|

Weekly Market Update

SPECIAL EDITION:

Annual Report on the financial health of Medicare and Social Security |

|

|

The Markets:

Each year the Trustees of the Social Security and Medicare trust funds report on the current and projected financial status of the two programs. This year's report was released on Friday, and we thought you might like to know about the key findings.

According to government predictions, Medicare's largest trust fund will run out of money in 2024, five years earlier than projected last year. The program's faulty finances are, in part, a symptom of the sluggish economy. Higher projected health-care costs and lower payroll taxes are being blamed for the shortfall. Pressure will doubtless intensify in Washington as a bipartisan effort is made to shore up the 46-year-old healthcare plan that covers more than 47 million elderly and disabled Americans.

Regarding Social Security, the report showed that expenditures exceeded the program's non-interest income in 2010 for the first time since 1983, and that the program faces a $46 billion deficit for 2011. The projected point at which the combined Trust Funds will be exhausted comes in 2036 - one year sooner than projected last year. At that time, there will be sufficient income to pay only 77% of scheduled benefits.

The report concluded by saying that, "projected long-run program costs for both Medicare and Social Security are not sustainable under currently scheduled financing, and will require legislative corrections if disruptive consequences for beneficiaries and taxpayers are to be avoided. The financial challenges facing Social Security and Medicare should be addressed soon. If action is taken sooner rather than later, more options and more time will be available to phase in changes so that those affected can adequately prepare."[1]

While it is impossible for us to address all the nuances of Medicare and Social Security in this brief communication, let alone all the proposed solutions, we wish to draw your attention to the two italicized words at the end of the previous paragraph: adequately prepare. Of all the information we found in the eye-crossing 244 page report (you can read it here: http://www.socialsecurity.gov/OACT/TR/2011/tr2011.pdf), these two words strike us as most significant.

No one can predict with certainty what the future of Medicare and Social Security will be. Most people agree that reforms are needed and that changes will be made, but what those changes will be and how they will affect beneficiaries, remains to be seen. What we do know, is that we must adequately prepare in every way possible.

Adequate preparation requires a number of things. It involves taking your life expectancy into consideration when deciding what withdrawal rates are sustainable in your portfolio. It includes choosing an asset allocation that is likely to keep pace with inflating healthcare costs. It means considering whether long-term-care or other insurance coverage is right for you. It dictates determining the best time to start collecting benefits. Many important decisions must be made when preparing for the future and it is unwise to rely too heavily on government programs for support. Although making the right decisions can be challenging, we are here to guide you through the process.

If you have questions about how anything in this report could affect you or your loved ones, please don't hesitate to reach out to us. We are here to serve you.

ECONOMIC CALENDAR:

Monday - Empire State Manufacturing Survey, Treasury International Capital, Housing Market Index

Tuesday - Housing Starts, Redbook, Industrial Production

Wednesday - FOMC Minutes

Thursday - Jobless Claims, Existing Home Sales, Philadelphia Fed Survey, Leading Indicators

|

|

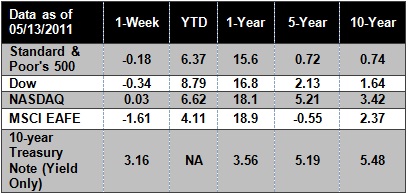

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. NA means not available. |

|

Headlines:

The average 401(k) balance rose to $74,900 at the end of March, Fidelity said, the highest since the firm began tracking the data in 1998 and a 12% jump from a year ago. Nearly 10% of participants raised their contribution rate during the first quarter, also a record.[2]

Consumers continued to feel the pinch at grocery stores and gasoline stations in April as higher prices pushed up a widely used index of inflation to the fastest 12-month pace since the later part of 2008, according to government figures released Friday. The Labor Department said the consumer price index, the most widely used measure of inflation, was up 0.4 percent in April from March, and up 3.2 % from a year earlier.[3] US oil drilling activity slipped this week, down by 6 rotary rigs compared with a year ago, Baker Hughes Inc., an oilfield services company, reported. Land operations had the biggest loss, down 7 units, and inland waters activity decreased by 2 rigs. In what has become an unusual situation, offshore drilling registered the only increases, up by 3 rigs to a total of 33 rigs drilling in US waters.[4]

The euro fell against all but two of its 16 most-traded counterparts, reaching a six-week low against the dollar, on concern Greece may have to restructure its debt and the nation's problems may spread in the region.[5]

|

|

|

The strongest oak of the forest is not the one that is protected from the storm and hidden

from the sun. It's the one that stands in the open where it is compelled to struggle for its existence against the winds and rains and the scorching sun. - Napoleon Hill |

|

|

Garden Risotto   From: Better Homes and GardensSlow cooking, with stirring and watching, ensures success in producing the creamy results for this classic Italian side dish. From: Better Homes and GardensSlow cooking, with stirring and watching, ensures success in producing the creamy results for this classic Italian side dish.

Total Time: 30 mins

Ingredients:

1 cup arborio rice or medium-grain white rice

2 tablespoons olive or cooking oil

2 cloves garlic, minced

3-1/4 to 3-1/2 cups reduced-sodium chicken broth or vegetable broth

1 cup shredded carrot

1/4 cup thinly sliced green onion

¼ to ½ cup shredded Parmesan or Romano cheese

2 tablespoons snipped fresh basil

Thin carrot curls (optional)

Basil leaves (optional)

Directions:

1. In a large saucepan cook and stir uncooked rice in hot oil over medium heat for 5 minutes. Add garlic; cook and stir 1 minute more.

2. Meanwhile, in a medium saucepan, bring broth to boiling; reduce heat and simmer.

3. Slowly add 1 cup of the broth to rice mixture (be careful of spattering, because broth will steam up when it hits the hot pan); stir constantly. Cook and stir over medium heat until broth is absorbed (about 5 minutes).

4. Add 2 more cups of broth, 1/2 cup at a time, stirring constantly until broth is absorbed. Stir in remaining broth, shredded carrot, and green onion. Cook and stir until rice is creamy and just tender. Stir in cheese and snipped basil.

5. If desired, garnish with the carrot curls and basil leaves. Makes 4 side-dish servings.

|

|

|

Keep Your Emotions in Check

To get yourself back on track after a poor shot, ask yourself these four questions: - How was my tempo or rhythm?

- Was I fully committed to the club, target, and type of shot?

- How well did I visualize the shot in advance?

- How did that shot "feel"?

By running through this checklist to determine the reason behind a bad shot, you'll keep your tension level low and your emotions in check.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced! Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] All information in this commentary is taken from: http://www.socialsecurity.gov/OACT/TR/2011/tr2011.pdf

[2] http://online.wsj.com/article/SB10001424052748703730804576313682030967852.html

[3] http://www.bls.gov/news.release/cpi.nr0.htm

[4] http://www.ogj.com/index/article-display/6817829475/articles/oil-gas-journal/drilling-production-2/drilling-operations/20100/may-2011/us-drilling_decreases.html

[5] http://www.bloomberg.com/news/2011-05-14/euro-drops-to-six-week-low-versus-dollar-before-ministers-meet-on-greece.html

|

|

|