|

The Final Stretch

Weekly Update - December 27, 2011

|

|

|

In This Issue

|

|

|

|

|

It looks like the stock market got a shot of holiday cheer as major U.S. indexes logged better than 3% gains last week. The Dow is now up 6% for the year, and the S&P 500 is back in positive territory. While many were calling for a so-called "Santa Claus rally," others were concerned that fears surrounding Europe's situation would continue to be a drag on the markets.[1] Last week however, Europe's troubles were of little account as stocks rallied to their third weekly gain in four after Congress approved an extension of the payroll tax cut to ensure taxes won't increase on January 1.[2] In addition, tentative signs of improvement seen in government reports on personal spending, income, and housing, all helped boost equity markets last week.[3]

What's in store for the week ahead? With Wall Street closed for business on Monday, a number of major players on vacation, and few economic reports expected, trading volume will probably be light. Even so, there is something interesting we would like to share with you. According to the Stock Trader's Almanac, the five trading days before January 1, and the two trading days that follow, typically generate abnormally high returns, yielding positive returns in 31 of the last 41 holiday seasons.[4] Of course, past performance cannot be relied upon to predict future results, and other factors must be considered, but the trend is worth noting.

While many investors have already closed their books for the year, we head into the final stretch eager to end 2011 in the black. Regardless of what happens during the final four trading days of the year though, we encourage you to take comfort in knowing that we will keep an eye on things for you. Again we urge you to relax and enjoy some well-deserved time with your family and friends.

Stay tuned for our annual recap due next week!

ECONOMIC CALENDAR:

Monday - U.S. Holiday Observed - Christmas Day

Tuesday - Consumer Confidence, S&P Case-Shiller HPI

Wednesday - EIA Petroleum Status Report

Thursday - Jobless Claims, Chicago PMI, Pending Home Sales

|

|

|

|

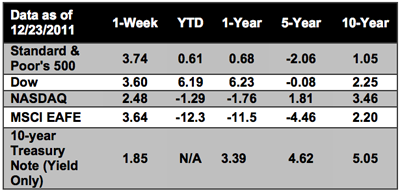

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized.

Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not available |

|

Headlines

Gasoline rose to a six-week high after a U.S. government report that durable goods orders increased last month signaled an improving economy. Prices advanced 8% this week, capping the biggest weekly gain since March.[5] While some workers are worried about smaller paychecks next year, more than 1.4 million low-income earners will see their wages go up on New Year's Day. Minimum wage rates in Arizona, Colorado, Florida, Montana, Ohio, Oregon, Vermont, and Washington will rise between 28 and 37 cents per hour on January 1, thanks to state laws requiring that minimum wage keeps pace with inflation.[6] The total value of Americans' retirement assets stood at $17 trillion at the end of September - a drop of 7.5% from the record high of $18.4 trillion recorded on June 30, 2011.[7] Shoppers will return $46.28 billion in holiday merchandise, a record high, according to the National Retail Federation. At brick-and-mortar stores, holiday returns can boost business because it gets shoppers into the store once more. "If people return something, there's a 70% chance they will buy something else," said Britt Beemer, retail analyst and chairman of America's Research Group.[8] |

|

|

|

"The future belongs to those who believe in the beauty of their dreams." - Eleanor Roosevelt

|

Cheese and Herb Mini Sweet Peppers   These colorful stuffed peppers will brighten up your appetizer tray. Source: Better Homes and Gardens Ingredients:

30 red, yellow, and/or orange mini sweet peppers (about 12 oz. total)

18 ounces semi-soft goat cheese (chevre)

1/4 cup snipped fresh chives, tarragon, basil, or thyme

Fresh basil leaves

Directions:

1) Preheat oven to 350 degree F. Leaving the stem intact, cut a slit along the top of each pepper. Remove the seeds; set aside. In a small bowl combine goat cheese and snipped herbs. Spoon cheese mixture into prepared pepper. Arrange filled peppers close together on a baking sheet. Bake for 8 to 10 minutes or until cheese is heated through and peppers are crisp-tender.

2) Use tongs to arrange warm peppers on a serving dish, stacking peppers into a pyramid shape. Garnish with fresh basil leaves. Makes 30 servings.

|

|

|

Mastering Steep Downhill Putts It can be difficult to execute a tiny, soft putting stroke. When faced with a relatively steep, downhill putt, use the toe end of the putter head to strike the ball. This will deaden the impact and greatly reduce the velocity of the ball leaving the clubface. This, of course, will be less effective with some extreme perimeter weighted putters.

|

Wear a Pedometer New research suggests routinely wearing a pedometer encourages people to walk about an extra mile each day, lose weight, and lower their blood pressure. Aim for at least 30 minutes of brisk walking and a total of 10,000 steps per day.[9]

|

Give up Paper Towels No matter how you look at it, paper towels create waste. During your next trip to the grocery store, buy some reusable microfiber towels, which grip dirt and dust like a magnet, even when they get wet. When you are finished with them, toss the towels in the wash and reuse them again and again. They are even great for countertops and mirrors. When you absolutely have to use disposable towels, look for recycled products. If every household in the United States replaced just one roll of fiber paper towels (70 sheets) with 100 % recycled ones, we could save 544,000 trees.[10]

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] http://www.marketwatch.com/story/us-stocks-look-to-keep-holiday-rise-alive-2011-12-24

[2] http://money.cnn.com/2011/12/23/markets/markets_newyork/index.htm?iid=HP_LN

[3] http://www.bloomberg.com/news/2011-12-23/u-s-november-personal-income-and-spending-text-.html

[4] http://www.stocktradersalmanac.com/

[5] http://www.bloomberg.com/news/2011-12-23/oil-has-biggest-weekly-gain-in-two-months-commodities-at-close.html

[6] http://money.cnn.com/2011/12/23/news/economy/minimum_wage_increases/index.htm?iid=HP_LN

[7] http://www.dailyfinance.com/2011/12/22/u-s-retirement-assets-declined-by-1-4-trillion/

[8] http://money.cnn.com/2011/12/21/pf/holiday_money_returns/index.htm?iid=HP_LN

[9] http://www.boston.com/lifestyle/food/gallery/healthtips?pg=2

[10] http://www.thedailygreen.com/environmental-news/latest/green-new-years-resolutions-10109

|

|

|