|

Weekly Update - October 3, 2011

Quarterly Review - 3Q 2011

|

|

|

In This Issue

|

|

|

|

|

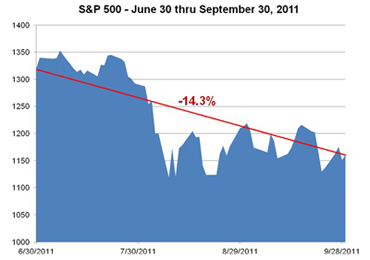

From the debt ceiling debate, to S&P's downgrade of the United State's prized bond rating, to ongoing challenges in the Eurozone, and wild swings in the stock market, the third-quarter has taken investors for quite a ride!

Source: Yahoo! Finance. The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. Past performance does not guarantee future results. You cannot invest directly in an index.

July - After a volatile first half that eventually ended U.S. stocks in positive territory, the debt ceiling debate quickly took center stage. As policymakers debated ways to cut spending and raise the nation's borrowing limit, stock markets faltered.

August - Following an eleventh hour debt ceiling compromise, Italy rose to the forefront of debt problems in Europe and anemic economic news pushed investor sentiment downward. As fear dominated the markets, major indexes erased their gains for the year during the first week of the month. Hitting especially close to home, S&P downgraded the nation's bond rating from AAA to AA+ on August 5th.[1]

September - After a brisk market rally early in the month, European debt woes dominated investor sentiment once again. By the middle of the month, tables turned dramatically as many asset classes experienced their worst weeks in years. Even gold faced its largest monthly fall since October 2008.[2] In conjunction with persistent concerns about European debt and a weakening U.S. economy, the Fed's Open Market Committee (FOMC) launched "Operation Twist" on September 21st, leading to further selloffs.

In reading the quick summary above, it's easy to see why investors could be forgiven for feeling somewhat dazed and confused. The last three months have been rough. The stream of bad news coupled with occasional flickers of optimism led to one of the most volatile periods ever for stocks. The Dow moved more than 200 points on 18 separate times during the quarter, swinging by more than 400 points on four consecutive days in August alone.[3] When you couple the nauseating stock market performance with anxiety about the European sovereign-debt crisis and headlines forecasting a double-dip recession, it's no wonder people are running scared.

Now What?

While past performance doesn't guarantee future results, some investors are taking comfort in the fact that the third-quarter, historically, has been the worst of the year, and the fourth-quarter is typically the best.[4] And while some are finding it difficult to be optimistic, others are turning their sights to corporate earnings for a barometer of where the economy is headed. Companies will start releasing their third-quarter reports in coming weeks.

Interestingly, the third-quarter edition of the Investment Manager Outlook (a survey of investment managers conducted by Russell Investment Group and released 9/29) found that 78% of managers do not expect the U.S. to slide into a double-dip recession. "Strong corporate balance sheets and high corporate profits should ensure that the United States avoids a new recession. However, Russell also believes, along with the majority of the managers surveyed, that we will see a slow-growth trend for the next several years, as well as ongoing market volatility," the report stated. We agree with this assessment.[5]

As long as confidence in the global economy and government policymakers remains shaky, markets are likely to be volatile. Even so, we still believe that fundamentals are strong in many areas, and we know that successful investing is a long-term project undertaken with risk and uncertainty. Equity markets do not move in a straight line, and neither do economic recoveries. Despite being painful, volatile periods like this historically run their course and then come to an end.

We understand that fear can be contagious, but we urge you not to let yourself be overtaken by it. While many types of investments are currently experiencing a difficult period, we believe that those who remain committed to their long-term investment plan will be rewarded over time.

If you have any questions or would like any guidance, please don't hesitate to reach out to us. We consider it a great privilege to help you protect what you've worked hard to earn.

ECONOMIC CALENDAR:

Monday - ISM Mfg Index, Construction Spending

Tuesday - Motor Vehicle Sales, Factory Orders

Wednesday -ADP Employment Report, ISM Non-Mfg Index, EIA Petroleum Status Report

Thursday - BOE Announcement, ECB Announcement, Jobless Claims

Friday - Employment Situation

|

|

|

|

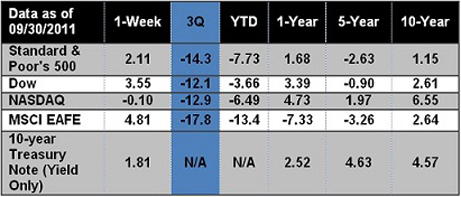

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not available. |

|

Headlines

According to a Bloomberg Gallup Poll, 63 % of global investors approve of President Barack Obama's plan to tax people with annual incomes of $1 million or more. The so-called Buffett rule is a nod to investor Warren Buffett and his New York Times op-ed piece calling on the wealthy to pay their fair share.[6]

Consumers made less money and spent less money in August, according to a report released Friday. The Commerce Department said personal income declined by 0.1% in August. Consumer spending rose just 0.2%, and was flat when adjusted for inflation.[7]

An examination of credit-rating agencies by the Securities and Exchange Commission staff found repeated instances of the companies failing to follow their own procedures or adequately manage conflicts of interest, according to an S.E.C. staff report issued Friday. The examinations were mandated in the Dodd-Frank regulatory law passed last year after numerous investigations into the causes of the financial crisis. Several of those inquiries found that the rating agencies issued inaccurate reports, failed to report or manage conflicts of interest, and put generating revenue ahead of rigorous financial analysis.[8]

Eurozone inflation has surged unexpectedly to a three-year high of 3%, adding to the dilemma facing the European Central Bank as an escalating debt crisis pushes the region towards recession.[9]

|

|

|

"What matters is not the idea a man holds, but the depth at which he holds it."

- Ezra Pound

|

|

|

Pinwheel Pear Tart

Pears are arranged in a pretty pinwheel pattern on top of the pie crust for this low-fat dessert. Pears are arranged in a pretty pinwheel pattern on top of the pie crust for this low-fat dessert.Ingredients: 1/4 cup sugar 1 tablespoon all-purpose flour 1 teaspoon finely-shredded lemon peel 1/4 teaspoon nutmeg 3 pears, cored and sliced 1 rolled, refrigerated unbaked pie crust Milk Coarse or granulated sugar Dried cherry Directions: 1) Heat oven to 375 degrees F. Line a baking sheet with parchment paper; set aside. 2) In a large bowl, stir together the sugar, flour, lemon peel and nutmeg. Add pears and toss to coat. 3) Unroll the piecrust on the prepared baking sheet. Arrange pears in a pinwheel shape in the center of the crust, leaving a 1-1/2 inch border of dough exposed. Moving in a clockwise direction, fold the dough toward the center, pleating as necessary. When you're finished, the opening with the pears in the middle should measure about 5 inches wide. Brush the pastry with milk and sprinkle with coarse sugar. 4) Bake tart for about 40 minutes, or until pastry is golden and pears are tender. Place the dried cherry in the middle of the pinwheel. Serve warm or at room temperature.

|

|

|

Grip Check

After you have hit the ball, can you bring your club back down from your follow-through position and address another ball without readjusting your grip? If you can't hit the next ball without resetting your hands, then your grip needs improvement. Ben Hogan could hit dozens of successful shots in a row without ever readjusting his fingers. A good grip ideally provides a constant and stable connection to the golf club. Genuine accuracy and consistency are not possible with a fluid, flimsy grip.

|

Boost Your DefensesAn Archives of Internal Medicine review reports that 400 IU of vitamin D a day reduces your risk of an early death by 7 %.

|

Greener (and Cheaper) Fuel BillsDuring the cooler months of the year, lower your thermostat to 55 degrees F if you'll be gone for two days or more. Whenever you can lower your thermostat, you'll also save a little on the operation of the refrigerator and freezer, which won't need to work so hard to maintain their cool.

|

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. The DJIA was invented by Charles Dow back in 1896. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia. The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market. Google Finance is the source for any reference to the performance of an index between two specific periods. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. You cannot invest directly in an index. Consult your financial professional before making any investment decision. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information. By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site. [1] http://www.standardandpoors.com/ratings/articles/en/us/?assetID=1245316529563

[2] http://www.marketwatch.com/story/gold-rises-to-regain-safe-haven-shine-2011-09-30?link=MW_latest_news

[3] http://online.wsj.com/article/SB10001424052970204226204576603202392429600.html?mod=WSJ_Markets_LeadStory

[4] http://online.wsj.com/article/SB10001424052970204226204576603202392429600.html?mod=WSJ_Markets_LeadStory

[5] http://www.russell.com/US/documents/investment_manager_outlook_Q311.pdf

[6] http://www.bloomberg.com/news/2011-09-30/obama-s-buffett-rule-backed-by-63-investors.html

[7] http://www.forbes.com/2011/09/30/consumer-income-spending-weak-in-august-marketnewsvideo.html

[8] http://www.nytimes.com/2011/10/01/business/sec-finds-problems-at-credit-rating-agencies.html

[9] http://www.ft.com/intl/cms/s/0/2a5a15fa-eb48-11e0-9a41-00144feab49a.html#axzz1ZStm9eP4

|

|

|