|

Up, Down, Up... What Now?

Weekly Update - October 31, 2011

|

|

|

In This Issue

|

|

|

|

|

In its longest winning streak since January, the S&P 500 has rallied for four straight weeks, adding 14% in October alone. According to a Bloomberg article published on Saturday, this puts the index on track for its biggest monthly gain since 1974! [1] The Dow Jones Industrial Average similarly scored an 11% gain this month and just logged its fifth week of gains. [2]

In comparison with the near 20% decline we saw during July and August, it certainly seems like the stock market has a split personality. What's causing all these ups and downs? While many factors are at play, the market moved downward over the summer based primarily on two assumptions:

1) That the U.S. was entering another recession.

2) That the Eurozone financial system was on the verge of collapse.

When neither of these things occurred, investors became uncertain - waiting and watching every headline for signs of what would come next. This led to the heightened levels of volatility we experienced in September.

What led to the rally? Frankly, the crisis atmosphere has died down. European Union leaders announced a "deal" on debt crisis measures early Thursday that aims to resolve issues in Greece, instability in the banking sector, and their sorely deficient bailout fund. [3] Equities also climbed after the government announced that the U.S. economy expanded 2.5% in the third quarter; its fastest pace in a year. [4]

So are we out of the woods? Not completely. We are wise to temper our expectations for the moment, as many details about Europe's plan and how it will be implemented still remain unsettled. Other factors are also worth keeping an eye on. Earnings season is still under way, and 100 more companies are set to report this week. The nation's highly anticipated jobs report, due Friday, will be in focus. And as the Federal Reserve concludes its two-day meeting on Wednesday, investors will be watching for signals regarding whether a third round of quantitative easing, or QE3 is on the way.

As always, we pledge to monitor the relevant issues, and to keep you informed about any factors that have the potential to shape your financial future.

ECONOMIC CALENDAR:

Monday - Chicago PMI

Tuesday - Motor Vehicle Sales, ISM Manufacturing Index, Construction Spending

Wednesday - ADP Employment Report, FOMC Meeting Announcement

Thursday - Jobless Claims, Productivity and Costs, ECB Announcement, Factory Orders, ISM Non-Manufacturing Index,

Friday - Employment Situation

|

|

|

|

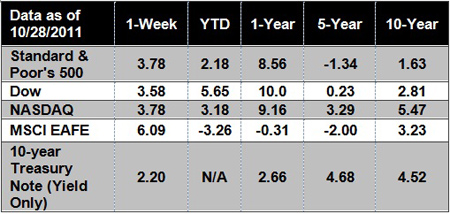

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not available. |

|

Headlines

Treasury 30-year bonds dropped for a fifth week, the longest skid in more than two years, as a deal reached by European leaders to tame the region's debt crisis fueled appetite for higher-yielding assets. [5]

Europe's appeal for Chinese help has come under fierce criticism for potentially weakening their negotiating position in political and economic disputes with Beijing. On Sunday, Eurogroup chairman Jean-Claude Juncker said it made sense for China to invest its surplus in Europe to help the region overcome its debt crisis, but this would not involve political concessions. [6]

As stimulus funds dry up, cash-strapped states are facing steep rises in Medicaid spending, forcing them to slash services and trim costs. States will have to spend another 28.7% on Medicaid this fiscal year - by far the largest increase ever, according to new data released by the Kaiser Family Foundation Thursday. [7]

Sales of new homes, a benchmark indicator both for the housing market and the overall economy, rose slightly but remained slow in September. Sales reached a 313,000 annual rate in September, 5.7% more sales than the revised estimate for August, according to a monthly report from the Census Bureau released Wednesday. But sales were off 0.9% compared with 12 months earlier. [8]

|

|

|

"Energy and persistence conquer all things."

- Benjamin Franklin

|

|

|

Pumpkin Spice Whoopies   Cake mix and canned pumpkin make these little cakes, which have a light marshmallow filling. From Better Homes and Gardens. Cake mix and canned pumpkin make these little cakes, which have a light marshmallow filling. From Better Homes and Gardens.

Total Time: 50 mins.

Servings: 15 whoopies

Ingredients:

1 cup canned pumpkin

1/3 cup butter, softened

1 package 2-layer-size spice cake mix

2 eggs

1/2 cup milk

1 recipe Marshmallow-Spice Filling (see below)

Directions:

1) Preheat oven to 375 degrees F. Line a cookie sheet with parchment paper or foil (grease foil, if using). In a large mixing bowl, beat pumpkin and butter with an electric mixer on medium speed until smooth. Add cake mix, eggs, and milk; beat on low speed until combined, and then on medium speed for 1 minute.

2) By the heaping tablespoon, drop mounds of batter 3 inches apart on cookie sheet; keep remaining batter chilled. Bake 15 minutes or until set and lightly browned around edges. Carefully remove from parchment or foil; cool on wire rack. Repeat with remaining batter, lining cooled cookie sheets each time with new parchment or foil. If desired, place cookies in a covered storage container with waxed paper between layers to prevent sticking. Store cookies at room temperature for 24 hours. Prepare Marshmallow-Spice Filling up to 2 hours before serving. Spread about 2-1/2 tablespoons filling on flat side of one cookie; top with a second cookie. Repeat. Serve immediately or cover and chill up to 2 hours.

Marshmallow-Spice Filling:

Up to 2 hours before serving, beat together 1/2 cup softened butter and one 8-ounce package softened cream cheese until smooth. Add 2 cups sifted powdered sugar, 1/2 of a 7-ounce jar marshmallow cream, 1 teaspoon vanilla, and 1/2 teaspoon each ground cinnamon and nutmeg. Beat until well combined.

|

|

|

Don't Over-Analyze Your GameIf you're like most golfers, hitting a poor shot starts you analyzing the mechanics of your swing. This is the worst thing you can do because it activates left brain thinking and makes it even harder to perform well.

Like the old adage, paralysis by analysis, you start to think about too many details. Within moments you may even begin to question every part of your swing. The result is often more poor shots.

In truth, many poor shots are due to mental errors that lead to physical errors. Try to limit your thought process. Relax and let your swing work... don't work your swing.

|

|

|

Stretch it Out

One of the biggest problems we have as a society is overconsumption. We buy, consume, and throw out a huge amount of stuff. The habit to develop is to see if you can do without something instead of buying it right away. When you feel the urge to buy something, hesitate. Put it on a 30-day list, and don't buy it until 30 days have elapsed since you put it on the list. Instead, while you're waiting, think about whether it's truly necessary. This is good financial advice too!

|

|

Use Less Stuff

One of the biggest problems we have as a society is overconsumption. We buy, consume, and throw out a huge amount of stuff. The habit to develop is to see if you can do without something instead of buying it right away. When you feel the urge to buy something, hesitate. Put it on a 30-day list, and don't buy it until 30 days have elapsed since you put it on the list. Instead, while you're waiting, think about whether it's truly necessary. This is good financial advice too!

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues.If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced! Please share this market update with family, friends, or colleagues.If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

|

|

|