|

|

| | click to play |

Featured Video Staggering Stats of Student Debts Americans are faced with an insurmountable amount of debt. The US national debt is less than $16 billion away from reaching $15 trillion. That means the debt per citizen is nearly $50,000 and debt per taxpayer is over $133,000. But wait until you hear the amount of total debt on student loans. The numbers will shock you. Watch the video as CNBC's Courtney Reagan takes a closer look at the staggering statistics that face soon-to-be graduates. |

|

Dear Readers,

For the last few months, I have been waiting for the initial drill results from Abzu Gold's (TSX Venture: ABS) Nangodi project. On Thursday, they finally came - unearthing a new Ghanaian gold discovery. And the initial results are BIG...

Before I go over the results, let's play some catch up.

Abzu Gold (TSX-V: ABS) is a West African junior in Ghana that was featured in the Equedia Letter back in July (click for report).

Just last month, they teased us with 4.72 g/t gold over 20 metres at their Asafo location, near PMI Gold's Obatan gold project (see update here). While those numbers were good, the real kicker for Abzu was their recent option on their Nangodi project - one of ten concessions currently under option agreement with Red Back Mining Ghana, a wholly owned subsidiary of Kinross Gold, with no current drill results...until now. The Nangodi Discovery

The Nangodi is the site of a 1930's vintage underground mine that produced gold at an average grade of ~26 g/t gold. Back in those days, gold was nowhere near current price levels (between $20-$35/oz) which meant that only extremely high grade gold deposits with visible gold showings were ever mined. Obviously, the mine eventually shut down as the cost to pull the gold out far exceeded gold prices.

Historical drill intercepts have intersected gold mineralization along a strike distance of 1.2 kilometres with true widths up to 60m with mineralization open in all directions and at depth.

But that was then and this is now.

Gold prices are now heading toward $2000/oz with extreme violence and the Nangodi project remains mostly untouched.

On Thursday, Abzu announced the first holes from the project...and the numbers are big.

Abzu Gold Announces New Ghanaian Gold Discovery at Nangodi Property

The Nangodi Project centers on a historic gold mine and the results released Thursday are from just one of several targets on the large, 142 km2, Nangodi concession.

Thursday's drill results clearly confirm the presence of a broad gold mineralized system, with multiple higher-grade gold intercepts. Mineralization remains open in all directions including depth - which means a lot of room for expansion.

Take a look at the highlights:

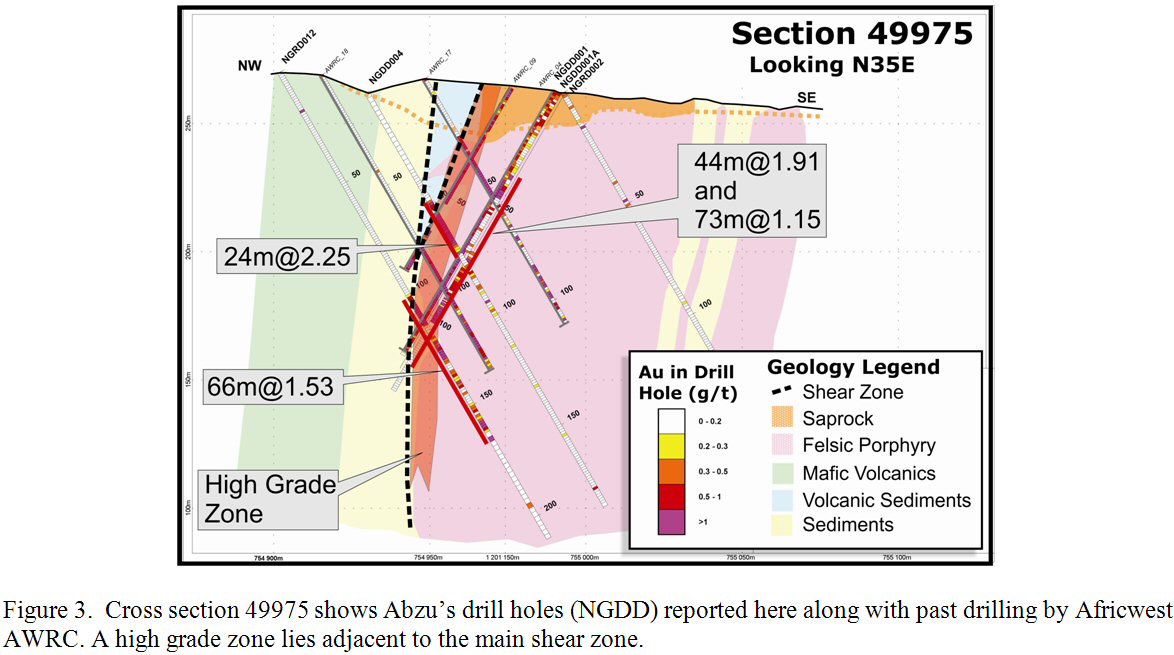

- 73 metres @ 1.15 g/t gold

- 66 metres @ 1.53 g/t gold

- 44 m @ 1.91 g/t Gold

| |

click to enlarge

|

In addition, this drilling demonstrates the presence of a high-grade zone 1 to 15 m wide with values up to 41.6 g/t gold over 1 metre and 4.65 g/t gold over 15 metres.

So far, Abzu has completed 27 Reverse Circulation (RC) and diamond core drill holes totalling 4,039 metres in its phase 1 drill program. So far, 4 out of the 5 holes have returned significant results (as shown in above figure) and as shown here.

That means there are still 22 holes that have yet to be released. If they come back as strong as their first holes, we're looking at a serious game changer for Abzu - especially considering their geophysical location and proximity to nearby deposits and mines. In a bull market, these results would send any junior skyrocketing in share price.

Abzu is in a great position to fully exploit not only high gold prices, but an extremely promising prospect at Nangodi.

Even today, artisanal miners are recovering gold from the Nangodi zone due to the richness of gold in the area. The grades are high and mineralization is open in all directions and at depth. That means there is significant room for expansion and I bet that Abzu's management will be aggressive in moving this project forward.  | | Gold tail in artisanal miner's gold pan washed from artisanal bedrock diggings at Nangodi. |

Last week, I went over some basics on mining evaluation in the letter, "It's Not That Simple: Mining 101." In it, I stressed that proximity to producers and other deposits create great synergies in economies of scale which make juniors much more attractive.

If you're looking for those traits, Abzu easily fits the bill with its projects directly near or adjacent to major deposits and producers in Ghana.

West African gold companies continue to draw serious attention due to the simplicity of its geology which allows companies in the area to move projects forward at record pace.

Just take a look at a few of the companies advancing projects in the area:

Combined, these projects include a total of more than 70 million ounces of gold!

Abzu's Nangodi Main and other targets also align along a regional shear zone that continues to the northeast across the border into Burkina Faso where it hosts the Youga Mine of Endeavor Mining Corp.

| |

The Nangodi and Yameriga concessions are located in northern Ghana in the Bole-Nangodi Gold Belt. Targets in these concessions are aligned along a regional shear zone that extends northeast into Burkina Faso and hosts the Youga Mine.

|

I am extremely encouraged by the most recent results from Nangodi. Not only have the first few holes shown us incredible numbers, mineralization is open in all directions and at depth. The remaining results should come out soon and if they are anything like the ones just announced, we're looking at a potential game-changer for Abzu.

Given what I have seen, I fully expect the remaining upcoming results from Abzu to be positive. Abzu has properties and the potential to find the next big deposit in Ghana - let's see what management can do.

Next week, I'll continue with more in-depth discussions on mining valuations as promised last week.

Until next week, Ivan Lo Equedia Weekly

Questions?

Call Us Toll Free: 1-888-EQUEDIA (378-3342)

We're biased towards Abzu Gold because we own shares, they are an advertiser, and we own options in the Company. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Reports, including Abzu Gold for which we have not sold any shares. It's your money to invest and we don't share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn't mean they all will. |

|

The Gold Investor's Biggest Risk

By Jeff Clark, The Casey Report

While we're convinced that our gold and silver investments will pay off, they don't come without risk. What do you suppose is the biggest risk we face? Another 2008-style selloff? Gold stocks never breaking out of their funk? Maybe a depression that slams our standard of living? While we're convinced that our gold and silver investments will pay off, they don't come without risk. What do you suppose is the biggest risk we face? Another 2008-style selloff? Gold stocks never breaking out of their funk? Maybe a depression that slams our standard of living?

Though those things are possible, we at Casey Research don't see that as your greatest threat:

"Your biggest risk is not that gold or silver may fall in price. Nor is it that gold stocks could take longer to catch fire than we think. Not even the prospect of the Greater Depression. No, your biggest risk is political. As bankrupt governments get increasingly desperate for revenue, any monetary asset held domestically could be a target. It is absolutely essential that every investor diversify themselves politically. In fact, at this point, it is the one action that should be taken before anything else." - Doug Casey, September 2011

I know many reading this are prudent investors. You own gold and silver as solid protection against currency debasement, inflation, and faltering economies. You set aside cash for emergencies. You have strong exposure to gold stocks, both producers and juniors, positioned ahead of what is likely the next-favored asset class. You feel protected and poised to profit.

Yet, despite all this preparation, you remain exposed to one of the biggest risks.

Similar to holding a diversified portfolio at a bank without checking the institution's solvency, many investors keep their entire stash of precious metals inside one political system without considering the potential trap they've set for themselves. While storing some of your gold outside your home country is not a panacea, it does offer one important thing: another layer of protection.

Consider the exposure of the typical US investor: 1) systemic risk, because both the bank and broker are US domiciled; 2) currency risk, as virtually every transaction is made in US dollars; 3) political risk, because they are left totally exposed to the whims of a single government; and, 4) economic risk, by being vulnerable to the breakdown of a single economy.

Viewed in this context, the average US investor has minimal diversification.

The remedy is to internationalize the storage of some of your precious metals. This act reduces four primary risks...

Click Here to Continue Reading

More Casey Research Articles

> Adam Fergusson: "Inflating your economy means playing with fire" (Video)

> The Problem with Seeing Government as God

> Economic Insights from a Lord of Finance

|

|

Increasing Volume to Uncover Institutional Buying

| | click to play |

One of the best ways to find stocks on the move that are grabbing investors' attention is to screen for stocks with increasing volume.

This is because increased volume shows investor interest. As more investors buy the stock, that stock's price should go higher.

But the individual investor, while important to the market, doesn't really have the firepower to affect volume the way that big institutional investors do. So how do you find institutional buying?

Watch the video as Kevin Matras shows how to screen for weekly volume increases to uncover institutional buying.

.

Click Here to Continue Reading or Watch the Video

More Zacks Videos:

> Europe: Is It Safe Yet? Turnaround Trader > The Buzz on Linkedin > Why Energy Ruled October - Tactical Trading > Growth & Income Stock Picks featuring analyst research on Caterpillar (CAT) and The Timken Company (TKR) Video - November 10, 2011 > Value Stock Picks with analyst research on CNH Global (CNH) and Corn Products International (CPO) Video - November 7, 2011 |

|

Technical Trading with Harry Boxer

| | click to play |

Harry has more than 40 years of Wall Street investment and technical analysis experience, including eight years on Wall Street as chief technical analyst with three brokerage firms. Watch the November 9 video as he walks you through his technical analysis on a whole bunch of stocks he thinks you should be watching from last week. To see more videos, Click Here.

Like his analysis?

Click Here to receive a Free 15-Day Trial to Harry Boxer's Real-Time Technical Trading Diary for Equedia members. |

|

Upload Your Own Videos - Embed Videos

Is there a video on Youtube or another website that you want to post without uploading it through our technology?

With our new Embed feature enabled, you can now upload and embed any object or video into your blog post. Many of our users are already embedding videos from Fox, Youtube, and CNBC and sharing them with our users.

Embedding is simple. Just copy and paste the embed codes from another website ino the main blog section of your post (not the exceprt).

Where do you find these embed codes?

Embed codes for videos are usually right beside a video.

Here is an example of where the code is on Youtube, highlighted in yellow:

So share what you find with everyone! To learn more, feel free to email or call us at 1-888-EQUEDIA

|

|

Equedia Tips - The Markets Tab

Using the search function at the top right corner of the website, search for any company. Let's use Research in Motion as an example. Once you reach their profile page, click on the MARKETS TAB. You should now see 12 seperate tabs underneath their logo. Try clicking on them and you will find in-depth information such as:

Detailed Quotes - Depth/Level II - Options - Java Charts - News - Profile - Financials - Insiders trades - Filings - Analyst Consensus - Earnings - Historical Data (Highs/Lows, Volumes, Closing/Opening Prices)

|

|

Additional Features (you may not know)

Equedia has many features (you may have overlooked) that will help you manage your investment life and ensure a more enjoyable and useful experience.

Here are just a few of them:

Calendar subscriptions: Keep track of your business events, subscribe to other events, and have access to your online calendar from anywhere in the world. In the near future, we will be working with public companies to add their events to the calendar so that shareholders will never miss an important event again. So call your companies and get them to participate!

Tagging companies to videos and images: Did you know that all of your videos and images can be tagged to public companies? Do you have a video about Google? How about a blog with an image? How about just a blog? Tag it to Google in your blog post, so that anyone searching for Google's quotes and finances can find your coverage!

Buy, Sell, and Hold Ratings: Once you log in, you can submit your buy, sell and hold ratings on the ratings tab so that other shareholders can see what YOU think. You may also access your associates' ratings and see what they think of the shares you hold.

Blog feed subscriptions: Once you add someone as an associate, you will have access to all of their blog posts through your blog feeds. Simply go to your "blog feeds" tab once you log in!

Search function: By far one of the most overlooked but important functions on Equedia. Using the top right hand corner search function, you can find and add any corporations, media users, or investors to your network.

Markets Tab: Under any corporate profile, you will find this tab. Under this tab, you can find the company's news, level 2 depth (delayed), options, charts, profile, financials, insider trades, filings, analyst overviews, earnings, and historical data (these may not be available for all companies)

There are many more useful features on Equedia.com but we think its better if you experience them for yourself. The more associates you have, the more useful Equedia will become for you. So use the new "invite my contacts" function and get started!

|

Forward-Looking Statements

Except for the statements of historical fact, the information contained herein is of a forward-looking nature. Such forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievement of the Company to be materially different from any future results, performance or achievements expressed or implied by statements containing forward-looking information.

Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that statements containing forward looking information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on statements containing forward looking information. Readers should review the risk factors set out in the Company's prospectus and the documents incorporated by reference.

Cautionary Note to U.S. Investors Concerning Estimates of Inferred Resources

This presentation uses the term "Inferred Resources". U.S. investors are advised that while this term is recognized and required by Canadian regulations, the Securities and Exchange Commission does not recognize it. "Inferred Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of "Inferred Resources" may not form the basis of feasibility or other economic studies. U.S. investors are also cautioned not to assume that all or any part of an "Inferred Mineral Resource" exists, or is economically or legally mineable.

|

|

|

|

|

|

This Week's Most Wanted

The Stock Market's Most Interesting Videos That You Should Watch

|

Companies Under Evaluation This Past Week

|

|

|

|

Disclaimer and Disclosure

Disclaimer and Disclosure Equedia.com & Equedia Network Corporation bears no liability for losses and/or damages arising from the use of this newsletter or any third party content provided herein. Equedia.com is an online financial newsletter owned by Equedia Network Corporation. We are focused on researching small-cap and large-cap public companies. Our past performance does not guarantee future results. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. This material is not an offer to sell or a solicitation of an offer to buy any securities or commodities.

Furthermore, to keep our reports and newsletters FREE, from time to time we may publish paid advertisements from third parties and sponsored companies. We are also compensated to perform research on specific companies and often act as consultants to many of the companies mentioned in this letter and on our website at equedia.com. We also make direct investments into many of these companies and own shares and/or options in them. Therefore, information should not be construed as unbiased. Each contract varies in duration, services performed and compensation received.

Equedia.com is not responsible for any claims made by any of the mentioned companies or third party content providers. You should independently investigate and fully understand all risks before investing. We are not a registered broker-dealer or financial advisor. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed and the giving of the same is not to be deemed as an offer or solicitation on our part with respect to the sale or purchase of any securities or commodities. Any decision to purchase or sell as a result of the opinions expressed in this report OR ON Equedia.com will be the full responsibility of the person authorizing such transaction.

Again, this process allows us to continue publishing high-quality investment ideas at no cost to you whatsoever. If you ever have any questions or concerns about our business or publications, we encourage you to contact us at the email or phone number below.

Please view our privacy policy and disclaimer to view our full disclosure at http://equedia.com/cms.php/terms. Our views and opinions regarding the companies within Equedia.com are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect. Equedia.com is paid editorial fees for its writing and the dissemination of material and the companies featured do not have to meet any specific financial criteria. The companies represented by Equedia.com are typically development-stage companies that pose a much higher risk to investors. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time. Statements included in this newsletter may contain forward looking statements, including the Company's intentions, forecasts, plans or other matters that haven't yet occurred. Such statements involve a number of risks and uncertainties. Further information on potential factors that may affect, delay or prevent such forward looking statements from coming to fruition can be found in their specific Financial reports. Equedia Network Corporation., owner of Equedia.com has been paid $6428 HST per month for 7 months which totals $45,000 plus hst of media coverage on Abzu Gold Ltd. and has been granted 100,000 options at $0.64 vesting over a one year period. Abzu Gold Ltd. has paid for this service. Equedia.com currently owns shares of Abzu Gold Ltd. and we may purchase more shares without notice, as we did after the initial release of our Abzu Gold Report. We intend to sell every share we own for our own profit. We may sell shares in Abzu Gold Ltd. without notice to our subscribers. Equedia Network Corporation., owner of Equedia.com has been paid $45,000 plus hst for a 19-month consulting agreement and 7 months of media coverage on Kiska Metals Corporation and has been granted 100,000 options at $1.35 vesting over a two year period. Kiska Metals has paid for this service. Equedia.com currently owns shares of Kiska Metals Corporation and we may purchase more shares without notice. We intend to sell every share we own for our own profit. We may sell shares in Kiska Metals Corporation without notice to our subscribers.

Equedia Network Corporation is also a distributor (and not a publisher) of content supplied by third parties and Subscribers. Accordingly, Equedia Network Corporation has no more editorial control over such content than does a public library, bookstore, or newsstand. Any opinions, advice, statements, services, offers, or other information or content expressed or made available by third parties, including information providers, Subscribers or any other user of the Equedia Network Corporation Network of Sites, are those of the respective author(s) or distributor(s) and not of Equedia Network Corporation. Neither Equedia Network Corporation nor any third-party provider of information guarantees the accuracy, completeness, or usefulness of any content, nor its merchantability or fitness for any particular purpose.

[email protected]

1-888-EQUEDIA

|

|

|