|

|

|

|

| Quarterly Newsletter |

Apr 2012

|

|

|

2012 Homebuyer

Workshop Schedule

|

Workshops are free to attend Oahu

Kapolei - DHHL Hale Ponoi

8:30a - 5p

- Apr 28th

- May 19th

- Jun 30th

Aiea - Old Republic Title & Escrow

8:30a - 5p

Maui

Wailuku - Queen Liliuokalani Children's Center

Big Island

Hilo - Hawaii County Office Building 8:30a - 5p - Apr 21st

- Jun 2nd

- Aug 4th

- Oct 27th

- Dec 8th

Kona - West Hawaii Civic Center

8:30a - 5p

Kauai

includes orientation and 2 part workshop series

5p - 9p

- May 14, 22/24

- Jun 4, 12/14

- Jul 2, 10/12

- Aug 13, 21/23

- Sept 10, 18/20

- Oct 8, 16/18

- Nov 5, 13/15

- Dec 3, 11/13

For more information or to register for a workshop in your community, contact HCA at (toll-free) 1.866.400.1116.

|

|

|

Hawaiian Community Assets (HCA) is a HUD approved housing counseling agency and Native community development financial institution. HCA offers this quarterly newsletter to provide you with updated information on current programs and services.

HCA's mission is to build the capacity of low and moderate income communities to achieve and sustain economic self-sufficiency with a particular focus on Native Hawaiians.

HCA programs and products include:

- Renter Education and Counseling

- Pre-Purchase Homebuyer Education and Counseling

- Post-Purchase Education and Counseling

- Foreclosure Prevention Services

- Youth and Family Financial Education

- Youth and Renters MATCH Savings

- Tax and FAFSA Preparation Services

- Credit Builder Loans

- Loan Packaging

|

|

HCA Report Identifies Barriers to Sustaining Homeownership in Hawaii

HAWAII - In a Foreclosure Program Report released in April, HCA cites reduced household income, high housing costs, and subprime loan products as barriers to sustaining homeownership in Hawaii. Program Report released in April, HCA cites reduced household income, high housing costs, and subprime loan products as barriers to sustaining homeownership in Hawaii.

The Report, which includes client data on 90 Hawaii homeowners HCA served with National Foreclosure Mitigation Counseling Program funding between May 1, 2010 and December 31, 2011, found that said homeowners had an average monthly household income of $5,486 with an average monthly mortgage payment of $2,679, representing, on average, 49% of borrowers' monthly income.

The Report goes on to highlight that 56% of HCA clients who received foreclosure prevention counseling services held subprime loan products, such as option ARMs (Adjustable Rate Mortgages), interest-only, and interest-only option ARM hybrid mortgages. The data reflects a sustained 4-year trend first reported by the United States Department of Housing and Urban Development in 2008 , in which, subprime loans spiked to represent 55% of all foreclosure starts in the nation. Showing the true impacts of such risky loan products on our Hawaii homeowners, one HCA client saw her option ARM loan reset her interest rate from 5.25% APR (Annual Percentage Rate) to 15.95% APR in one month.

"Our Hawaii homeowners already find themselves in a highly competitive housing market," says HCA Executive Director, Jeff Gilbreath pointing out the large gap between Hawaii's median home price ($521,500, US Census Bureau) and annual average pay rate of the State's residents, which ranks last in the nation ($24,203, Corporation for Enterprise Development). "While the Report identifies key trends our families face when struggling to sustain homeownership, it also provides us with the data necessary to establish effective, community-specific solutions to prevent foreclosure and keep the dream of homeownership alive."

Reinforcing the connection between the State's high housing costs, low pay rates, and barriers to sustaining homeownership, the Report confirms that 68% of Hawaii homeowners who received HCA foreclosure prevention assistance cited loss of a job or reduction of income as the primary reason for mortgage delinquency. Another 12% of clients identified increases in expenses, including mortgage payments, as the second most common reason for delinquency followed by decline in health and marital issues (10%).

With a goal of addressing barriers to sustaining homeownership, a series of recommendations are contained in the Report, including, principal reduction for families with reduced income, subprime mortgage loans, or increases in the amount of their mortgage payments; greater refinance options for both current and delinquent homeowners; a concerted public education campaign on consumer protection to combat predatory loan scams; and targeted HUD approved housing counseling combined with asset building and micro-lending programs.

Click here to view the full-length Foreclosure Prevention Program Report.

|

|

Are you or someone you know at-risk of foreclosure?

Call Us ~ We Can Help Prevent Foreclosure

1.866.400.1116

Our certified counselors can assist you with:

Loan Modifications * Lower Interest Rates

Work Out Plans * Reduced Monthly Payments

|

|

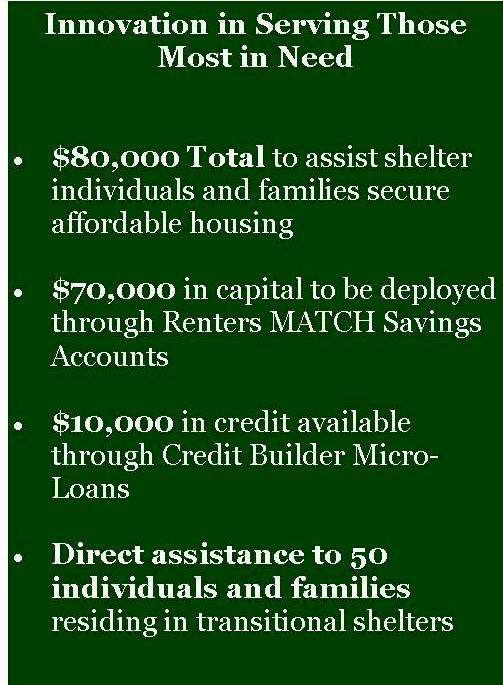

Hawaii Community Lending Launches Initiative to Deploy $80,000 to Empower Hawaii's Homeless

WAIANAE - Through its nonprofit community development financial institution arm, Hawaii Community Lending, HCA announced that it will launch a 12-month initiative to deploy $80,000 in capital and credit to assist homeless individuals and families build savings, improve credit, and secure affordable housing.

The funds will be dedicated to Renters MATCH Savings Accounts and Credit Builder Micro-Loans, two innovative financial products HCA developed in 2010 in order to address income and credit  barriers keeping homeless Hawaii residents from securing affordable housing. barriers keeping homeless Hawaii residents from securing affordable housing.

"At a time when our housing prices are rising and our options becoming more limited, families can look to Hawaii Community Lending as a statewide, community-based financial institution dedicated to innovation in serving those most in  need," says HCA Executive Director, Jeff Gilbreath. "We mahalo Office of Hawaiian Affairs for making the funds available for this initiative and look forward to getting the money into the hands of our community." need," says HCA Executive Director, Jeff Gilbreath. "We mahalo Office of Hawaiian Affairs for making the funds available for this initiative and look forward to getting the money into the hands of our community."

To date, HCA has enrolled 2 individuals in its Renters MATCH Savings Accounts, which provide a 5:1 match on savings up to $500 for a total of $3,000 toward the cost of securing or sustaining affordable rental housing, and has successfully administered 10 Credit Builder Micro-Loans representing $5,000 in credit to "very-low income" individuals and families on the Waianae Coast.

According to Gilbreath, the 12-month initiative will provide direct assistance to 50 individuals and families through the organization's Financial Literacy/Renter Education and Credit Counseling Project, a 3-year project funded by the Federal Administration for Native Americans to increase the transition rates of transitional shelter residents into affordable rental housing.

|

|

Financial Literacy Month Sparks Garden Isle Effort to Educate Future Generations

LIHUE - On April 2nd Kauai County Mayor, Bernard Carvalho, signed a proclamation recognizing April as National Financial Literacy Month as designated by the United States Congress. LIHUE - On April 2nd Kauai County Mayor, Bernard Carvalho, signed a proclamation recognizing April as National Financial Literacy Month as designated by the United States Congress.

"As the County, we recognize that financial literacy provides a new framework for strategic coordination and an overarching strategy to serve our people," stated Mayor Carvalho presenting HCA Community Services Specialist, Desiree Vea with the signed proclamation.

The signing ceremony built on the momentum of a Kahua Waiwai Trainer Session HCA conducted on March 20th equipping 13 staff from community-based organizations, education institutions, and government agencies on Kauai to develop and implement free youth financial education workshops using the organization's place-based Kahua Waiwai: Building a Foundation of Wealth(c) curriculum.

Attendees included staff from Queen Liliuokalani Children's Center, Child and Family Services, Kawaikini Charter School, Hale Opio, National Tropical Botanical Gardens, Kekaha Hawaiian Homes Association, and WorkWise.

"Youth financial literacy is important because it not only teaches the next generation about money management, but gives them the skills to make good life decisions," said Ms. Vea. "The Kahua Waiwai Financial Edicaton Program is about more than building wealth; it is about building community."

To increase public awareness around youth financial education, HCA AmeriCorps VISTA member, Marina Loew, has established partnerships with local Kauai elementary schools to have 3rd and 4th graders create art projects identifying needs versus wants with the goal of creating a broader island-wide public education campaign around financial self-sufficiency.

For more information about HCA' s Kahua Waiwai Youth Financial Education Program call 1.866.400.1116 or email info@hawaiiancommunity.net.

|

|

If you experienced foreclosure in 2009 or 2010...

You may be eligible for financial compensation.

If you were a homeowner who  experienced foreclosure between January 1, 2009 and December 31, 2010, you may be eligible to receive a free Independent Foreclosure Review and compensation for "financial injury". experienced foreclosure between January 1, 2009 and December 31, 2010, you may be eligible to receive a free Independent Foreclosure Review and compensation for "financial injury".

For more information and to access a review application, call 1.888.952.9105 or visit https://independentforeclosurereview.com.

*Complete applications must be submitted by July 31, 2012*

|

|

Kanehili Families Receive $500 for Achieving Homeownership

KANHELILI - In April, HCA assisted 10 Kanehili families claim $500 post closing vouchers for achieving homeownership. The families were part of the Kanehili Hawaiian Home Lands Development in Kapolei and had worked with HCA for many years through its homebuyer education and counseling program.

Funding for the post closing vouchers was made possible through the Hawaii Family Finance Project, a 3-year, $3.1 million project funded by the US Department of Treasury and administered by the Council for Native Hawaiian Advancement to increase the homeownership rates of Hawaii's low- and moderate-income families. "I am so grateful for this opportunity," says kupuna and long-time waitlist Beneficiary, Elliot Whitford (pictured left with daughter, Kimberly). "The first night I slept like a baby, because I know that I am in a safe, healthy community." The Whitfords were among 10 families who took part in the Homestead Self-Help Program, a program is administered by the Council for Native Hawaiian Advancement with support from the Department of Hawaiian Home Lands, Build Systems International, and Hawaiian Community Assets. The Program uses sweat equity and a shared building process to make affordable housing a reality on Hawaiian Home Lands. To enroll in HCA's free homebuyer education and counseling program call 1.866.400.1116 or email info@hawaiiancommunity.net. For more information about the Homestead Self-Help Program, contact the Council for Native Hawaiian Advancement at 808.596.8155. |

|

Sandwich Isles Supports Homeownership!

Mahalo to Sandwich Isles Communications, Inc for sponsoring HCA's May 26th Homebuyer Education Workshop!

As part of the sponsorship, Sandwich Isles will:

- Present its affordable products and services during the workshop,

- Have a table to offer additional promotional materials, and

- Be recognized and receive logo placement in all workshop marketing materials.

"We are grateful to have Sandwich Isles support in educating our families about the steps to homeownership," says HCA Executive Director, Jeff Gilbreath. "When counseling our families, we often see that affordable communication products are critical to establishing and maintaining an affordable household budget."

Sandwich Isles is the broadband telecommunications services provider for Hawaiian Home Lands. Sandwich Isles offers affordable and reliable landline phone service, broadband (Internet) service and wireless (cell phone) services to Homesteaders throughout the state.

|

|

Homebuyer Workshops Educate Families on Consumer Protection Laws

HAWAII - Every month HCA delivers a series of 8-hour homebuyer education workshops statewide on Oahu, Maui, Hawaii Island, and Kauai.

During the workshops, certified HCA trainers teach from the organization's place-based Kahua Waiwai, Homebuyer Edition(c) to review the costs and benefits of buying home, family values around housing, budgeting, saving, credit and credit reports, qualifying for a loan, the home buying process, home maintenance, surviving a financial emergency, and protecting against predatory loan scams.

"Homebuyer education is important," says HCA Community Services Specialist, Sonja Gonzaga. "But if we are to keep families from getting into predatory mortgages and loan products as they  did before the housing crisis, we need to combine education with hands-on activities that clearly define key consumer protection laws available to us." did before the housing crisis, we need to combine education with hands-on activities that clearly define key consumer protection laws available to us."

Since the beginning of 2012 HCA has received a steady increase of calls from senior citizens and Native Hawaiian homeowners who have been targeted primarily for predatory refinancing scams. With the rise in such scams, HCA is taking a proactive approach in educating families through its workshops and community outreach.

"If we educate one family, we hope they share what they learn with their friends and neighbors," finished Gonzaga.

To enroll in a homebuyer education workshop contact HCA at 1.866.400.1116 or via email at info@hawaiiancommunity.net.

|

|

|

Don't Become a Victim to Predatory Loan Scams

Educate Yourself and Your Family

Predatory loan scams are changing every day. Here are some quick tips to protect you and your ohana:

1) Do NOT pay a Fee In Advance for services promised.

2) Stay clear of anyone who says they GUARANTEE they will stop your home from going into foreclosure

3) NEVER STOP PAYING your mortgage, even if someone tries to convince you they can refinance your loan if you pay them.

If you have a been a victim of a predatory loan scam, call the authorities today.

Hawaii State Office of Consumer Protection: 808.587.3222 ext. 2

Federal Consumer Financial Protection Bureau: 1.855.411.2372

|

|

|

|

|

|