight months of gains and finish with their best performance since 1997.[1] Unfortunately, some momentum was lost last week after the government said the U.S. economy expanded at a slower-than-expected pace in the fourth quarter. For the week, the Dow Jones Industrial Average fell 0.5%, while the S&P 500 and Nasdaq notched modest gains.[2]

Because the figures reported by the Commerce Department were lower than expected and stocks pulled back, should that lead us to conclude that economic growth was poor? Not at all. Gross domestic product, the broadest measure of the nation's economic health, grew at a 2.8% annual rate during the last three months of the year, which is a major improvement from the 1.8% we saw during the third quarter, and is the fastest growth we've experienced since the second quarter of 2010.[3]

On the other hand, when you look closely at the numbers, there are some important points to note. One is that the majority of the growth came from one area - business inventories. Private businesses increased inventories $56.0 billion in the fourth quarter, following a decrease of $2.0 billion in the third. Of course that sounds wonderful, but it can also be a double-edged sword. While it shows that businesses are optimistic about the health of the economy and feel confident they can sell their goods, if sales fall short of expectations, it can create a financial burden for them in the future. Only time will tell how this works out.

Another important point is that "real final sales of domestic product" - GDP less the change in private inventories - only increased 0.8% in the fourth quarter, compared with an increase of 3.2% in the third. So while GDP as a whole picked up in the fourth quarter, real sales slowed down. This is likely one of the reasons why the Federal Reserve lowered its outlook for the economy in 2012, announcing that they expect it to grow between 2.2% and 2.7% this year.[4]

What's next? The week ahead is a heavy one for economic data that includes personal income, consumer confidence, auto sales, manufacturing, construction, and the key nonfarm payrolls figure at the end of the week. In addition to the economic news, nearly 100 companies in the S&P 500 will report quarterly earnings.

Why are all these numbers important? For months, U.S. economic indicators have taken a back seat to headlines out of Europe, but as confidence grows that the Eurozone will survive, focus should gradually shift back to the health of the U.S. economy. We'll be watching this data and sharing our thoughts with you along the way.

ECONOMIC CALENDAR:

Monday - Personal Income and Outlays

Tuesday - Employment Cost Index, Redbook, S&P Case-Shiller HPI, Chicago PMI, Consumer Confidence

Wednesday - Motor Vehicle Sales, ADP Employment Report, ISM Manufacturing Index, Construction Spending, EIA Petroleum Status Report

Thursday - Jobless Claims, Productivity and Costs

Friday - Monster Employment Index, Employment Situation, Factory Orders, ISM Non-Manufacturing Index

|

|

|

|

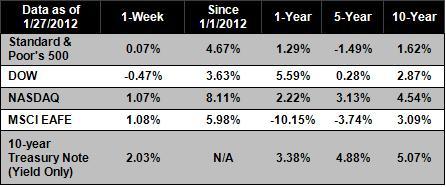

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not available. |

|

Headlines:

On Friday, the Obama administration said it was expanding eligibility for its Home Affordable Modification Program, known as HAMP, to borrowers with higher debt loads and tripling the incentives it pays banks that reduce principal on loans. While the new changes could greatly expand the number of homeowners that receive help from HAMP, subsidizing real estate investors with taxpayer money could also create controversy.[5]

The leaders of Denmark and Finland said China is "willing" to contribute to International Monetary Fund efforts to bail out debt-ridden southern Europe, within limits. Speaking at the World Economic Forum annual meeting in Davos, Helle Thorning-Schmidt, prime minister of Denmark, and Finnish Prime Minister Jyrki Tapani Katainen stressed the need for China and the European Union to cooperate on some form of bailout from the IMF.[6]

A U.N. nuclear team arrived in Tehran, Iran early Sunday for a mission expected to focus on Iran's alleged attempt to develop nuclear weapons.[7]

Facebook may finally be ready to go public. The company is planning to file IPO registration papers with the Securities and Exchange Commission next Wednesday, according to the Wall Street Journal. Few additional details are available so far.[8]

|

|

|

|

"In the end, it's not the years in your life that count. It's the life in your years."

- Abraham Lincoln

|

|

|

Baby Tiramisu

If you're a fan of the classic Italian dessert Tiramisu, try this quick, lower-calorie variation the next time you need a dessert in a hurry. From Eating Well.

Ingredients:

1/2 cup nonfat ricotta cheese, (4 ounces)

2 tablespoons confectioners' sugar

1/2 teaspoon vanilla extract

1/8 teaspoon ground cinnamon

12 ladyfingers, (about 1 3/4 ounces)

4 tablespoons brewed espresso, or strong coffee, divided

2 tablespoons bittersweet chocolate chips, melted (see tip)

Directions:

1) Combine ricotta, sugar, vanilla, and cinnamon in a medium bowl.

2) Place 6 ladyfingers in a 9-by-5-inch (or similar size) loaf pan. Drizzle with 2 tablespoons espresso (or coffee). Spread the ricotta mixture over the ladyfingers. Place another layer of ladyfingers over the ricotta and drizzle with the remaining 2 tablespoons espresso (or coffee). Drizzle with melted chocolate. Refrigerate until the chocolate is set, about 30 minutes.

Tip: To melt chocolate, microwave on Medium for 1 minute. Stir, then continue microwaving on Medium in 20-second intervals until melted, stirring after each interval. Or place in the top of a double boiler over hot, but not boiling, water. Stir until melted.

|

|

|

Maintain Your Balance

Maintaining your balance is important in all sports. In golf, it ensures a solid shot. Here are two ways to improve your balance, which in turn will improve your contact and control, leading to lower scores.

1) Limit the amount of force you use when hitting the ball. Too many golfers think they need to use all their strength to hit the ball and this causes control problems. The majority of golf professionals will tell you they only use about 75% of their strength when hitting and/or swinging at the ball.

In order to practice this, simply go to the driving range and try to develop the feeling you are only hitting and/or swinging at the ball with 75% of your power by:

a. Hitting balls with a 3/4 back swing

b. Hitting balls shorter distances, say 25% shorter.

2) Wear the slickest soled regular street shoes or boots possible whenever you practice. (No spikes or golf shoes) It's amazing how fast you learn to swing within yourself when not doing so can cause you to lose your balance.

|

|

|

Sleep with Your Curtains Open

Going to bed with your curtains open or blinds cracked will allow the light to wake you naturally and may help you feel awake sooner.

|

Get Houseplants

Houseplants have more advantages for your home than just looking pretty. They can actually filter the air in your house and rid it of pollutants. Keep one houseplant per every 10 square yards to help keep the air clean in that area. If you mix night synthesizing plants (like orchids) with regular plants, your plants will work around the clock to filter your air.[9]

|

|

Share The Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] http://blogs.barrons.com/stockstowatchtoday/2012/01/27/another-big-week-puts-dow-in-strong-position/

[2] http://money.cnn.com/2012/01/29/markets/sunday_lookahead/index.htm?iid=Lead

[3] http://www.bea.gov/newsreleases/national/gdp/gdpnewsrelease.htm

[4] http://money.cnn.com/2012/01/25/news/economy/fed_interest_rates/index.htm?iid=EL

[5] http://money.cnn.com/2012/01/27/real_estate/hamp_program/index.htm?iid=HP_LN

[6] http://www.forbes.com/sites/kenrapoza/2012/01/28/china-closer-to-bailing-out-europe/

[7] http://www.foxnews.com/world/2012/01/28/un-nuclear-team-arrives-in-iran/

[8] http://finance.fortune.cnn.com/2012/01/27/report-facebook-ipo-filing-next-week/?iid=HP_MPM

[9] http://greenliving.lifetips.com/

|

|

|