|

Weekly Market Update

Week of June 27, 2011 |

|

|

The Markets:

With the Dow logging its seventh drop in eight weeks and the S&P off 7% from its three-year high at the end of April[1], many people are wondering if the markets have hit a speed bump or a roadblock. Combine weak stock performance with lukewarm economic readings and it's easy to understand Fed chairmen Ben Bernanke's comments last week: "We don't have a precise read on why this slower pace of growth is persisting...some of these headwinds may be stronger and more persistent than we thought."[2]

The expressions: "We don't have a precise read" and "than we thought" are interesting. They clearly demonstrate that even the "experts" do not have all the answers, and that they must change their viewpoint from time to time. Along these lines, the Fed issued new economic projections that call for slower growth, higher unemployment and higher inflation in 2011 and 2012 than in its previous forecast. At a press conference Wednesday afternoon, Bernanke referred to the new forecast as a significant revision. At the same time, the Fed still downplayed the chance of another recession, saying that it "expects the pace of recovery to pick up over coming quarters and the unemployment rate to resume its gradual decline."

Why do we point this out? This illustrates why we do not try to predict the future of the stock market or the economy. Doing so consistently and accurately is simply not possible. Whether we are facing a temporary slowdown or one that will last much longer is still open to interpretation and there are vocal proponents on both sides of the issue.

Since there is no way for us to predict the future, our goal is to help you commit to a sound investment plan based on your personal risk tolerance, goals and time horizon. Doing this requires that we take a long-term approach, not a short-term one. If we lose sight of the long-term and think we can time the market by exiting at the peak and re-entering at the trough, we open ourselves up for big mistakes. To quote legendary investor Warren Buffet: "Someone is sitting in the shade today because someone planted a tree a long time ago."

ECONOMIC CALENDAR:

Monday - Personal Income and Outlays

Tuesday - S&P Case-Shiller-HPI, Consumer Confidence

Wednesday - Pending Homes Sales Index, EIA Petroleum Status Report

Thursday - Jobless Claims, Chicago PMI

Friday - Motor Vehicle Sales, Consumer Sentiment, ISM Mfg Index, Construction Spending

|

|

Performance

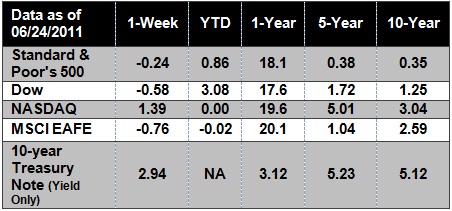

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. NA means not available. |

|

Headlines:

Irving Picard, the trustee liquidating Bernard Madoff's firm, revised a claim against JPMorgan Chase & Co. requesting a minimum payment of $19 billion in damages for its role in the fraud. The new amount represents Picard's latest estimate of principal lost by all Madoff investors by the time the Ponzi scheme collapsed in December 2008.[3]

On Thursday, President Obama decided to release 30 million barrels of oil from the nation's strategic reserve, which will put 60 million barrels of fuel on the market over the next 30 days. Done in conjunction with other developed nations including Saudi Arabia, the move is not only an attempt to salvage Libya's lost supply and meet rising demand in Asia and the Middle East, but is also seen as an attempt to lower fuel prices.[4]

New-home sales fell 2.1% in May, the Commerce Department reported Thursday. The numbers showed a seasonally adjusted annual rate of 319,000 homes, far below the 700,000 homes per year that economists say must be sold to sustain a healthy housing market.[5]

An EU-IMF team has approved Greece's new five-year austerity plan after committing to an additional round of tax rises and spending cuts.[6]

|

|

|

| "The only thing worse than being blind is having sight but no vision." - Helen Keller |

|

|

Poached Chicken with Apples   From Better Homes and GardensTarragon and apple flavor this heart-healthy chicken recipe. From Better Homes and GardensTarragon and apple flavor this heart-healthy chicken recipe.

Servings: 4 servings

Total: 20 mins

Ingredients:

1 /2 cup apple juice or apple cider

1 /2 teaspoon instant chicken bouillon granules

1 clove garlic, minced

1/4 teaspoon dried tarragon, crushed

Dash pepper

4 small (12 oz. total) boneless, skinless chicken breast halves

1 medium apple, cored and thinly sliced

1/4 cup sliced green onions

1 tablespoon water

1 ½ teaspoons cornstarch

Directions:

1. In a 10-inch skillet combine apple juice, bouillon granules, garlic, tarragon, and pepper. Bring to boiling. Add chicken breasts; reduce heat. Cover and simmer for 7 minutes.

2. Turn chicken over; add apple slices and green onions. Cover and simmer 4 to 5 minutes more or until chicken is tender and no longer pink.

3. With a slotted spoon remove chicken and apples; keep warm. Reserve cooking liquid.

4. In a small bowl stir together the water and cornstarch. Stir into liquid in skillet. Cook and stir until thickened and bubbly. Cook and stir for 2 minutes more. Spoon over chicken and apples. Makes 4 servings.

|

|

|

You know that annoying putt that has the ball resting right up against the cut on a green? You can't hit a wedge, and if you try to use your putter, you'll either grab the grass, or top the ball and bounce it halfway to the hole?

Here may be a solution for you: Take out your three wood. Why does this work? A putter or an iron has a thin flange on the bottom of the club that causes it to grab, throwing the momentum and direction of the club off target. The three wood on the other hand, has a long, flat bottom that bounces into the rough and stays true.

To execute this shot effectively, take your regular putting stance and putt the ball as you would normally, but choke up on your grip to where it meets the shaft. After a few tries on the practice green, you'll be putting out of this trouble spot with much more consistency.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced! Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] http://www.bloomberg.com/news/2011-06-24/asian-stocks-rise-treasuries-drop-on-eu-support-for-greece-oil-rebounds.html

[2] http://money.cnn.com/2011/06/22/news/economy/federal_reserve_statement/index.htm?iid=EL

[3] http://www.bloomberg.com/news/2011-06-24/madoff-trustee-demands-19-billion-in-damages-from-jpmorgan-1-.html

[4] http://money.cnn.com/2011/06/24/news/international/oil_obama/index.htm

[5] http://www.msnbc.msn.com/id/43509178/ns/business-personal_finance/

[6] http://www.msnbc.msn.com/id/43514233/ns/business-world_business/

|

|

|