|

Weekly Market Update

Week of February 21, 2011 |

|

|

The Markets:

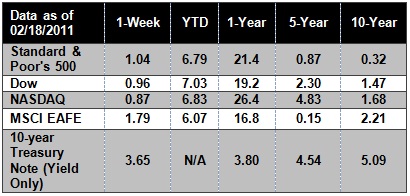

With optimism holding steady, markets entered the long weekend at fresh multi-year highs. Despite continued unrest in the Middle East and China's reserve tightening, the Dow Jones rose 0.96% and the S&P500 added 0.19%, levels last seen in June 2008. Similarly, the Nasdaq reached 0.08%, its highest close since October 31, 2007.[1] Amid all this positive news it is easy to forget that the markets are cyclical. Just because the Dow has returned nearly 20% in the last 12 months doesn't mean we should expect this kind of growth to continue. At some point, a correction will likely move markets in the opposite direction. This is why careful, consistent planning is required to help reach long-term goals.

Wells Fargo recently sponsored a survey which turned up some startling statistics. Not only do 72% of middle-class Americans expect to work through their retirement years, but many expect to spend 10% of their nest egg each year (despite industry recommendations to withdraw no more than 4%).[2] In most market conditions, a withdrawal rate of 10% is unsustainable. Since the median savings of most respondents in their 50s was $29,000, a retirement of 20 years (assuming a 5% rate of return) would yield only $190 per month! Similarly, while most respondents recognized the impact healthcare expenses can have on retirement, their calculated spending of $32,000 on post-retirement healthcare costs would consume more than the entire $20,000 they have earmarked.[3] A similar Harris Poll showed that 25% of baby boomers have no retirement savings, and one-third of Americans have no retirement or personal savings.[4] The recession has undoubtedly impacted people's decisions about investing: two-thirds are not confident in the stock market; more than half cite other financial responsibilities that keep them from having any extra money; and 71% are working to reduce debt.[5] If you are working with our firm, you already have a financial plan in place, but don't forget about your family and friends. If they are anything like the average American, they can probably use some assistance. Why not encourage those you care about to take advantage of "America Saves Week" (February 20-27) to rewrite their future![6] Urge them to take time to structure a detailed, written retirement plan. Perhaps our firm can assist them. Remember, we are here to help safeguard your future and theirs, so don't keep us a secret! ECONOMIC CALENDAR:

Monday - U.S. Holiday Observed: President's Day

Tuesday - S&P Case-Shiller HPI, Consumer Confidence

Wednesday - Redbook, Existing Home Sales

Thursday - Durable Goods Orders, Jobless Claims, Industrial Production, EIA Petroleum Status Report, EIA Natural Gas Report

Friday - GDP, Consumer Sentiment |

|

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. NA means not available. |

|

Headlines:

On Sunday, 20-year-old Trevor Bayne won the Daytona 500 and its $1.5 million in prize money in only his second NASCAR Sprint Cup Series Race.[7] Brent crude oil prices surged to more than $105 a barrel for the first time since 2008 on Monday on fears that spiraling violence in Libya could lead to wider supply disruptions from the OPEC member.[8] Euro zone countries are working on what they call a comprehensive package of measures to resolve their year-long debt crisis, aiming for a deal by the end of March. An EU summit on February 4 produced no breakthrough, and another summit is due on March 11 to sustain momentum toward a deal. The complete package is expected to be finalized at a final summit on March 24-25 in Brussels.[9] Silver futures climbed to their highest level in nearly 31 years Friday, posting an almost 8% gain for the week. Gold marked a five-session winning streak, based on growing tensions in the Middle East and amid reports that Egypt has agreed to allow passage of Iranian naval ships through the Suez Canal.[10] |

|

|

"Associate with men of good quality if you esteem your own reputation;

for it is better to be alone than in bad company." - George Washington |

|

|

Wrap-And-Roll Basil Pinwheels   From: Better Homes and GardensMake these appetizers yourself or put out all of the fixings and have guests create their own snacks. From: Better Homes and GardensMake these appetizers yourself or put out all of the fixings and have guests create their own snacks.

Ingredients:

3 7- or 8-inch flour tortillas

1 5.2-ounce carton Boursin cheese or one 5-ounce container semi soft cheese with garlic and herbs

12 large fresh basil leaves

1/2 of a 7-ounce jar roasted red sweet peppers, cut into 1/4-inch wide strips

4 ounces thinly sliced cooked roast beef, pork, ham, or turkey

1 tablespoon mayonnaise or salad dressing

Fresh basil leaves (optional)

Directions:

1. Spread each flour tortilla with 1/3 of the Boursin cheese or semisoft cheese with garlic and herbs. Add a layer of the large basil leaves to cover cheese. Divide roasted red sweet pepper strips between the tortillas; arrange roasted red pepper strips over the basil leaves 1 to 2 inches apart. Top with meat slices. Spread 1 teaspoon mayonnaise or salad dressing over the meat on each tortilla. Roll up the tortillas tightly, into a spiral, enclosing the filling. Wrap each roll in plastic wrap. Chill the tortilla rolls in the refrigerator 2 to 4 hours to blend flavors.

2. To serve, remove the rolls from the refrigerator. Remove the plastic wrap from the tortilla rolls; cut each of the rolls into 1-inch slices (make diagonal slices, if desired). Garnish with the remaining basil leaves, if desired. Skewer each of the cut tortilla rolls on frilly picks or on short decorative skewers, if desired. Makes about 24 pinwheels.

|

|

|

Bigger is Better!

When a head is designed oversize, a higher percentage of its weight is moved toward the outside. Ever heard the term "perimeter weighted?" This is exactly what it means. A head that has more weight on its perimeters will tend to twist less during off-center hits. The scientific label for this is "higher moment of inertia." Clubs with larger heads, be they woods, irons or putters, will not twist as much when you don't hit them perfect, resulting in straighter - and longer - shots. So the next time you are shopping for a new club, remember: Bigger may indeed be better when it comes to clubhead size!

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced! Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

[1] www.marketwatch.com/story/stocks-edge-higher-in-cautious-trading-2011-02-18?dist=markets

[2] www.wellsfargo.com/press/2010/20101208_RetirementSurvey

[3] www.wellsfargo.com/press/2010/20101208_RetirementSurvey

[4] www.gobankingrates.com/retirement/one-third-americans-no-retirement-personal-savings

[5] www.wellsfargo.com/press/2010/20101208_RetirementSurvey

[6] www.marketwatch.com/story/whats-in-your-wallet-likely-not-enough-2011-02-16?reflink-MW_news_stmp

[7] www.latimes.com/sports/la-sp-daytona-notes-20110221,0,7166350.story

[8] http://www.reuters.com/article/2011/02/21/markets-oil-idUSLDE71K0TK20110221

[9] http://www.reuters.com/article/2011/02/21/us-eurozone-crisis-response-aa-idUSTRE71K2R820110221

[10] www.marketwatch.com/story/silver-futures-hit-highest-level-since-1980-2011-02-18?dist=markets

|

|

|