|

Weekly Market Update

Week of January 31, 2011 |

|

|

The Markets:

U.S. stocks' winning streak ended Friday amid news of political strife in Egypt. The Dow closed down 1.39%, the S&P 500 declined 1.79%, and the Nasdaq fell 2.48% -- the biggest single day losses in nearly six months.[1] This pullback left many investors asking what political strife in Egypt has to do with the U.S. stock market. You may be wondering the same thing. So what is the answer?

While many factors are involved, the primary issue is that the stock market hates uncertainty. It's an old adage, but one that is often true. On a fundamental level, the stock market is based on people's speculation about what is going to happen in the future. Uncertainty about the future leads many to sell and/or sit on the sideline because they aren't comfortable investing their money until they feel like they know what is ahead. For the time being, the situation in Egypt is anything but certain.

Uncertainty, combined with Egypt's position along one of the busiest trade routes in the world, had a combined affect on the markets last week. The price of oil rose with fears about the stability of maritime operations on the Suez Canal. As a major trade route, any interruption or closure has the potential to create a spike in oil and energy prices.[2] As a result, analysts predict a measure of volatility until calm is restored.[3] As we saw on Friday, when volatility increases, a flight to safety often drives uneasy investors into so-called "safe havens" and away from stocks.[4]

The affect of Egyptian politics on U.S. stock markets serves as a reminder that we are part of an intricate international economy. The ups and downs of the markets are rarely predictable, and a measure of risk is to be expected. Historically, stocks have outperformed all other investments,[5] but in the short-term, fluctuations are inevitable.* At times like this, rest assured that we will continue to monitor the situation abroad and bring you relevant information as soon as it becomes available.

ECONOMIC CALENDAR:

Monday - Personal Income and Outlays, Chicago PMI

Tuesday - Motor Vehicle Sales, Redbook, ISM Mfg Index, Construction Spending

Wednesday - ADP Employment Report, EIA Petroleum Status Report

Thursday - ECB Announcement, Jobless Claims, Productivity and Costs, Factory Orders, ISM Non-Mfg Index

Friday - Employment Situation

|

|

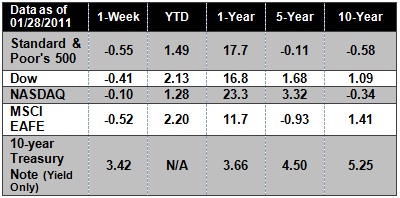

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. NA means not available. |

|

Headlines:

The United Nations reported that international food prices rose by an all-time high of 25% in December. The rising costs for staples like rice, wheat, and maize have been affected by bad weather in Australia and Russia, rising incomes in China and India, and a push for biofuels. The sharp inflation in food costs has sparked political unrest throughout the Middle East, including Egypt and Tunisia.[6] The GDP figures for the last quarter showed that consumer spending was up a strong 4.4% on an annualized basis, and final sales surged 7.1%, its largest jump in nearly 30 years. Trade was a big contributor to the economic gains, with exports surging 8.5% and imports declining 13.6%. Inventories grew by $121 billion in the third quarter, but only rose by $7 billion in the final three months of the year.[7] Comcast Corp., took control of NBC Universal shortly before midnight on Friday. The deal comes after the government shackled Comcast's behavior in the coming years to protect online video services such as Netflix and Hulu. The takeover gave Comcast 51% control of NBC Universal, which owns the nation's fourth-ranked broadcaster, NBC, the Universal Pictures movie studio and related theme parks, and a bevy of cable channels including Bravo, E! and USA.[8] Chinese authorities have blocked the word "Egypt" from searches on Twitter-like microblogging sites in an indication of concern among Communist Party leaders that the unrest there could encourage similar calls for political reform in China.[9]

|

|

|

| "Peace is not something you wish for; it's something you make, something you do, something you are, and something you give away." -Robert Fulghum |

Oreo Truffles   From: Better Homes and GardensYou only need three ingredients to make these white chocolate treats. They're great for parties or to give as gifts. From: Better Homes and GardensYou only need three ingredients to make these white chocolate treats. They're great for parties or to give as gifts.

Makes 50 truffles.

Ingredients:

1 18-oz. pkg. chocolate sandwich cookies with white filling, finely crushed

1 8-oz. pkg. cream cheese, softened

1 lb. white baking chocolate, melted

Directions:

In large bowl combine crushed cookies and cream cheese. Beat with mixer on low speed until well blended. Form 1-inch balls by hand. Dip balls in white chocolate; place on baking sheet covered with waxed paper. Refrigerate 1 hour or until firm. To store, cover and refrigerate. Makes 50 truffles.

|

|

|

Find The Right Tempo

In golf, tempo refers to the overall speed of your swing. It's the total amount of time it takes to create your golf swing from beginning to end. Some players have a relatively fast tempo, while others have a slower tempo. A golfer's optimum tempo is often related to his or her personality, and yours should be too. Golfers get into trouble when they either slow down or speed up their natural tempo. Most often, the tendency is to speed up with the longer clubs to gain extra yards, especially with the driver. When your tempo starts varying from club to club, the timing required to hit consistent golf shots is destroyed.

For every club in the bag, the tempo, or time it takes to make the swing from start to finish, should be the same. For example, it should take the same amount of time to make a swing with your pitching wedge as it does with the 7-iron or the driver. What varies is the speed of the clubhead. Because the driver is longer than the pitching wedge, the club head moves faster throughout the swing, but if it takes two seconds to swing a pitching wedge, it should take the same two seconds to swing the driver.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced! Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

*Stock investing involves market risk including loss of principal. The fast price swings of commodities will result in significant volatility in an investor's holdings. Government bonds and Treasury Bills are guaranteed by the US Government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

[1] www.marketwatch.com/story/us-stocks-fall-on-fears-over-egypt-djia-biggest-drop-in-2-months-2011-01-28?dist=afterbell

[2] www.marketwatch.com/story/us-stocks-fall-on-fears-over-egypt-djia-biggest-drop-in-2-months-2011-01-28?dist=afterbell

[3] http://www.msnbc.msn.com/id/41317914/ns/business-oil_and_energy/

[4] www.marketwatch.com/story/us-stocks-fall-on-fears-over-egypt-djia-biggest-drop-in-2-months-2011-01-28?dist=afterbell

[5] www.money.cnn.com/magazines/moneymag/money101/lesson4/

[6] http://money.cnn.com/2011/01/28/news/international/inflation_food_prices_middle_east/index.htm

[7] http://www.dailyfinance.com/story/gdp-report-economy-improving-2011/19819798/

[8] http://www.msnbc.msn.com/id/41326456/ns/business-media_biz/

[9] http://online.wsj.com/article/SB10001424052748704832704576113810779590744.html?mod=googlenews_wsj

|

|

|