|

Weekly Market Update

Week of April 25, 2011 |

|

|

The Markets:

Do you want to pay higher taxes? I know I don't! But if you happen to be among the fortunate few that earn more than $250,000 a year, new polls suggest your neighbors want you to pay up.

According to the latest New York Times/CBS News poll, 72% of adults approve of increasing federal taxes on households making more than $250,000 starting in 2013.[1] At the same time, a separate poll from ABC News and the Washington Post showed that 72% of respondents want to raise taxes on the rich to help reduce the federal deficit.[2] The desire to see America's wealthiest citizens paying higher taxes even spans political boundaries, with 55% of Republicans, 74% of independents and 83% of Democrats all calling for an increase.[3] So will increasing taxes on the rich fix the budget? This is not a question we will even try to answer in this brief commentary. It is worth noting however, that less than 3% of all American households earn more than $250,000 per year,[4] and as it stands today, the U.S. tax system is already highly disproportionate. The top 1% of income earners pay 40% of all federal income taxes, the bottom 50% pay only 3%, and more than one-third of U.S. earners pay no federal income tax at all.[5] As new data from the Congressional Budget Office shows, raising all six income tax rates by 1 percentage point would yield an additional $480 billion over 10 years, while raising the top two rates by 1 percentage point would yield only $115 billion.[6] So what is better: Increasing taxes a little bit for everyone or a lot for just a few? Perhaps another question to ask is whether America has a spending problem or a revenue problem? Again, these are not questions we can answer in this forum.

The point of sharing this information with you is not to fuel a political debate. The nation is already sharply divided on this issue. The reason we draw your attention to this matter is because directly or indirectly, it affects every American. And, at the rate things are going, there is a good chance we will see higher taxes in the future. Taking into consideration how taxes can affect your investments, both now and in the future, is an important element to preparing sound financial strategies. As always, we will monitor how the landscape changes and do our best to help you adapt to changing conditions.

ECONOMIC CALENDAR:

Tuesday - S&P Case-Shiller Home Price Index, Consumer Confidence

Wednesday - Durable Goods Orders, FOMC Meeting Announcement

Thursday - GDC, Jobless Claims, Pending Home Sales Index Friday - Personal Income and Outlays, Chicago PMI, Consumer Sentiment, Ben Bernanke Speaks

|

|

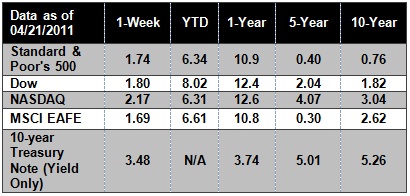

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. NA means not available. |

|

Headlines:

U.S. stocks advanced for a third straight session Thursday, with the Dow closing at almost a 3-year high following a slew of strong earnings.[7] Sales of existing homes increased in March. Home sales rose at an annual rate of 5.1 million in March, up 3.7% from February, the National Association of Realtors said Wednesday. However, sales were 6.3% lower than in March 2010.[8] With a 4% gain so far this month, following March's 10% rise, benchmark oil futures are keeping up with a long-running trend - advancing in March, April and May before taking a breather in June.[9] Toyota Motor Corp.'s global car production, disrupted by parts shortages from Japan's earthquake and tsunami, won't return to normal until November or December, imperiling its spot as the world's top-selling automaker.[10]

|

"Don't judge each day by the harvest you reap but by the seeds that you plant."

- Robert Louis Stevenson |

|

|

Orange Snowdrops   From: Better Homes and GardensFrozen orange juice concentrate imparts sunshine-fresh flavor to these cookies. For thorough orange flavor, use the juice concentrate in the dough as well as the frosting. From: Better Homes and GardensFrozen orange juice concentrate imparts sunshine-fresh flavor to these cookies. For thorough orange flavor, use the juice concentrate in the dough as well as the frosting.

Ingredients:

½ cup butter (no substitutes)

½ cup shortening

1 cup sifted powdered sugar

½ teaspoon baking soda

1 egg

½ of a 6-ounce can (1/3 cup) frozen orange juice concentrate, thawed

1 teaspoon vanilla

2 cups all-purpose flour

1 recipe orange frosting

Finely shredded orange peel (optional)

Directions:

1. In a large mixing bowl beat butter and shortening with an electric mixer on medium to high speed for 30 seconds. Add powdered sugar and baking soda; beat until combined, scraping sides of bowl occasionally. Beat in egg, orange juice concentrate, and vanilla until combined. Beat in as much of the flour as you can with the mixer. Using a wooden spoon, stir in any remaining flour.

2. Drop dough by rounded teaspoons 2 inches apart onto an ungreased cookie sheet.

3. Bake in a 375 degree F oven about 8 minutes or until edges are lightly browned. Cool on cookie sheet for 1 minute. Transfer to wire racks: cool completely. Spread cookies with Orange Frosting. If desired, sprinkle with finely shredded orange peel. Makes about 36 cookies.

Orange Frosting

Stir together 1/2 of a 6-ounce can (1/3 cup) frozen orange juice concentrate, thawed; 1/2 teaspoon finely shredded orange peel; and 3 cups sifted powdered sugar till smooth.

|

|

|

Play by Intelligence, Not Ego

Ego involvement affects many golfing situations. We may elect to shoot over a dog-leg instead of around it. We may use a high-compression ball because hard hitters do, although we could get more distance with less compression. We may shoot for the pin when our general accuracy can only justify shooting at the green.

One of the secrets to better play is not allowing your ego to affect your choices on the course. If your opponent uses a six iron, don't hesitate to use a four wood if "your game" calls for it. In other words, play your game and not your ego.

There are some ego involvements which can be beneficial, such as pride in improvement. In general though, ego involvements prevent us from doing what a given situation calls for, and this is unfortunate. Nothing can be solved if pride produces wishful thinking or otherwise prevents us from seeing the problem as it is. Let intelligence and not ego drive your golf game and your scores will improve.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] http://www.nytimes.com/interactive/2011/04/22/us/politics/20110422-poll-republicans-economy.html?ref=us

[2] http://www.langerresearch.com/uploads/1122a2%20Debt%20Debate.pdf

[3] http://www.langerresearch.com/uploads/1122a2%20Debt%20Debate.pdf

[4] http://www.census.gov/hhes/www/income/income.html

[5] http://www.heritage.org/budgetchartbook/top10-percent-income-earners

[6] http://money.cnn.com/2011/04/12/news/economy/national_debt_taxes_obama/index.htm?iid=EL

[7] http://money.cnn.com/2011/04/21/markets/markets_newyork/index.htm

[8] http://money.cnn.com/2011/04/20/news/economy/existing_home_sales/index.htm

[9] http://www.marketwatch.com/story/oil-prices-likely-to-keep-rising-until-june-2011-04-20

[10] http://www.latimes.com/business/la-fi-toyota-20110422,0,3070748.story?track=rss

|

|

|